Why Many Retirees Choose Medigap

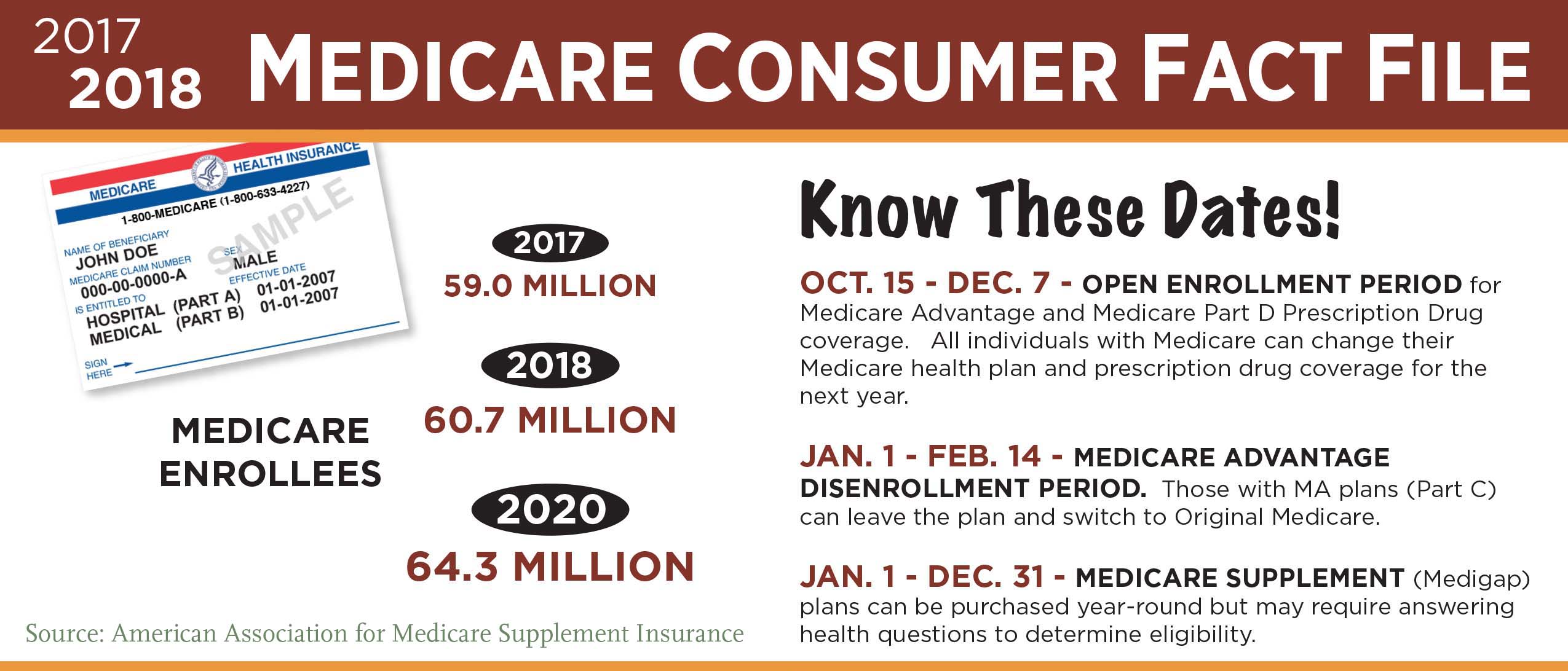

The Medicare open enrollment period starting Oct. 15 applies only to two specific insurance plans: Part D prescription drug coverage and Medicare Advantage plans.

But before choosing among various plans sold in the insurance market, the first – and bigger – decision facing people just turning 65 is whether to hitch their wagons to Medicare-plus-Medigap or Medicare Advantage. Squared Away spoke with insurance broker Garrett Ball, owner of Secure Medicare Solutions in North Carolina, who sells both. Most of his clients buy Medigap, and he explains why.

In a second blog post, we’ll interview a broker who deals mainly in Advantage plans. Another source of information about Medigap and Advantage plans are the State Health Insurance Assistance Programs.

Q: Let’s start with explaining to readers what your company does.

We’re an independent Medicare insurance broker that works with some 2,000 clients on Medicare annually who are shopping for supplemental plans. My company began in 2007, then in 2015 I launched a website tailored to people just turning 65 to answer the questions I get every day. We’re not contractually obligated to just one insurance company. When we work with someone, we survey the marketplace where they live, assess their needs, and help them pick a plan. We get paid by the insurance companies when someone signs up for a plan. Different states have different commission levels, and there is more variation state-by-state than company-by-company. Insurers typically pay fees of $200-300 per person per year.

Q: What share of your clients buy Medigap policies, rather than Medicare Advantage plans?

Approximately 10 percent of my clients end up with Medicare Advantage vs 90 percent with Medigap. Some states have a higher percentage in Medicare Advantage. I do business in 42 states, so this depends on the insurance markets in individual states.

Q: Why do you sell more Medigap plans?

A couple of reasons. Medigap gives you flexibility without having to worry about a physician network. I’m seeing more people who travel when they retire, and they spend half the year in one state and half the year in another state, or they like to visit their grandkids across the country. Medigap gives you that flexibility, because there’s no network. The other reason is Medigap’s more predictable out of pocket (OOP) costs. With Medigap, you don’t have copays in most cases. You pay a higher monthly premium but you know you’re only going to have a certain amount of OOP costs, which tend to be lower than Advantage plans’ OOP costs.

Q: But isn’t Advantage plans’ big selling point that they have lower premiums?

