Who Is Middle Class?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Some think in terms of household income of $250,000; the answer is $60,000.

All the rhetoric surrounding the coming tax reform proposals says that the changes will benefit the middle class. The question is what income group constitutes the middle class?

Many politicians have adopted household income of $250,000 as a meaningful demarcation point for defining the middle class. Similarly, hanging around financial types and academics who worry about pensions and retirement income, it is easy to get lulled into the notion that the mass affluent – the upper middle of the income distribution – have incomes of about $250,000.

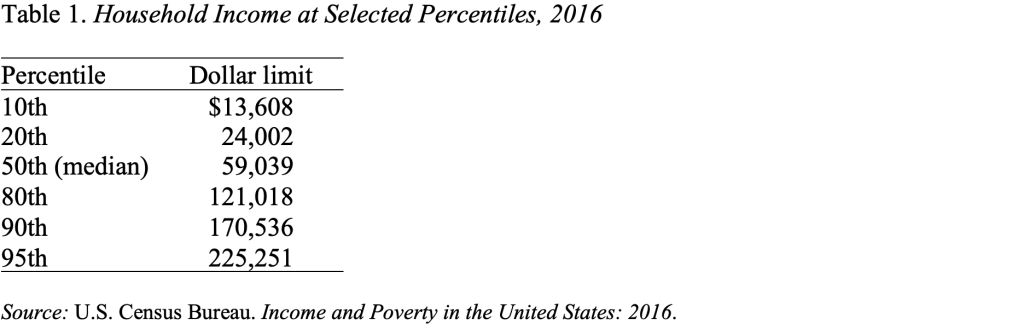

Where does this concept of $250,000 as the appropriate cut-off come from? According to the data in the most recent Census report shown in Table 1 below, the typical household in 2016 had an income of $59,036. A household with an income of $170,536 was at the 90th percentile point, or in the top tenth of the income distribution. Even at the 95th percentile, household income is only $225,251. The thresholds must be interpreted with caution because households include old and young, urban and rural, coastal and midland, and small and large. But it is very hard to understand how anyone could think of $250,000 as the middle. Middle-class households have incomes of about $60,000.

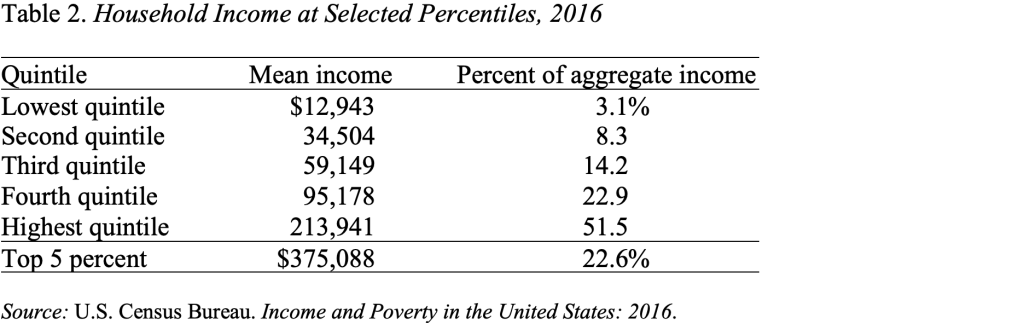

Not surprisingly, the middle class does not receive a significant proportion of aggregate income. That rests with the $214,000-plus households, who receive 52 percent of the total (see Table 2).

The bottom line is keep these numbers in mind as the tax reform debate commences, so you can identify the winners and losers.