Suddenly Everyone’s Talking about Defined Benefit Plans

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Some form of risk-sharing plan would be good, but coverage is the real issue.

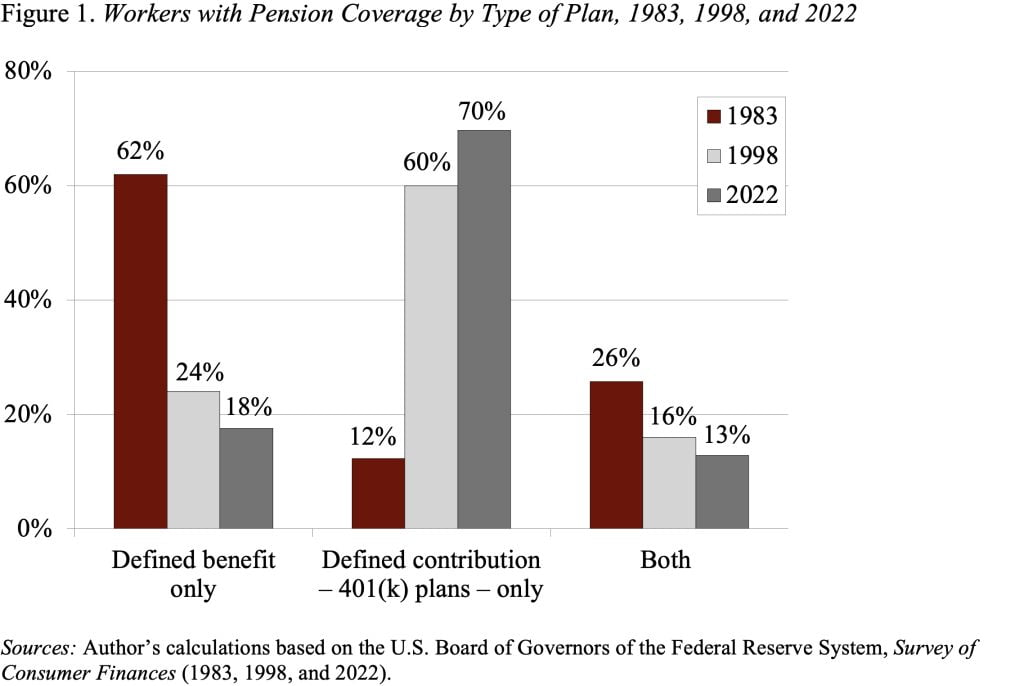

How did this happen? Now that the shift from defined benefit plans to 401(k)s is almost complete (see Figure 1), everybody seems to be talking about defined benefit (DB) plans. They were on the wish list of the United Auto Workers. The Wall Street Journal had an editorial arguing that the time is perfect for the comeback of defined benefit plans. And it looks like IBM just re-opened its cash balance plan. What’s going on and does it make any sense?

The WSJ article argues that defined benefit plans may now be the most cost-effective way for employers to provide retirement income. The high interest rate associated with the current inflation has made future obligations cheap, thereby greatly improving the funded status of private sector DB plans. And higher returns also make it cheaper to fund a $100,000 annual retirement annuity.

Several thoughts. First, employers do not provide benefits out of the goodness of their hearts; they decide on the total compensation they want to pay workers and if they increase retirement benefits, they cut back on wages. That is, employees pay for their retirement benefits through lower wages however they are structured.

Second, under the traditional DB pension employers bear both investment and mortality risk. They did not like that. On the flip side, employees have no protection from inflation. Since inflation took off in 2021, retirees have seen the value of their private sector DB benefits decline by 18 percent. Retirees don’t like that. In the end, it would be nice to have a system in which employees and employers shared risks.

