Not All Baby Boomers Can Work to 70

There’s one problem with expecting all baby boomers to delay retirement beyond their 60s: it might not be fair.

That’s because people with lower incomes and less education die younger than the well-to-do with more education. Think about what would happen if everyone retired at, say, 70. Those with less education and a lower socioeconomic status (SES) would enjoy fewer years in retirement than people with higher SES.

That’s because people with lower incomes and less education die younger than the well-to-do with more education. Think about what would happen if everyone retired at, say, 70. Those with less education and a lower socioeconomic status (SES) would enjoy fewer years in retirement than people with higher SES.

This gap in retirement duration has also widened in recent decades. That’s because the lowest SES group has seen much smaller improvements in their life expectancy, according to economists at the Center for Retirement Research, which supports this blog.

Their study tracked adults surveyed by the U.S. Census Bureau over time and assigned each one to an SES group by sorting them into four education quartiles. Education levels correlate with income and are widely used to measure SES.

The researchers, by using separate data that match the adults to their death certificates, found that while mortality improved for all SES groups, the gap between the top and bottom SES has increased over the past three decades.

Converting mortality data into average life expectancies, they found that 65-year-old men in the highest SES back in 1979 lived nearly to age 79 – 1½ years longer than men in the lowest SES. But today, older men in the top SES are living to 85 – about 3½ years longer than the lowest SES group.

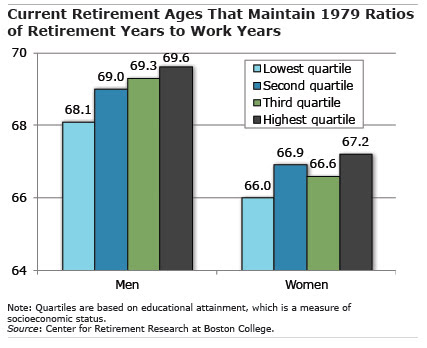

Given these uneven longevity gains, the researchers asked this question: how much longer could men work today if the goal were to maintain the same retirement-to-work ratios they enjoyed in the late 1970s?

Back then, high-SES men enjoyed more than 3.8 months of retirement for every year of work. For low-SES men, the retirement-to-work ratio was around 3.5 months if they also retired at 65.

To maintain these ratios today, low-SES men would retire around age 68, while men at the top could work almost to 70. [The above table shows the age differences for all four educational quartiles for men and also for women, who tend to live longer but have experienced smaller gains in longevity.]

The upshot of this research is important at a time baby boomers are being encouraged to prepare financially for retirement by working longer.

Due to the inequities in life expectancy, the researchers conclude, “those in the lowest [educational] quartiles cannot work as long.”

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

When Social Security (SS) was first started, the goal was to provide a safety net for individuals following retirement — which was then expected to be on average just over three additional years. If the retiree lived longer, good for them. If they only collected SS for a few years — that was the expectation,

The logic that a revised average age for starting to receive SS should not be set — given the longer life expectancy — just because some individuals won’t live as long as others makes no sense. The same criteria should apply to everyone, no matter the occupation, race, gender, etc., despite the life expectancy difference between the various groups.

A personal example –> My parents were the same age; my father started receiving SS at age 68 and died at age 69; my mother continues to receive SS at age 96. Life/death happens — there is nothing intrinsically unfair or inequitable about it.

Dear Brian –

The purpose of this research was to point out that some people have less time in retirement than others. This has been an issue historically with the uniform retirement age, but the differences are growing over time.

Thanks for your comment!

Kim

There are many oddities to Soc. Sec. retirement. The latest rule curtailing file and suspend strategies for younger married couples being a recent example.

What remains is married couples of any income or educational status retain advantages over the never married or seldom married. For example, spousal benefits can be claimed by multiple partners over your lifetime. Is this fair?

At the same time, the once married incur the same “penalty” with loss of one retirement check at the death of the first spouse. Even now, this comes as a major surprise to many unprepared beneficiaries. Is this fair?

Compare this to private pensions and annuities offering survivor options for payment over joint life expectancy. Why not consider this as a Soc. Sec. retirement choice?

Providing better SS income for survivors by reducing combined income of married couples is one of the proposals in the Bipartisan Policy Center’s Report of the Commission on Retirement Security and Personal Savings. Great reading, by the way, for any retirement policy nerd (and who here isn’t?).

