Unexpected Retirement Costs Can be Big

Resourceful retirees usually weather the financial surprises that come their way. But a handful of unexpected health events can really hurt.

Resourceful retirees usually weather the financial surprises that come their way. But a handful of unexpected health events can really hurt.

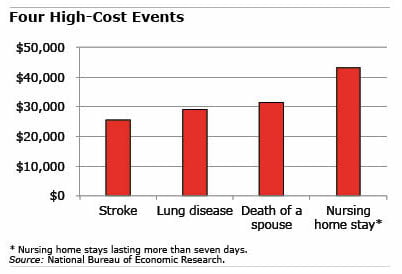

The death of a spouse is at the top of the list. Net worth drops by more than $30,000 over a couple of years as retirees pay for the extraordinary medical and other expenses surrounding a spouse’s death.

Two serious health conditions also deplete retirees’ assets: strokes and lung disease, which strike about one in five older Americans during their lifetimes, according to a National Bureau of Economic Research study funded by the U.S. Social Security Administration that tracked changes in the finances of people 65 and over.

Despite the presence of Medicare, a first-time stroke reduces a retired household’s average wealth by more than $25,000 – or 6 percent – and lung disease reduces it by about $29,000.

Net worth in this study includes financial assets and home equity minus debts.

These estimates of the cost of various events provide new information about a few of the many unknowns that go into retirement planning. Workers who may think they are saving enough to cover their routine retirement expenses don’t necessarily factor in medical and related costs that are difficult or impossible to predict.

Taken together, single and married retirees will use anywhere from 3 percent to 14 percent of their wealth to pay these unpredictable expenses. But wealthy retirees, who can afford first-rate care, spend much more than the average, while poor people, who have Medicaid to supplement their Medicare, spend very little.

Aside from stroke and lung disease, the other medical conditions the researchers examined – heart attack, arthritis, diabetes, cancer, and high blood pressure – did not have a major impact on retirees’ finances. For example, arthritis is pervasive, afflicting half of retirees, but the cost of the medication to treat this condition is low.

One potential expense retirees are very attuned to is the prospect of eventually going into a nursing home. Although this happens to a minority of older Americans, nursing home stays that exceed seven days deplete an average $43,000 of a household’s wealth.

This study shows that surprise expenses can undermine any retiree – even the ones who thought they were well-prepared.

To read this study, authored by James Poterba and Steven Venti, see “Financial Well-being in Late Life: Understanding the Impact of Adverse Health Shocks and Spousal Deaths.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

In the year 2018 the US healthcare bill was 3.65 TRILLION with a T and 18% of GDP; it also represents close to 80% of all bankruptcies regardless of age. The average US citizen spends twice on health care than any other country in the world with no better outcomes.

This reminds us that despite what many believe, Medicare does NOT cover long-term care. If one or both spouses end up in a nursing home, the options are long-term care insurance, self-pay for the well-off or spending down one’s assets and then becoming eligible for Medicaid. It is too late to try to give assets to heirs when the need arises.

Perhaps difficult, but nothing is impossible to estimate; some estimates are simply more easily quantifiable than others.

According to one of the industry’s most diversified financial services firms, a 65-year old couple retiring in 2019 can expect to spend $285,000 in health care and medical expenses throughout retirement. (That’s one way of getting an estimate.)

What we did was to review our prior 10 years of medical expenses (each year’s premiums + all out-of-pockets), calculate the average of all those year’s medical expenses, and then extrapolate that average amount of healthcare expenses out for 30 years. We then budgeted that amount into our total retirement projections.

(As for long-term care, we purchased a partnership-qualified LTCi policy that provides “spend down” protection. For every dollar of LTCi we purchase, that amount of our financial assets are protected from the spend down threshold to qualify for Medicaid. The Partnership Program also protects those assets after death from Medicaid estate recovery.)

This is the first I’ve learned of Long Term Care Insurance Partnership Policies. Thank you very much for informing us. That is a very interesting program, and I wonder how well it has survived the overall contraction of the long term care insurance market.

Ken – The Center for Retirement Research, where I work, has done a study on the effectiveness of these partnerships:

https://crr.bc.edu/working-papers/can-long-term-care-insurance-partnership-programs-increase-coverage-and-reduce-medicaid-costs/

Retirement is scary!