UAW Agreement Strengthens Retirement Security

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

How unusual is a 10-percent 401(k) contribution – with no required employee contribution?

A reporter asked recently what I thought of the new 401(k) contribution rate in the United Auto Workers (UAW) agreement with Ford, General Motors, and Stellantis. The companies have agreed to increase their 401(k) contributions from 6.4 percent 10 percent of pay – with no required employee contribution. Is that generous?

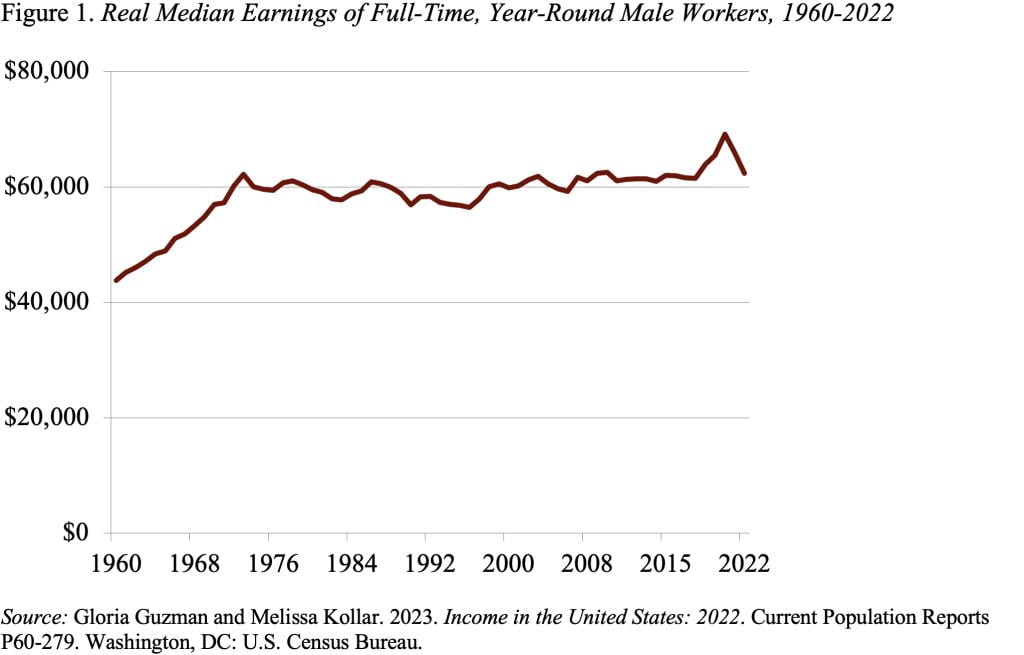

First, my framework for judging any worker/management deal is the pattern of wage growth since 1979. Median earnings for full-time year-round male workers in 2022 were $62,350 compared to $60,360 in 1979 (both figures in 2022$). That is, in terms of real buying power, the earnings of men in the middle of the pack working full time have remained virtually unchanged for more than 50 years (see Figure 1).

So, I rejoice at any development that raises the compensation of these workers – especially in light of the enormous concessions that the UAW made in 2007 when the companies were teetering, and the record earnings of the automakers in recent years. Anyone hired after the 2007 contract became a “second-tier” employee with lower wages and benefits – importantly, their retirement coverage shifted from the defined benefit plan to a 401(k). Indeed, restoring the defined benefit plan was on the UAW’s list of demands.

While the automakers did not agree to restoring the defined benefit plan, they did concede to a 25-percent increase in wages, the reinstatement of cost-of-living adjustments, a more rapid path to top wages, and significantly enhanced retirement benefits. For those in the defined benefit plan, the automakers agreed to a $5 credit each month for each year of service – that is, a worker with 25 years of service would receive $125 more per month. For those hired after the 2007 contract, they agreed to increase the contribution to the 401(k) plan.

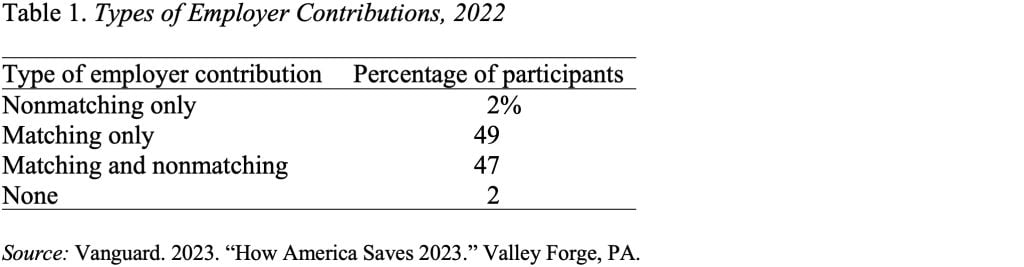

In terms of the specific question about the 10-percent contribution to the 401(k), data from Vanguard suggest that the contribution is higher than that provided by most other employers. First, it is unusual for a company to provide solely a nonmatching contribution – just two percent of plan participants received one in 2022 (see Table 1).