Providing better SS income for survivors by reducing combined income of married couples is one of the proposals in the Bipartisan Policy Center’s Report of the Commission on Retirement Security and Personal Savings. Great reading, by the way, for any retirement policy nerd (and who here isn’t?).

How do you define quartiles by educational attainment?

Dear Ken,

The quartiles are defined in the working paper:

https://crr.bc.edu/working-papers/calculating-neutral-increases-in-retirement-age-by-socioeconomic-status/

Sincerely,

Amy

(Center for Retirement Research at Boston College)

The paper seems to ignore the fact that the lower quartiles need to work longer as they have less resources to enable them to retire – what’s fair about that?

This is a very interesting article to an almost 69-year-old woman who works part-time. The guess as to health and then passing away is a toss of the proverbial dice. I feel very lucky to have what I have when I read Squared Away blogs.

Life is not fair.

The past ratios of work to retirement were achieved at the expense of the generations to follow, who are poorer.

Time to face that fact and admit it.

Particularly as it is asserted that those in or near retirement need even more, while those coming after have “time to adjust” (current Republican) or “things will just work out so take what we need for us now” (Democrats and Donald Trump).

Because of Congressional “vote buying” the presentation of (gifting?) of revised and always increased benefits with expanded eligibility, has been the direction and purview of mostly liberal legislators, although Moderates seem to join in, in unreasonable numbers, figuring that they need a share of voter goodwill as well.

But, here’s the sad facts: Social benefits will consume an ever greater portion of the federal budget, over and above the so-called “trust funds” pay-as-you-go setup, to the point that under current regimes, payouts will exceed the entire federal budget in a relatively short period. And, all this is because we should have recognized a long time ago that what was a socialist policy for the good has needed change as societal circumstances have changed, We now have a “cradle-to-grave” type of government thinking, portrayed by liberal legislators and politicians as the only “fair” way to treat the ever-growing demands. Yes, I said demands of the ever-increasing numbers of poor, who have been led to expect ever-larger government programs that allow being “poor and disadvantaged” to become a lifestyle choice, supported by a government structure and taxation that does’t generate opportunity, good education, or jobs. A guilt resolution of the “problems” of the poor, I suppose.

We should be headed in the opposite direction. Build a private account retirement program that allows participants to retire at age 55, say, when health and financial circumstances permit choices of travel, second careers, community and volunteer work, and as many other activities that age and income would allow. Note: a 24-year-old person who saves 10 percent of their average income of $30,000 (which grows 2-3% based on promotions and other normal considerations), not including any employer contributions, would create a retirement fund of $1,200,000 to $1,500,000 at age 55.

For your scenario, is it fair to request expenses and returns assumptions? Of course, much depends on that steady (real?) income growth, with which we can compare our own experience.

Thank you for posting this article, which reminds us that not everyone was fortunate enough to stay healthy or spend their careers sitting behind a desk. At least half of the population may fall victim to infirmities that would preclude them from working beyond age 70 — indeed some may not even be able to work past 60. It is very disconcerting to hear the oft repeated notion that saving Social Security is a mere matter of extending the retirement age, usually posited by those sitting behind desks who have never actually “labored.”

The idea that “all” people are being expected to work beyond their 60’s is a bit misleading.

The truth for many — no matter what their educational status — is that they have not saved enough to get by with just Social Security, if they retire at their full retirement age.

The idea of making it OK to work longer and to have some choice about it, vs. feeling like they have lost their golden years, is healthy in my opinion.

Still, it is the choice of each person to make given their circumstances.

The pension plans that were supposed to have been our mainstay in retirement simply do not exist for most people. Our 401(k) funds have been gambled with and a lot of people lost a large percentage of their savings during the last crash. Couple these with the uncertainty of health coverage for increasing expenses in old age and you have a recipe for poverty. This country can easily afford to take care of its seniors; it just has its priorities misplaced. Simply taking the earnings cap off contributions, so that the wealthy pay the same share on every dollar as the working poor, will fix this situation nicely.

Why do we think that it is ok to ask workers making less than about $120,000 per year to pay Social Security on their whole incomes but those making more than that amount to pay only up to about $120,000 and then nothing more? We have investments and 401ks that are at the mercy of the stock market. Social Security should be a safety net and add stability to retirement. Let’s call this situation what it is… Welfare for the rich. Time to treat us all equally. All should pay the same rate then “magically” Social Security has no funding problems.