Filter

Wisconsin Finds Owners of Lost Pensions

Some people lose old retirement accounts because they forget about them. Others don’t want the hassle required to retrieve small amounts. And workers who change jobs fairly often can leave a lot of small accounts in their wake. As a result, millions of dollars of retirement wealth – in pensions, 401(k)s, IRAs, profit-sharing plans, and annuities – sit in state repositories of unclaimed property. So how can workers and retirees be united with their long-lost money? To answer this question, a new study contrasts what has happened to unclaimed retirement accounts in two states with vastly different approaches to handling them: Wisconsin and Massachusetts. Wisconsin in 2015 began to use Social Security numbers to automatically match up and return misplaced…

February 2, 2021

Got a Retirement Plan? Race Plays a Role

The following statistic will sound familiar since I use it regularly: about half of U.S. workers are not saving enough and may see their standard of living drop when they retire. A major culprit in this poor state of preparedness is that millions of Americans at any given moment don’t have a traditional pension or 401(k) savings plan at work. A new study takes a close look at who these people are and shows stark differences along racial lines. A large majority of Hispanic workers in the private sector – two out of every three – do not have access to a pension or 401(k)-style plan, and more than half of Black workers do not have access. Although the numbers…

May 12, 2022

Homeownership in Retirement: an Asset or a Burden?

The conventional wisdom for older workers heading into retirement is that owning a house is a good thing. The property has no doubt appreciated over many years, adding to their wealth. But new research finds that homeowners often strain to a pay a mortgage that is larger than what they can realistically afford. The essence of the problem for retirees, who usually rely on savings to help with living expenses, is that many do not have enough to make their monthly payments comfortably. This problem has become more pressing over the years. Half of the retired homeowners who were born in the early years of the baby boom wave are still making mortgage payments. They are in a very different…

March 14, 2024

‘Do I Have a Pension?’ Sleuths Can Find it

Diane Taylor Betty Taylor is 74 and retired from a job she held for more than a decade filling Spiegel catalog orders and packing them up for shipping – she left in 1984. Diane Taylor, 70, was a packer and then a keypunch operator there between 1982 and 1995. But the sisters, who live together in their late mother’s house on Chicago’s Southwest Side, couldn’t track down anyone who could confirm that their low-paying jobs entitled them to Spiegel pensions. This is more common than one might think. When a single employer or union has continued to maintain its pension plan over several decades, retiring workers know where to go to sign up for their benefits. But the sisters’ pensions…

May 3, 2018

Pre-Retirement Debt is Rising Over Time

Baby boomers have a lot more debt than their parents did. By all accounts, the parents were in pretty good shape for retirement because they held their debt levels down to a mere 4 percent of their total assets in the years immediately before retiring – ages 56 to 61 – according to a new study. At those same ages, the typical baby boomers’ debt has ranged from 19 percent to 23 percent of their assets, thanks in large part to the 2008 drop in stock portfolios and in the housing market. Generational trends in debt levels are difficult to analyze, and the issue is far from settled among researchers. This study notes, for example, that the situation might not…

March 3, 2020

Pandemic Puts More Retirements at Risk

Americans’ retirement outlook has gone from bleak to bleaker. The unemployment caused by COVID-19 has pushed up the share of working-age households not able to afford their current standard of living in retirement from 50 percent to 55 percent, according to a new analysis by the Center for Retirement Research, which sponsors this blog. The analysis updates a previous estimate, based on 2016 data, to include the harmful effects of surging unemployment. The researchers estimate that perhaps 30 percent of workers – far more than is reflected in the monthly jobless rate – could be affected by layoffs now and in the future. They did not factor in the recession’s impact on the housing and financial markets, which could mak…

July 21, 2020

What the Research Can Tell us about Retiring

It’s difficult to envision what life will look like on the other side of the consequential decision to retire. But research can help demystify what lies ahead – about the decision itself, the financial challenges, and even the taxes. Readers understand this, as evidenced by the most popular blog posts in the first three months of the year. Here are the highlights: The retirement decision. The article, “Retirement Ages Geared to Life Expectancy,” attracted the most reader traffic. Myriad considerations go into a decision to retire. But a sense of whether one might live a long time – because of good health or simply seeing that parents or neighbors are living unusually long – is a compelling reason to postpon…

