COVID Pressured Some Employers to Suspend Their 401(k) Match

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But suspension much less important this time around.

As soon as the economy shut down last March, our center decided to systematically record the names of companies that announced they were suspending the employer 401(k) match. We thought we were quite clever because during the 2008-2009 meltdown, we started late and had to go back and collect the announcements.

It looked initially like employer suspension of the 401(k) match was going to be a big deal. In March and April, a number of large companies suspended their match, including Kelly Services (113,468 participants), Marriott Vacations Worldwide (9,715 active participants), and Amtrak (18,780 active participants). (Active participant data are from the Department of Labor’s Form 5500.)

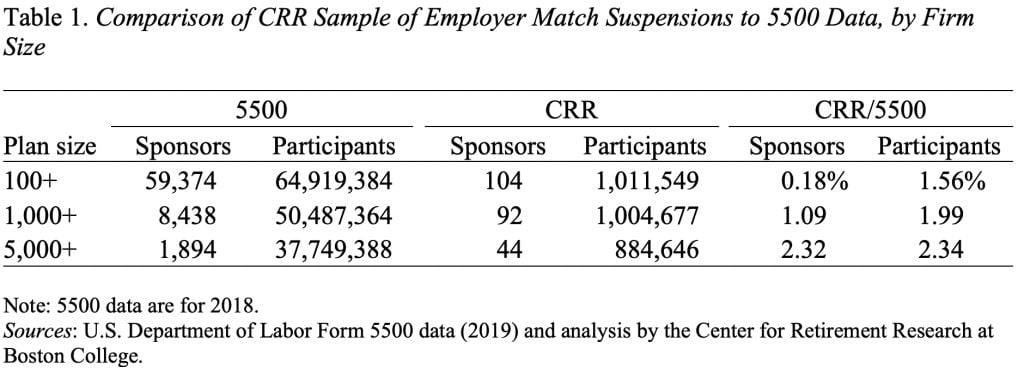

But, as of today, our data suggest that less than 1 percent of plan sponsors (with more than 100 participants) covering 1.6 percent of plan participants have suspended the match. A similar calculation for the Great Recession in 2008-2009 showed 5 percent of participants saw their employer’s match suspended.

The conclusion seemed to be that companies – outside of travel and hospitality – were not affected by the pandemic, did not experience liquidity pressures, and saw no need to suspend the employer match. I do think that suspension of the match is a much lesser deal this time around.

But our numbers are much lower than those emerging from the financial services industry. A December WSJ article reports numbers from T. Rowe Price (9 percent of large plan sponsors suspended or reduced matching) and Ascensus (21 percent of employers suspended contributions), noting that most of the companies who suspended their contributions have since reinstated them.

In contrast, among Vanguard plans, only 7 percent of companies have suspended their matches, and a November snapshot by the Plan Sponsor Council of America (PSCA) found only 5 percent of firms reported suspending their match.

In any case, based on the industry numbers, it seems reasonable to say that between 5 and 20 percent of plan sponsors suspended their matching contributions. This brings me back to our numbers.

Our information comes from weekly checks of major corporate newswires, companies’ quarterly SEC filings, and Google for any mention of match suspensions or reinstatements (using a variety of key words). We also monitor social media posts to identify companies that have suspended or reinstated a match. We then verify the report through either a corporate press release or a direct email response from the company.

Of course, not all suspensions are newsworthy enough to make it into the national press. Clearly, the larger the company the more likely the suspension would be reported. Therefore, it probably makes sense to look at our data on suspensions by plan size (see Table 1). For larger plans – 5,000+ participants – the reports show that the percentage of both plans and participants involved is 2.3 percent. For plans, this percentage turns out to be similar to the 3.4 percent reported for the same size firms in the November PSCA survey. So it appears that our data are doing a reasonable job of capturing large firm activity. Much of the additional count comes from smaller employers, whose compensation changes do not make the news.

Therefore, our data are useful for tracking the suspension behavior of large firms. And comparing our results – based on the same methodology – for the Great Recession and the pandemic supports the notion that match suspensions are simply not that important this time around.