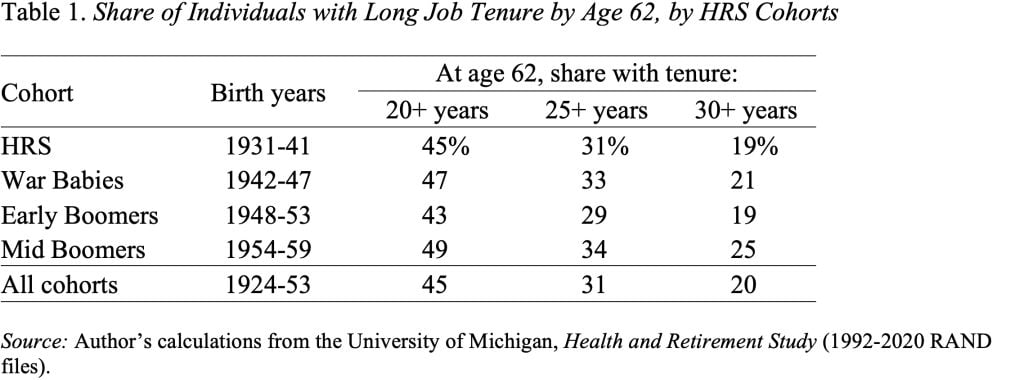

Third, DB plans work for those who stay with the same employer for years, but job hoppers actually do better – all else equal – with 401(k)s. I thought that more job-hopping was going on today than in the past, but that doesn’t appear to be true. At least it hasn’t shown up in lifetime employment patterns yet, where about 30 percent of those age 62 have spent 25+ years with one employer (see Table 1).

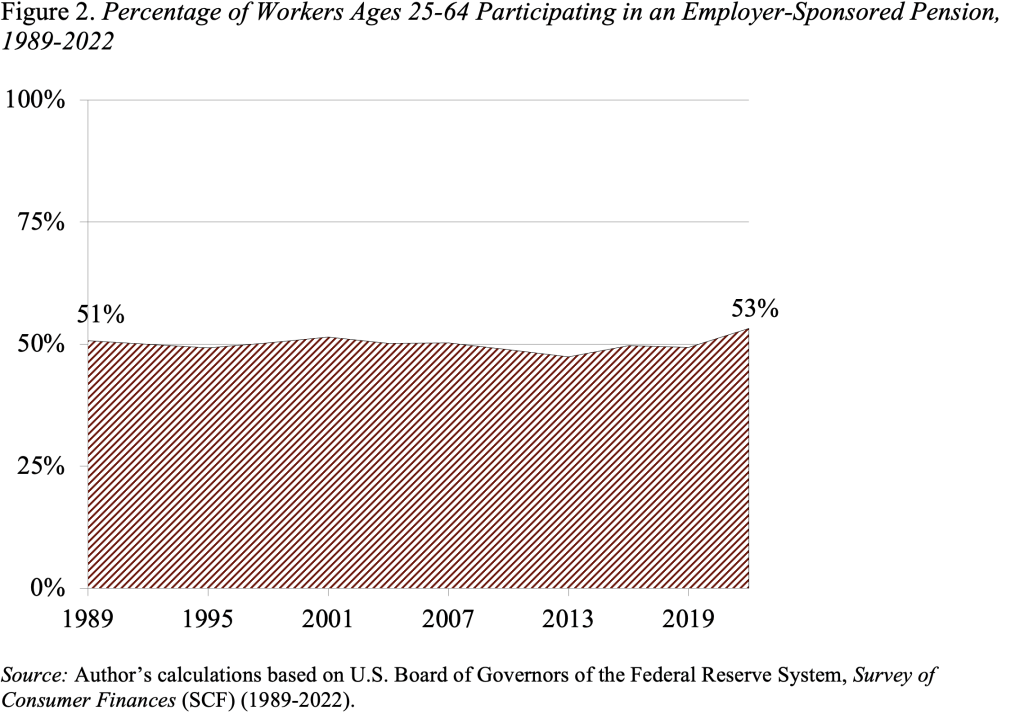

But all this chit chat doesn’t get at the main point. The big problem with today’s private sector retirement system is not that we have 401(k)s rather than DBs, but rather at any moment in time only half of the private sector workers are participating in a retirement plan (see Figure 2). This number has not budged over time; it wasn’t any higher in the DB world than in today’s 401(k) world. And the fact is that people who are continuously covered by a retirement plan – the top third of earners – do very well. Those who are virtually never covered – the bottom third of earners – do poorly and have to rely totally on Social Security. The middle third of earners, who move in and out of coverage, end up with inadequate retirement income. This pattern holds regardless of type of retirement plan.

In short, coverage – not type of plan – is the important thing to worry about. Going off on a toot about DBs is simply a diversion.