Warren Buffett Is Confusing the Tax Debate

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Warren Buffett has been making the point whenever possible that he pays a smaller percent of his income to the federal government than his secretary. President Obama regularly incorporates the plight of Mr. Buffet and his secretary into his speeches. The problems with Mr. Buffet’s statement are twofold: 1) his tax situation is not representative of high-income people generally; and 2) he diverts attention from the larger picture that we Americans under-tax ourselves.

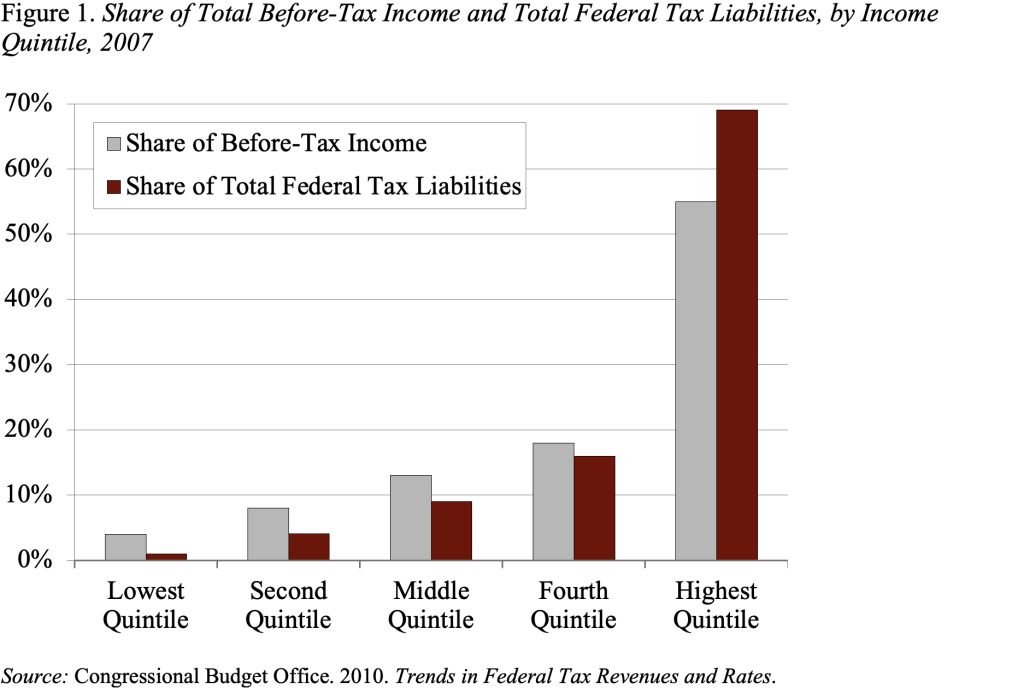

In the view of most economists a well-designed tax system will have tax rates that rise with income. Under such a structure, high-income people pay not only higher taxes but also a higher percentage of their income in taxes. The rates in the Federal personal income tax currently range from 10 percent for incomes under $8,500 to 35 percent on incomes over $379,150. For the population as a whole, these progressive marginal rates appear to translate into a progressive overall tax burden.

Figure 1 shows for different quintiles of the income distribution the shares of income before taxes and shares of total taxes paid. In 2007, households in the top quintile earned a disproportionate share – 55 percent – of before-tax income, but these households paid almost 70 percent of total taxes. That is, they paid a disproportionately large share of total taxes. For all other quintiles, their share of total taxes was less than their share of total income. Now some might argue that the wealthiest should have paid even more, but that concern seems secondary to the fact that the overall tax system is moderately progressive.

Presumably, Warren Buffet pays a low rate because he receives a large share of his income in long-term capital gains and other forms of non-wage income, where maximum tax rates are at an all-time low.

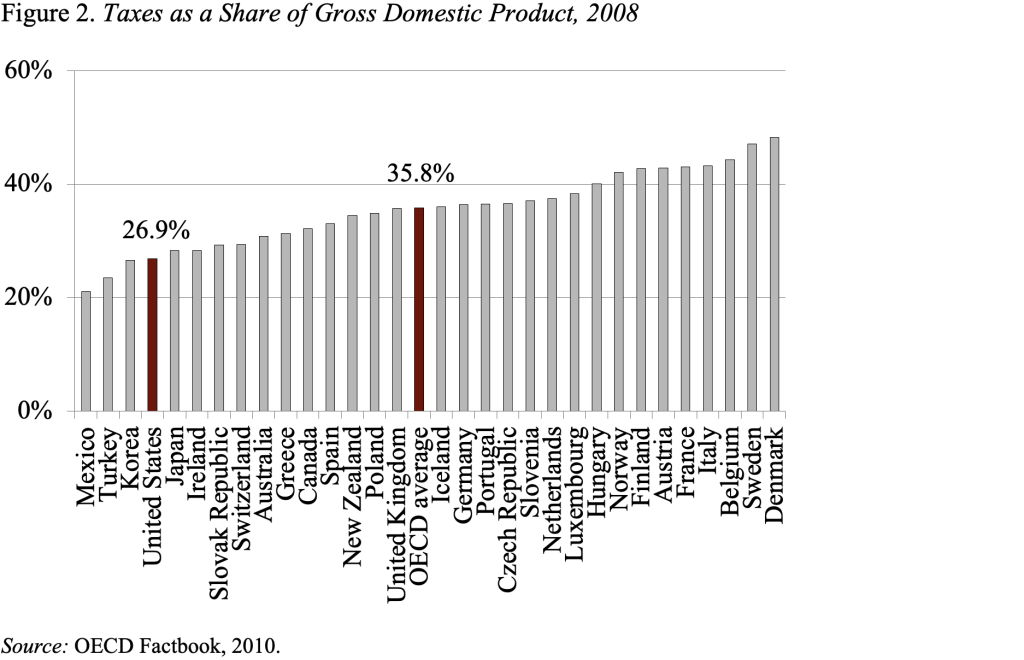

The real problem with our tax system is not the distribution of burden, but the fact that our total local, state, and federal taxes amount to such a small share of our Gross Domestic Product (GDP). As Figure 2 below, from the Organisation for Economic Co-operation and Development (OECD) shows, 2008 taxes amounted to only 26.9 percent of GDP in the United States. The average for all OECD countries was 35.8 percent. The only OECD countries with a lower national tax rate were Korea, Turkey, and Mexico.

The implications of our low national tax rate are profound. Proposals abound to cut back on “entitlements” – Social Security and Medicare – and to scuttle the safety net for our vulnerable populations. Unfortunately, in this context, the conversation about Mr. Buffet and his secretary is a diverting side show.