Pandemic Puts More Retirements at Risk

Americans’ retirement outlook has gone from bleak to bleaker.

Americans’ retirement outlook has gone from bleak to bleaker.

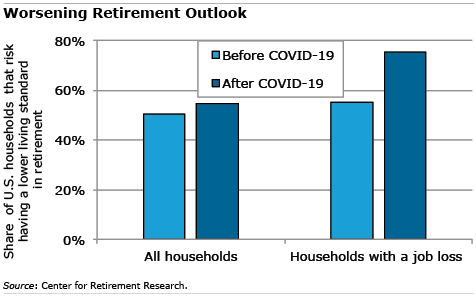

The unemployment caused by COVID-19 has pushed up the share of working-age households not able to afford their current standard of living in retirement from 50 percent to 55 percent, according to a new analysis by the Center for Retirement Research, which sponsors this blog.

The analysis updates a previous estimate, based on 2016 data, to include the harmful effects of surging unemployment. The researchers estimate that perhaps 30 percent of workers – far more than is reflected in the monthly jobless rate – could be affected by layoffs now and in the future. They did not factor in the recession’s impact on the housing and financial markets, which could make things worse.

Unemployment hurts retirement in a variety of ways. Laid-off workers’ paychecks vanish immediately, but they may also earn less in the next job. The depressed earnings, over months or years, reduce the money flowing into their 401(k)s, and the amount they’ll receive in pensions and future Social Security benefits. It may also force some to spend down savings that, had they not lost their jobs, would’ve been preserved for retirement.

Interestingly, the impact on low-income workers is mixed. In one way, they’re protected by Social Security’s progressive benefit formula, which will replace a higher percentage of their earnings as their lifetime earnings decline. But low-income workers have had more layoffs, which widens the gap in their retirement savings – between what they can save and what they should be saving – more than for higher-income people.

The 2020 recession will impact retirement “in a very different way” than the Great Recession, the researchers said. This time, “the destruction is occurring more through widespread unemployment and less through a collapse in the value of financial assets and housing.” However, the lessons of the previous recession can’t be dismissed either.

House prices are still holding up pretty well – so far. But the housing market will be vulnerable to a decline as the recession’s impact spreads. While 401(k) balances haven’t been battered like they were in the 2008 financial crisis, the stock market is still 7 percent below February’s record highs and continues to be volatile.

The best chance of stopping the deterioration in workers’ retirement prospects is to get them back to work. The tricky part of fully reviving the economy is getting better control of the virus.

Read more blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Yes, I work a part-time job three days a week and was forced to draw Social Security at 63.5 years of age. I have some savings but I am adding to it by still working. It is hard to find jobs that will hire people over 65 and I will be 66 soon. I am lucky to have had a career in healthcare (nursing administration). Still I could not find a full time job with my lost benefits when I needed it. Congress has not done enough to protect Seniors who have been forced out of their jobs due to their age. It is especially hard when you are not yet 65 and do not yet qualify for Medicare. Health insurance is expensive. I was glad when I finally qualified for Medicare last year.

So here is the basic problem with retirement finances, most people that attend both high school and university never study simple investing or finance at its most basic level (where to put one’s money for the best long term returns or the time value of money by investing for the long term). The average US citizen, as a whole, could save trillions more in retirement funds just by understanding the basics of these concepts. It really is not their fault but the government at all levels for failing to provide these courses. I am very fortunate because I have many family members with advanced degrees from Harvard, Yale, Columbia, Cornell and 2 generations at Cambridge University. The solution is at the beginning of their lives not near the end.

You are indeed very lucky. The retirement problem is not simply one of “simple investing education”. If someone is in the lowest 20% of the income percentile the chance of getting a university level education is very small. Income inequality and, hence, wealth inequality is a huge problem and is much more complicated than simply education about investing. Simply instituting a curriculum on investing throughout the US is only going to make a small dent in the problem.

“After decades of growing inequality, Alabama’s richest households have dramatically bigger incomes than its poorest households. The top 5 percent of households have average incomes 15 times as large as the bottom 20 percent of households and 5 times as large as the middle 20 percent of households.”

Alabama Among States with Highest Income Inequality:

Poorest 20%: $17,486

Middle 20%: $55,585

Top 5%: $255,862

*Incomes are for families of four in 2015 dollars.

Source: CBPP analysis of 2015 American Community Survey household income data. Income includes estimated SNAP payments,

payroll taxes, and federal income taxes (including Child Tax Credit and Earned Income Tax Credit) but omits capital gains income.

You are indeed very lucky. The retirement problem is not simply one of “simple investing education”. If someone is in the lowest 20% of the income percentile the chance of getting a university level education is very small. Income inequality and, hence, wealth inequality is a huge problem and is much more complicated than simply education about investing. Simply instituting a curriculum on investing throughout the US is only going to make a small dent in the problem.

“After decades of growing inequality, Alabama’s richest households have dramatically bigger incomes than its poorest households. The top 5 percent of households have average incomes 15 times as large as the bottom 20 percent of households and 5 times as large as the middle 20 percent of households.”

Alabama Among States with Highest Income Inequality:

Poorest 20%: $17,486

Middle 20%: $55,585

Top 5%: $255,862

*Incomes are for families of four in 2015 dollars.

Source: CBPP analysis of 2015 American Community Survey household income data. Income includes estimated SNAP payments,

payroll taxes, and federal income taxes (including Child Tax Credit and Earned Income Tax Credit) but omits capital gains income.

Just heard the latest news about the Medicare Trust. Without changes by Gov’t, the Medicare trust will be deprecated as soon as 2022.

That will have a greater effect than most anything else.

Kim, every minute I spent reading your article was worth it. You talked about both the problem and solutions. But, things have become tricky due to COVID-19.

Really frustrating situation.

The solution is at the beginning of their lives not near the end.

Quite helpful post. You need to keep patience!