The Art of Persuasion and Social Security

Retirees could get substantially more in their Social Security check if they would just wait longer – up to age 70 – to sign up.

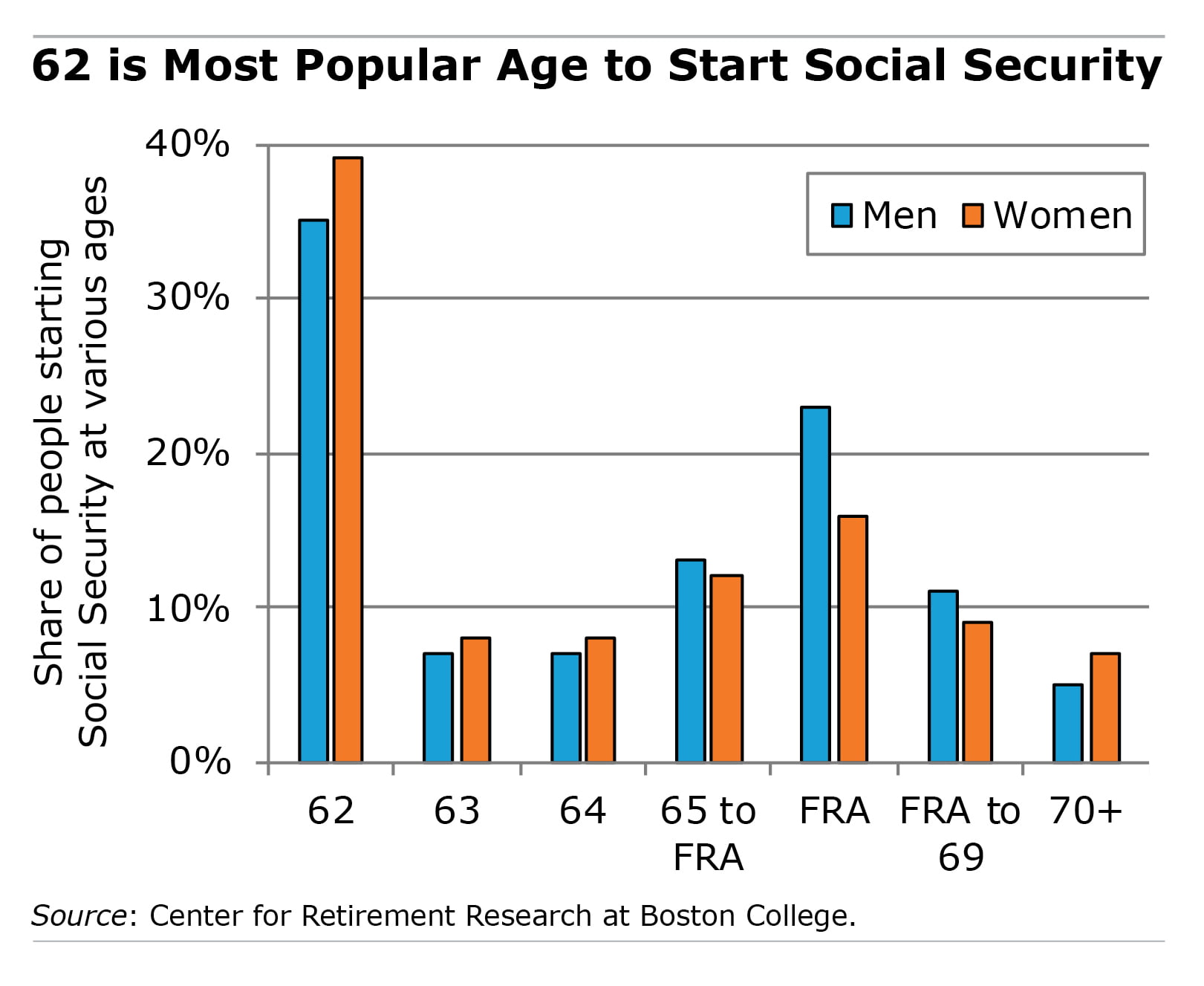

But only a tiny fraction of workers make it to 70, and more than a third get the minimum monthly benefits because they start them as soon as the program allows, at 62. A Bocconi University professor and three UCLA professors have set about trying to change minds by testing 13 ways of encouraging older workers to hold off and lock in a larger Social Security check.

But only a tiny fraction of workers make it to 70, and more than a third get the minimum monthly benefits because they start them as soon as the program allows, at 62. A Bocconi University professor and three UCLA professors have set about trying to change minds by testing 13 ways of encouraging older workers to hold off and lock in a larger Social Security check.