April 1, 2021

Public Pension Cuts Hit Recruitment

West Virginia teachers started the wave of strikes over pay. Photo courtesy of Janet Bass, American Federation of Teachers Teachers’ strikes and walkouts over inadequate pay – in Arizona, Kentucky, Louisiana, North Carolina, Oklahoma, and West Virginia – are making news this spring. In Oklahoma, half the people who’ve left teaching recently said pay was their top reason for moving on. A wave of reductions in another significant form of compensation – pensions – also appear to be making state and local governments a less appealing place to work, according to researchers Laura Quinby, Geoffrey Sanzenbacher, and Jean-Pierre Aubry at the Center for Retirement Research, which publishes this blog. Pensions have traditionally been the great equalizer for governments trying to recruit…

May 24, 2018

Second Careers Late in Life Extend Work

Moving into a new job late in life involves some big tradeoffs. What do older people look for when considering a change? Work that they enjoy, fewer hours, more flexibility, and less stress. What could they be giving up? Pensions, employer health insurance, some pay, and even prestige. Faced with such consequential tradeoffs, many older people who move into second careers are making “strategic decisions to trade earnings for flexibility,” concluded a review of past studies examining the prevalence and nature of late-life career changes. The authors, who conducted the study for the University of Michigan’s Retirement and Disability Research Center, define a second career as a substantial change in an older worker’s full-time occupation or industry. They also stress…

September 3, 2019

Breaking Up (the Pension) Is Hard to Do

In a divorce, splitting up the pension is trickier than dividing the house. Divorcing couples and their advisers “who aren’t hip to divorce splitting of retirement plan assets often do it improperly,” said Howard Phillips, a Delray Beach, Florida, actuary and author of “Dividing Retirement Plan Assets in a Divorce.” He knows, because he values pensions for couples negotiating their divorce settlements and then drafts the order that will be entered into the court. Dividing a house is easy. Two realtors pouring over sales of comparable nearby properties can readily agree on a value – once the house is sold, the parties pay the realtor and split the proceeds. But a pension plan’s value greatly depends on how and when…

February 17, 2015

Canadian Pension Reform: the Long View

Policymakers often worry that increasing government pension benefits won’t necessarily help retirees, if the reforms cause workers to change their behavior in ways that counteract them. For example, some workers might save less if they know pension benefits are rising, offsetting the income boost they’ll get from a larger pension. However, researchers examining Canada’s pension reform over five decades confirm that they have materially improved the financial well-being of retirees there. To reach this conclusion, Kevin Milligan of the Vancouver School of Economics and David Wise of Harvard University tracked the financial status of older Canadians from 1960 through 2010. They analyzed some 100,000 families between 55 and 80 years old using Canada’s Survey of Consumer Finances, the Survey of…

September 16, 2014

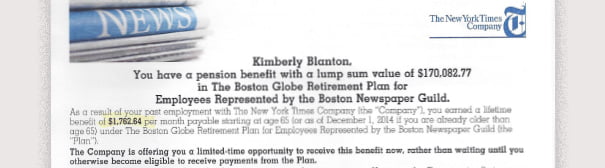

Evaluating a Pension Buyout Offer

Like many baby boomers, I’ve received an offer from a former employer that’s meant to entice: “The Company is offering you a limited-time opportunity to receive this benefit now, rather than waiting until you otherwise become eligible to receive payments from the Plan.” My 17-year employment as a Boston Globe reporter entitles me to a $1,762 monthly pension for life, starting at age 65. I’m 57 now. But a few weeks ago, the company put two alternatives on the table: take a smaller pension that starts now or trade my pension for a lump sum of $170,000 in cash. The deadline for accepting the new offer: the day after Christmas. The New York Times Co., which used to own t…