Single Retirees of Color Face Greatest Financial Hardship

Too many retirees of color are in the financially precarious state between outright poverty and barely getting by.

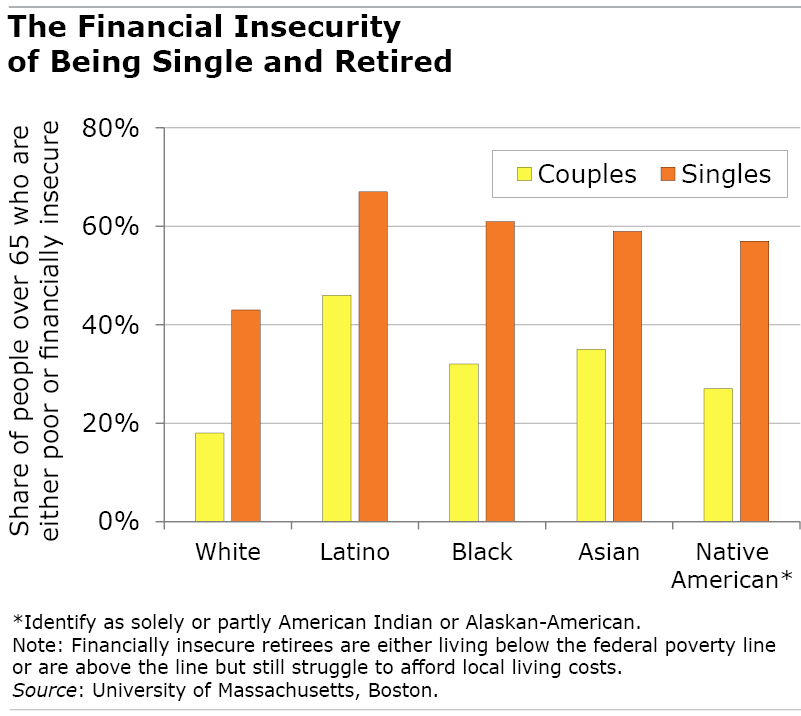

Far larger shares of the nation’s Latino, Black, Asian, and Native American retirees are financially insecure than Whites, according to a new report confirming the now-familiar racial disparities that face both workers and retirees in this country.

But what also stands out in this report, produced by The Gerontology Institute at the University of Massachusetts, Boston, is the gaping disparity between retired single people and married couples.

First, consider older White Americans. They are in the best position financially. Yet about two in five single White retirees are financially insecure, while only one in five couples is. Single Latino retirees are much worse off – two out of three are financially insecure, compared with under half of Latino couples.

The institute defines Americans over 65 as being financially insecure – a total of 12 million people – if they are either below the federal poverty level or, if they are not poor, do not have enough retirement income to afford the cost of living in their area.

More people of color fall into this gap because they earn less during their working years, and the financial disparity carries into their retirement.

Although Social Security benefits replace a larger percentage of low-income workers’ earnings when they’re retired, it’s still difficult to save if they’re just scraping by. And they may not have access to an employer 401(k) that would improve their chances of saving even small amounts. If a worker is an immigrant lacking legal residency, he or she would not qualify for Social Security benefits later.

The difference between the retirement standard of living for single and married people of color also “is really important,” said Jan Mutchler, the institute’s director, who pointed to a couple of reasons.

First, housing costs are less of a burden if two people are able to pool their Social Security and other sources of retirement income and split housing costs such as rent, utilities, or property taxes.

A second, related factor in the single-couples disparity is that more retired women, who tended to have had less income when they were working, are single: 33 percent of women over 65 are living alone and are more likely to be supporting themselves on one source of income. Men over 65 are more likely to be in two-person households – only 20 percent live alone.

“The intersection of race and gender is of special concern, as economic insecurity is especially prevalent among single women of color,” the report concluded.

Some interesting geographic patterns emerged from the institute’s estimates for each state. New York is where Asian inequality stands out. Retired Latinos in Massachusetts are worse off than in other states. Among Black retirees, the highest rate of insecurity can be found in Mississippi. And the highest rates for White couples can be found in two very different states: Mississippi and Vermont.

“People of color [are] at higher risk of entering later life with few financial resources, little wealth, and little or no pension income, compounding other challenges confronted in old age,” the report concluded.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

There’s no attribution to many generations of hard work; hard work and education solve many of these problems.