The Overlooked Data Point in the New Census Report: Most Families Don’t Have Much Income

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

This issue poses an enormous challenge for retirement security.

The headline from this year’s Census Bureau’s publications on Income, Poverty, and Health Insurance Coverage in the United States is fewer Americans are living in poverty but fewer also have health insurance. Both of these developments are newsworthy. The reduction in the poverty rate is good news and reflects several years of a strong economy. The reduction in health care coverage is startling given that the unemployment rate is at an all-time low.

While commentators are focused on poverty and coverage, the thing that always interests me the most from these reports is how little income most American families have and how little these amounts have grown over time.

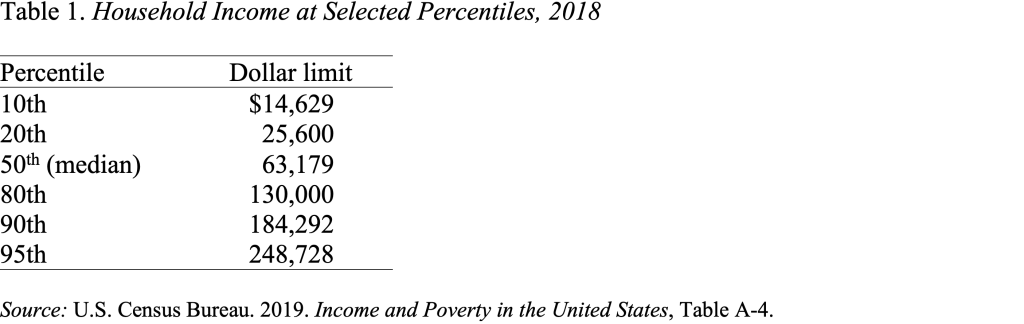

If you hang out in the Northeast and talk to financial types and academics who worry about pensions and retirement income, it is easy to get lulled into the notion that the mass affluent – the upper middle of the income distribution – have incomes of about $250,000. The truth is that if your household has $250,000, you’re in the top 5 percent. That’s evident in Table 1, which shows the thresholds for being in different parts of the income distribution. For example, a household with income of $63,179 is at the 50th percentile mark – right in the middle of the income distribution. A household with an income of $184,282 is at the 90th percentile point, or in the top tenth of the income distribution. And, as noted, $248,728 puts you in the top 5 percent.

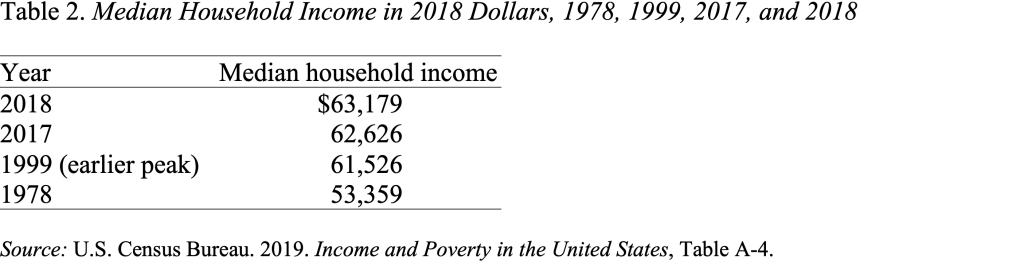

The thresholds must be interpreted with caution, though, because households include old and young, urban and rural, coastal and midland, and small and large. Yet, the data clearly show that those households with incomes of $250,000 are in the top five percent of households. In addition to most families having relatively little money, median household income in constant 2018 dollars has changed very little since 1978 and is only slightly above its earlier peak in 1999 (see Table 2).

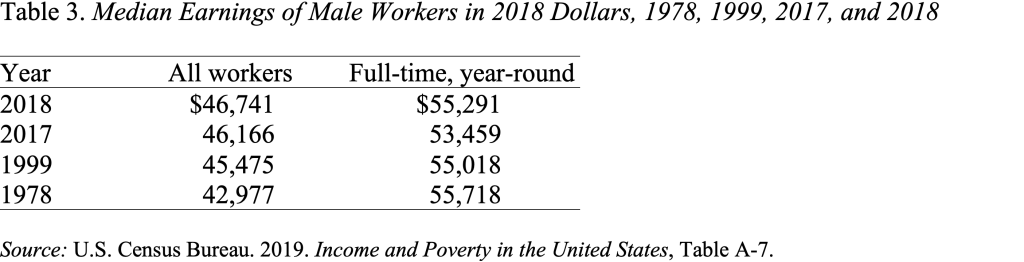

The reason that household income has not gone up very much is that earnings have been stagnant (see Table 3). While real earnings for all male workers in 2018 were above what they were in 1978, for full-time year-round workers they were lower even after two years with the unemployment rate below 4 percent.

For those of us interested in retirement security, these numbers create an enormous challenge. Social Security will not provide enough for the median household with $63,000 to maintain its standard of living. But saving for retirement would surely be a low priority item for households facing pressing demands for their dollars. Workers in these families need an easy and automatic way to save, but many do not have a retirement plan at work. Closing the “coverage gap” is a key requirement for improving retirement security in this country.