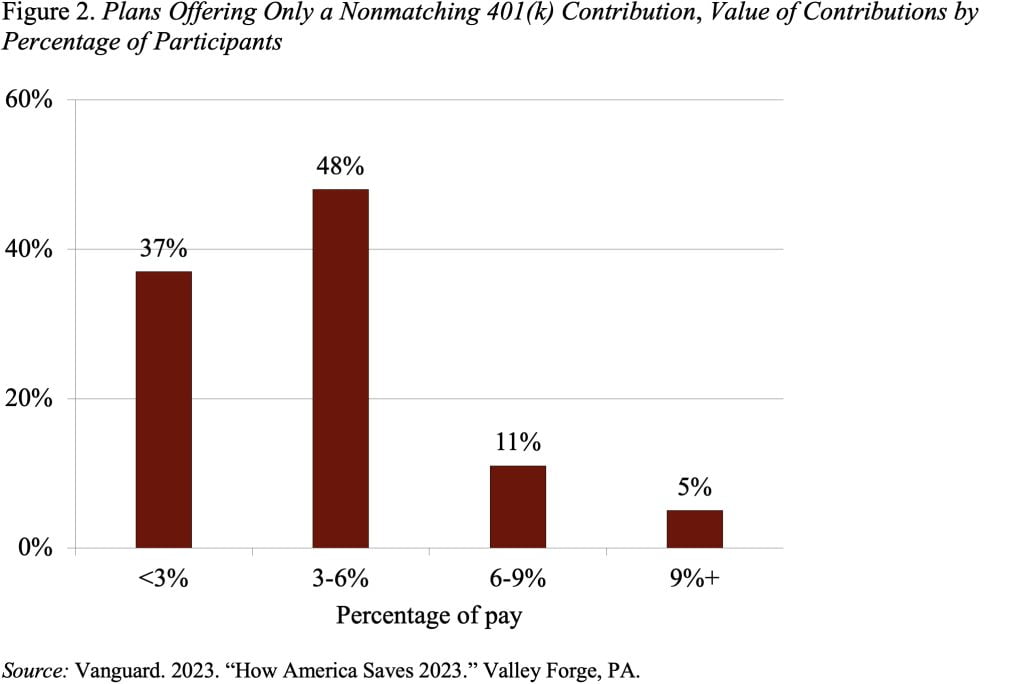

Second, for those employers offering only a nonmatching contribution, only 5 percent of participants were in plans that offered a contribution of 9 percent or more (see Figure 2).

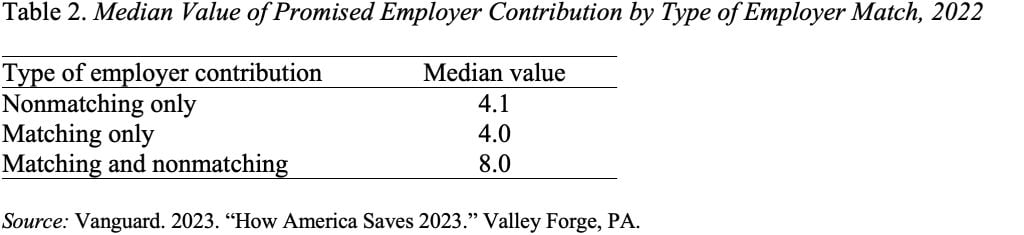

The final question is how the value of the employer contribution varies across type of contribution. In the case of nonmatching, the value is simply the percentage contributed. In the case of matching contributions, the value is calculated as the maximum amount promised by the employer. For example, a match of $0.50 per dollar on the first 6 percent of pay promises a 3-percent contribution from the employer. This calculation somewhat overstates the value of the matching contribution, since only two-thirds received the full employer matching contribution. Nevertheless, the pattern suggests that some participants in plans where the employer provides both a matching and nonmatching contribution may enjoy combined employer contributions comparable to those provided by the auto companies. But overall, the 10-perent non-matching contribution is definitely at the high end of plan providers.

In my view, this is good news.