State Auto-IRA Savings Could Affect Medicaid Eligibility

Low-income retired couples with less than $3,000 in assets can get Medicaid to supplement their Medicare insurance or pay for a nursing home. This asset cap, set by state governments, mainly applies to financial accounts and excludes the value of a home and vehicle.

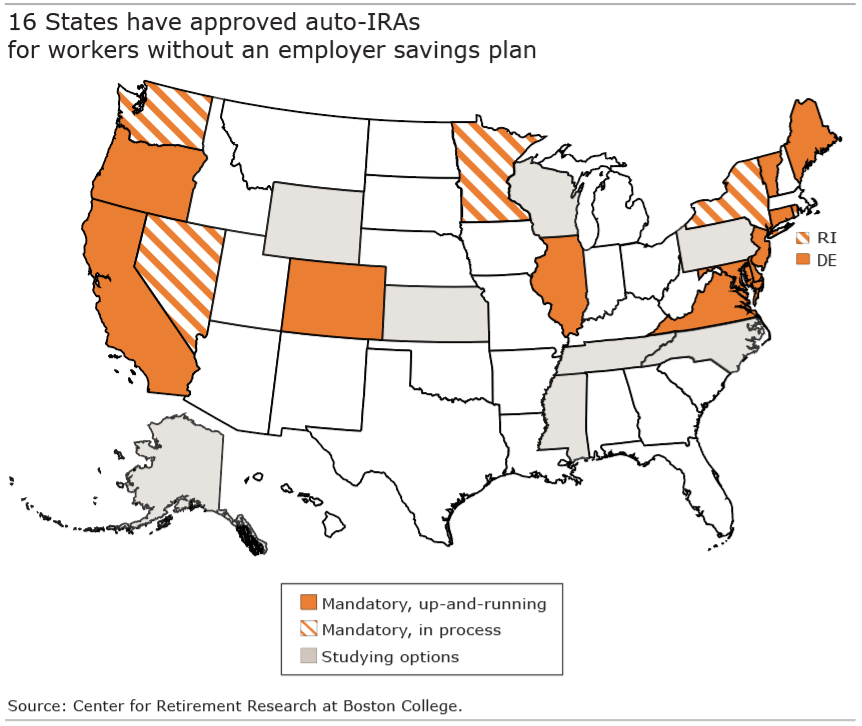

But Medicaid coverage in old age could conflict with auto-IRA initiatives in a growing number of states – 16 so far – that are designed to help workers without an employer 401(k) save for retirement.

The substantial savings workers will build up in these auto-IRAs could make some ineligible for the extra health insurance coverage once they retire, even if their income meets the program’s income cap, according to a new study by the Center for Retirement Research.

Typical workers who start saving in their early 20s would have $25,000 in an auto-IRA by their early 50s – this estimate, on the low end, is for a lower-paid worker who didn’t attend college and was enrolled intermittently in an auto-IRA. But account balances could go as high $105,000 – the most optimistic scenario – for a college-educated worker who lacks an employer 401(k) and saves continually in an auto-IRA.

Over a decades-long career, “workers accumulate significant new savings in the auto-IRA,” the researchers concluded from their estimates, which were based on data on U.S. workers’ earnings and a model that assumes a nationwide auto-IRA program was adopted in 2019.

The researchers chose to tally the workers’ auto-IRA balances at ages 51-56. Although individuals who don’t retire untill 65 will have accumulated even more savings, that’s not the case for many low-income workers. They tend to be vulnerable to developing disabilities that require them to reduce their work hours or stop working prematurely and apply for disability benefits. They might be forced to take money out of the Roth auto-IRAs – tax-free – to supplement their income or meet the Medicaid asset test.

Future Medicaid coverage would also be affected among workers who start saving later – in their 40s – but the impact would be more muted than it is for younger savers. The older workers in this study would have saved an estimated $22,000 to $25,000 by their early 50s. Even these relatively small balances might make some ineligible for Medicaid, providing an incentive in retirement to spend their savings quickly to get the low-cost health insurance or long-term care coverage they need.

States could eliminate the conflict between two financial goals – saving for retirement and containing healthcare expenses in old age – by following the lead of California’s Medicaid program, Medi-Cal. Low-income retirees applying for Medi-Cal to supplement their Medicare no longer face an asset limit. It was eliminated on Jan. 1, 2024.

But without similar legislation in other states, workers and retirees with auto-IRA accounts could face tough decisions about how to reconcile their financial needs with their health care needs.

To read this brief by Karolos Arapakis and Laura Quinby, see “Will Auto-IRA Programs Affect Medicaid Enrollment.”

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.