Middle Class Gets the Most from Medicare

This is a fact of retirement life: older Americans haven’t paid as much into Medicare and Medicaid as government spends on their healthcare and nursing home stays.

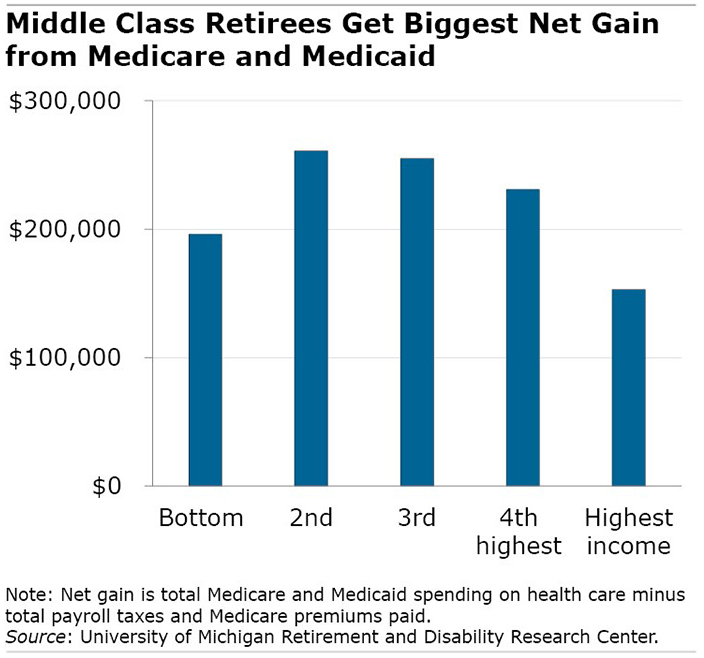

But it is middle-class retirees who get the most out of the system, according to a new study.

Middle-income households receive about $230,000 to $260,000 more in Medicare and Medicaid benefits, on average, during their retirement years than the total amount they’ve paid in. Their contributions consist of the Medicare payroll and income taxes deducted from workers’ paychecks, the portion of their federal and state income taxes devoted to Medicare and Medicaid, and the Medicare Part B and D premiums they are paying in retirement.

The net benefit of the programs to the middle class dwarfs the $153,000 in average net benefits for retired households in the top fifth of the lifetime earnings distribution, and it also exceeds the $196,000 gain for the bottom fifth.

The middle class is defined as the second, third, and fourth of the five earnings groups the researchers analyzed in this study. The annual data used to calculate the health spending and payment estimates for this analysis are adjusted for inflation.

Americans over 65 receive a third of all the medical care provided in this country. This new research, funded by the U.S. Social Security Administration, uses government administrative data to compare the benefits of Medicare and its smaller companion program, Medicaid, for each earnings group.

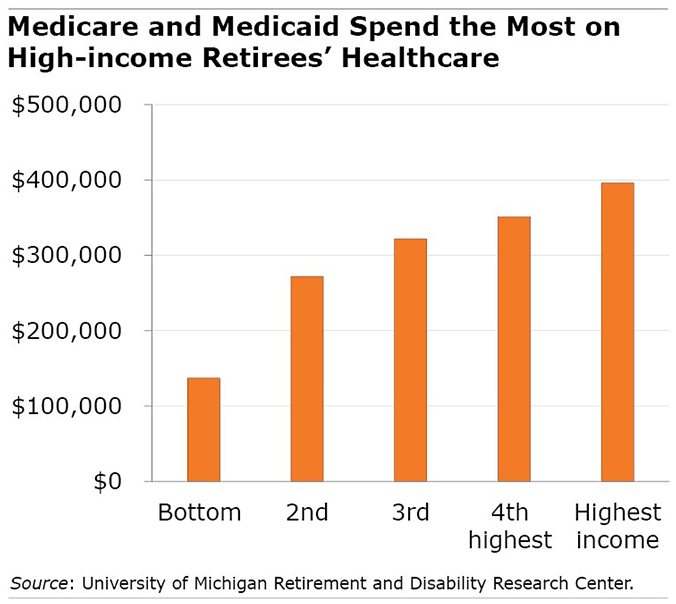

There are two reasons the middle class gets the most from the system. First, although the top earners live the longest and receive the most medical care, the middle class lives almost as long and ends up receiving a significant amount of care.

Second, the taxes the middle class pays to fund Medicare and Medicaid are less than is paid by the top earners. Middle-income workers and retirees have a lower marginal tax rate for the portion of their federal and state income taxes that go toward retiree medical care. And because their earnings are lower, they pay less in total for the Medicare payroll tax, which provides the same health benefits for everyone but is a fixed percentage of a worker’s income. The less someone earns, the less they pay for their future medical care.

Low-income retirees might at first glance seem to be the biggest beneficiaries, since they have paid the least in taxes over their careers and are far more likely to need the means-tested Medicaid program to cover the medical care that Medicare doesn’t cover, including expensive nursing homes. However, low-income retirees get less than the middle income group from the program because they have the shortest life span. Although they tend to be in poorer health, they don’t require as much health care overall as other retirees.

The researchers estimated the lifetime net benefits using surveys of workers who turned 65 sometime between 1999 and 2004. They paired the surveys with government data on earnings to estimate the total taxes paid by workers in each income group. Separately, they estimated the government subsidies of retirees’ medical care under Medicare Parts A, B, and D and Medicaid, which is a joint federal-state program.

The analysis is complicated but the researchers’ message is clear. “The largest beneficiaries of Medicare and Medicaid are those in the middle of the income distribution.”

To read this study, authored by Karolos Arapakis, Eric French, John Bailey Jones, and Jeremy McCauley, see “How Redistributive are Public Health Care Schemes? Evidence from Medicare and Medicaid in Old Age.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

A great piece of research. The most interesting section of the paper was a comparison with the UK NHS. It wasn’t quite apples to apples, but the aspect of the comparison that leaps out is that US spending is an order of magnitude higher for worse health outcomes. Yes – there is redistribution in the US health care system, but most of the redistribution is from taxpayers to the medical industrial complex.