With Inflation, Many Retirees Will Pay More Federal Income Taxes

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

While the system is generally indexed for inflation, taxation of Social Security benefits is not.

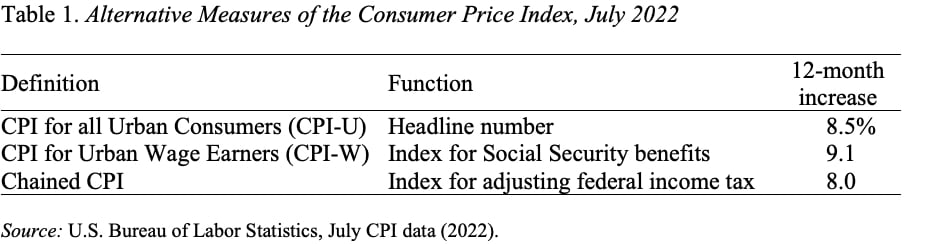

The federal income tax is generally indexed for inflation. Most particularly, the income brackets to which the marginal tax rates apply are increased in line with the “Chained CPI-U.” While the chained CPI-U has risen somewhat less rapidly than the headline CPI-U or the CPI-W used to adjust Social Security benefits, the adjustment will be significant (see Table 1).

The brackets in the federal personal income tax vary by household type – single, married, head of household; Table 2 shows the 2022 brackets for married households. Assume that the chained CPI for calculating the 2023 brackets increases by 8 percent; then the dollar cut-offs in Table 2 would all be increased by 8 percent. As a result, low-income couples would stay in the 10-percent bracket until their income exceeds $22,200, and high-income couples would not be subject to the 37-percent rate until their income exceeds $699,700. In addition, the standard deduction for married couples would be increased by 8 percent from $25,900 to $28,000.

While the indexation ensures that workers whose earnings go up by 8 percent are not harmed by inflation and those whose gains are less than 8 percent actually see a reduction in their tax burden, such is not the case for retirees. Because the provisions for taxing Social Security benefits are not indexed at all for rising prices, inflation leads to higher taxes for beneficiaries.

Under current law, married couples with less than $32,000 of modified adjusted gross income (AGI) do not have to pay taxes on their benefits. (“Modified AGI” is AGI as reported on tax forms plus nontaxable interest income, interest from foreign sources, and one-half of Social Security benefits.) Above this threshold, recipients must pay taxes on up to either 50 percent or 85 percent of their benefits (see Table 3).

Unlike the rest of the federal income tax, the thresholds for calculating Social Security taxes are not indexed for inflation. As a result, if the CPI-W in the third quarter of 2022 exceeds that of the third quarter of 2021 by, say, 9.5 percent, the 2023 cost-of-living adjustment will force many who currently do not pay taxes on their benefits to include 50 percent in their calculations and many others who only include 50 percent to pay taxes on up to 85 percent. That is, many retirees will see a tax hike.

The bottom line is that high rates of inflation will allow many workers to enjoy a reduction in their tax burden, while forcing many retirees to pay more. My view is that virtually everything in the policy world should be indexed for inflation!!