Retirement Saving – Latinos Get an App

Amid a growing awareness that many Americans aren’t properly prepared for retirement, various efforts have ramped up to push the non-savers to save.

A notable initiative is occurring in state government. California, Illinois, and Oregon have started IRA savings programs that require private employers to offer the state-sponsored IRAs to workers if the company doesn’t already have a 401(k).

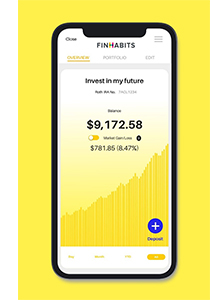

Cell phone apps are also popping up to make saving easier. One such app – Finhabits – is being marketed directly to Latinos, who financial experts say are particularly unprepared for retirement. Two out of three Latino workers aren’t saving in a retirement plan, often because they work in low-wage restaurant and hotel jobs that don’t offer one.

The Finhabits app offers both traditional and Roth IRAs, which can also be set up online. The IRA regularly deducts an amount, designated by the customer, from his bank account and invests the money in low-cost exchange-traded index funds managed by Vanguard or BlackRock.

Carlos A. Garcia created the app – in English and Spanish – to confront a barrier to saving that he experienced in his own family as a child growing up in the border towns of El Paso, Texas, and Juarez, Mexico. Saving “is not part of [Latino] culture,” he said. “Everybody’s working so hard. But you never talk about retirement.”

He carried this sentiment into his first job at Merrill Lynch after college graduation. He turned down the 401(k) option, because “I had no clue what a 401(k) was.”

This blog doesn’t recommend financial products, and Finhabits has advantages and disadvantages over competing apps. The app’s management fee is slightly higher than some, according to expert reviews. Nevertheless, Finhabits follows sound principles, such as investing in low-cost index funds. The Washington state government chose Finhabits as one of its vendors to provide a retirement plan through the state’s Retirement Marketplace for small businesses.

Finhabits courts customers through partnerships with credit unions serving Latino neighborhoods in Chicago and New York. It also hosts live marketing events in Spanish on Facebook and YouTube.

The firm charges a fee equal to 0.5 percent of the assets in the retirement accounts to manage them internally. But savers with less than $2,500 pay $1 per month, so an account with $1,000 costs them 1.2 percent.

In addition, the customer pays between 0.07 percent and 0.11 percent of assets to the financial firm that invests the customer’s money in the index fund. The average fee for all index funds is 0.09 percent.

A competing app, WealthFront, has a lower management fee – 0.25 percent of assets – but its investment fees range from 0.07 percent to 0.16 percent.

A final concern that some have expressed about Finhabits is its limited number of investment options. But Garcia has a good argument for this: simplicity is the best way to encourage saving among people who aren’t in the habit.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.