The techniques, which they tried on various groups of workers between ages 40 and 61, ranged widely in approach. But two of the most successful tests had one thing in common: participants were asked to engage in a little reflection about the personal impact of choosing when to start receiving their Social Security. This approach departed from the more common strategy of trying to influence people by feeding them financial or other information.

Everyone began the same way: they saw a table showing how much more they would receive from Social Security for each year after 62 that they delayed. One of the most effective tests was an exercise in self-reflection. The participants were asked to list “their own reasons” for how delaying would help them personally. Only after this step did they list the reasons to start their benefits at a younger age.

The order of these requests was intentional and intended to counteract the tendency by most people to focus on their short-term desires. This group reported that they intended to sign up 10 months later than the control group, which wasn’t exposed to the test, according to the study conducted for the Retirement Research Consortium.

A second exercise prompted participants to reflect on the implications of living to a very old age. As people get older, they face growing risks in the form of large medical bills and depleted retirement accounts. The participants were instructed to weigh the risks of longevity for someone in their life and to recommend a claiming age to them. This produced a six-month delay in when they intended to claim their benefits.

Individual workers have myriad personal reasons – health, unemployment, financial – for their decisions. But this study shows that something else also matters: how their choices are presented to them.

To read the study, authored by Adam Eric Greenberg, Hal Hershfield, Suzanne Shu, and Stephen Spiller, see “What Motivates Social Security Claiming? Testing Behaviorally Informed Interventions Alongside Individual Differences.”

The research reported herein was performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium. The opinions and conclusions expressed are solely those of the author(s) and do not represent the opinions or policy of SSA or any agency of the federal government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Many people imagine that claiming early allows them to spend more freely early in retirement when they know they’ll be healthy. Asking people to run the numbers on whether that’s really true might be helpful.

Why do researchers always default to “soft” behavioral explanations? Many people are anxious to begin benefits before the trust fund runs out of money. They believe cutbacks to existing recipients will be less likely than cuts to those who claim in the future, especially if they’ve been diligent savers and therefore might be perceived as high income seniors. Also, the government could decrease forced RMDs (instead taxing pre-tax IRAs at death unless donated to charity), so people aren’t worried about “tax torpedos”. Address the governmental risks and the numbers of seniors delaying social security will skyrocket.

Healthy versus health concerns is a major factor in deciding early SS retirement. People today are healthier and living longer. If one is healthier presently, it’s almost a no-brainer to choose earlier and enjoy true retirement plans and goals. If you have been battling health issues 10 years prior to 62, early retirement may be a welcomed gift. In my opinion, people who have money insecurities are always in save mode and money crunchers who simply cannot resist the extra dollars at 70, are not the ones that attempt to enjoy life to it’s fullest. People in any income bracket can adjust and enjoy what life offers. Also the reality of death lurking 24/7 is a real plan destroyer, eliminating the could have, would have, should have.

The government isn’t stupid. They know and are willing to take the bet and give you a larger check if you delay. You do not get more money by delaying. You just get a different payout. SS is based on average age of death amortization table.

Unless you are an outlier, beating the average age of death, it’s all a wash. Take SS at 62 and get a smaller check, but for a longer period of time or delay and get a larger check for a shorter period of time.

Who can afford to wait until they are 70? I just retired officially in October 2019. I can’t afford to live on just my social security so I chose to work part-time while I am healthy enough to do so!

I began SS @ 62 and never regretted it — I’m now 73. If I would have waited, working 8 more years would made me a time slave and I would have been in that middle level not rich enough or poor enough to live those last years comfortably. I get $1388 a month, have a subsidized 600 sq ft 1 bdrm apt for $315 a month, and $40 a month subsidized electric. I live smart — no TV, no car, no computer. Use my smart phone ($55 a month) for movies, research, tv news, sports, etc. The bus for seniors is $1! Did I mention I live on Maui and easily save $350 a month!

Question? Is it possible to stop receiving benefits if you find you want to go back to work?

Dave – I’m afraid that once you’ve filed with Social Security to start your benefits, the decision cannot be reversed. That’s why it’s so important to fully understand your finances ahead of filing.

However, people who are collecting Social Security can certainly work. But if you haven’t reached your full retirement age under the program, your Social Security benefits might be reduced – whether this happens depends on how much you’re earning in your job. This is known as the annual earnings test.

Be sure to check with the government for a more complete explanation of how this works.

Thanks for the excellent question.

Many people need the help NOW.

Provided that you have the means, the strong argument for delaying Social Security is that it guarantees an income, from the start of retirement, that may be higher than you would be willing to take from retirement savings. If you plan to spend retirement savings conservatively (e.g., follow the 4% rule), you are going to seriously shortchange yourself by claiming early.

Pretty! This was an extremely wonderful article.

Thanks for providing this information.