Relocating Can Boost Living Standards

COVID-19, by rearranging work arrangements, is allowing people to rethink where they live.

As the virus started to spread in Manhattan last spring, some residents fled the city and began snapping up houses in Westchester County and on Long Island. There is preliminary evidence some people are moving farther afield, to rural areas where small populations create the potential for lower COVID-19 transmission rates.

In a Pew Research Center survey, about one in five Americans said the pandemic had either prompted them or someone they know to relocate.

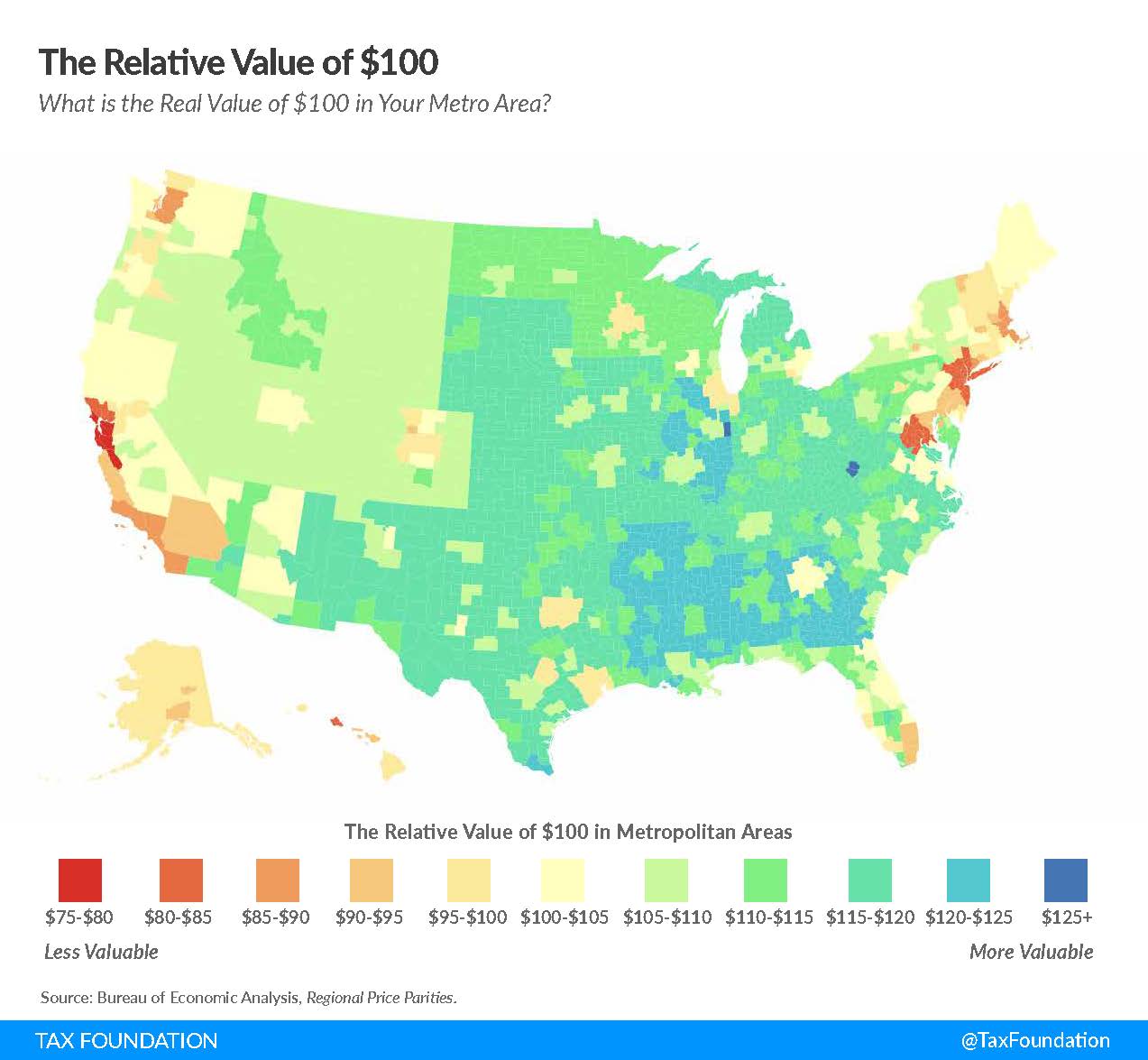

The map below shows the big changes in living standards that can accompany a move from a high- to a low-cost part of the country. In each location, the Tax Foundation calculated each region’s purchasing power, based on what $100 will buy, on average, nationwide.

For example, $100 will purchase $75 to $80 worth of goods in Manhattan. By moving to Upstate New York or New Mexico, someone who keeps her job and works remotely can increase her purchasing power to around $110 – the equivalent of at least a 37 percent increase.

Typically, an area’s cost-of-living is correlated with local incomes. For example, employers must pay more to attract workers to high-cost areas. But not in North Carolina, which has “higher-than-average incomes without corresponding higher-than-average prices,” the Tax Foundation said.

Offsetting the benefits of relocating to a low-cost area is the employment risk. If a remote job evaporates, it may be difficult to find a suburban or rural employer that pays as much or an employer in a larger city willing to hire someone new to work remotely. Poor wifi connections are a common problem in rural areas.

Moving is a complex decision with an array of considerations, from the health benefits to the difficulty collaborating with coworkers over Zoom. But what seems clear is that working remotely is, for many, becoming the new normal.

Read more blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

Does the cost of living calculation include state income, sales and property taxes?

Considering the study was done by the Tax Foundation, the answer is yes.

I recommend Greece. Low coronavirus infection rate. No looters or murderous cops.

With its extreme unemployment benefits, Mass also has high taxation. Plus if you have over one million dollars in your estate, Mass will take a chunk. No good reason to move there unless they double or triple your pay. I live there.

Massachusetts consistently ranks among the highest in the country for its K-12 schools and lowest for percent of those without health insurance. Decent higher education options lead to an educated workforce and high-paying jobs. Also, as you say, high unemployment benefits. A state with an actual safety net, rather than, say, low-tax Texas where the unemployed starve.

A bit of add on. The highest cost of living areas appear to be those controlled by politicians who like to tax & spend. The middle-class doesn’t do too well in those areas.

I’m astonished by the Tax Foundation page to which this links, in which there is just a map and a table comparing purchasing power by state. That is of no use whatsoever, and it’s amazing that somebody thought to present it! “For example, $100 will purchase $75 to $80 worth of goods in Manhattan. By moving to Upstate New York..” Exactly.

We’ve lived in the suburb for decades. While bloggers were slamming the “sprawling suburbs”, we’ve had moderate cost of living, great salaries, plenty of jobs, low (20-minute) commute times, good K-12 schools, low crime, socially-distanced living (though we didn’t know that at the time), and more. A great place to live, work, play, pray, and raise a family.