Yes, and you’re going to come out better on an Advantage plan in a year where you don’t go to the doctor at all and you’re perfectly healthy. But as people get older, the reality is they’re going to go to the doctor more. The consumer who thinks about it long-term takes that into account and often lands on the Medigap.

Another important point to mention is that everyone who turns 65 gets an open enrollment period during which they are ensured of Medigap eligibility. After that window closes, which is six months after you start Medicare Part B, then you may be limited in your Medigap choices. But if you choose an Advantage plan when you turn 65, and you later want to switch to a Medigap plan, you have to qualify medically for Medigap. Medigap plans were exempt from the Affordable Care Act, so they are not prohibited from asking you questions and turning you down for coverage. You can always switch from Medigap to Medicare Advantage, but you can’t always go from Medicare Advantage to Medigap. Some people choose the Advantage plans when they’re healthy and say they’ll switch to Medigap, but then they have a medical problem that might make it difficult or cost prohibitive to switch, though not impossible.

Q: So what do you recommend for someone turning 65 who has chronic medical problems?

A Medigap plan is likely to be a better choice, just because they might not be able to get it later. And if there are known medical conditions or upcoming visits, tests, and procedures, you’re going to come out better cost-wise – even paying a higher premium – in the Medigap plan.

Q: Is there a lot of variation in plans from state-to-state, given that insurance is a state-regulated business?

The premiums for both types of plans can vary considerably from state to state – as much as two or three times as much in some states as in others.

The rules also vary a lot by state. This matters, because the states determine the Medigap plans offered there. Most states have chosen to go with the 10 standard Medigap plans the federal government recommends. Massachusetts, Wisconsin, and Minnesota are among the states that have come up with their own Medigap plans, which look different than the ones the federal government adopted. New York requires that Medigap approve everyone at any time they wish to enroll, regardless of their medical conditions – it may not matter whether they choose Medicare Advantage or Medigap initially, because they can switch to Medigap more easily than people in other states.

Q: How can people determine what’s right for them?

The process I usually take is going through the benefits of every plan type – Medigap and Advantage. Most people already have that question anyway.

Q: What is the biggest difference in how Medigap and Medicare Advantage were set up?

Medicare Advantage plans pay instead of Medicare. If you have Advantage, Medicare no longer is paying your claims. With Medigap, the Medicare program pays its portion of your medical bills predefined by the federal government, and Medigap pays some or all of what is left over after Medicare pays. Under Medigap, there are fewer things you have to pay out of pocket: there are usually no copays, so you’re not paying a per-visit copay, whereas an Advantage plan has a long list of copays for each service or procedure someone may have.

Further, when you purchase Medigap, it’s guaranteed renewable at that same level of coverage, as long as you keep paying the premium. That’s another difference between Medigap and Medicare Advantage: Medigap plan coverage does not change annually, though the premiums may change periodically, but the Medicare Advantage plans are renewed each year. So if you sign up for an Advantage plan in August 2017, you’re signing up from Aug. 1- Dec. 31, but in January your benefits are set for a new calendar year. There’s no guarantee past the end of calendar year 2017. On Medicare Advantage, you do have an enrollment period during which you can change – between Oct. 15 and Dec. 7. If you have an Advantage plan, a notice of plan changes must be mailed to you by Oct. 1 telling you how your plan is changing for the following year. If you do nothing, you’ll keep the same Advantage plan. If you want to change, you will actively have to find another plan and sign up for it.

Q: What are the risks associated with Medigap plans?

The biggest risk is you’re going to be paying more in premiums, and the premiums tend to go up over time. When you buy in, the premium might be $100, but by the time you’re 75, it is $140. For people on a fixed income, that can be a problem. I do generally think that a portion of the people who choose Medicare Advantage do so because of the lower premium. But a lot of people don’t know or realize some of the things we’ve talked about – their exposure to out-of-pocket costs in the future.

Q: Surely Advantage plans have advantages too?

Yes, the lower premium plan can be a great option for people who are healthy – as long as they stay healthy. And it’s a great alternative to going only with Medicare. If someone chooses to get neither Medigap or Medicare Advantage, they’re on the hook for 20 percent of an unlimited amount of medical bills. Medicare Advantage is protection for people who can’t afford the higher Medigap premium and certainly a better option than only Medicare.

Prescription drugs are another advantage. Most of the Medicare Advantage plans include it. However, none of the Medigap plans cover prescription drugs, so you have to sign up for a separate Medicare Part D plan. That further increases the cost of Medigap.

To make an overarching statement, however, the downside of having the prescription drug plan included in Advantage plans is that you have to take whatever drug prices and benefits are in the plan. The upside of Medigap is that if you’re buying your own stand-alone Part D plan, most counties have 20 or 30 different plans. On Medicare’s website you can plug in your prescriptions, your dosages, and your preferred pharmacy, and it will tell you which plans fit your specifications. If you have more prescriptions, there would be more choices under Medigap with a Part D plan in most counties and more likelihood you can get a plan that covers all your medications. If you pick an Advantage plan, you might like the medical benefits, but it might not cover one of your medications. The fact that Advantages ties the medical and prescription drug benefits together might give you a little less choice. The prescription drug benefit is a mixed bag for either plan.

Q: How have the two plan options – Advantage and Medigap – changed over the years?

I’ve been in this business 11 years. The Advantage plans used to have more benefits than they do now in the form of extras such as dental and vision coverage. These are not covered under traditional Medicare. But they have also really been reduced in the Advantage plans over the past few years and are probably not very comprehensive.

The Medigap landscape has also changed. The plans were reconfigured in 2010. Some plans were eliminated and others were added. One of the more commonly chosen plans – Plan J – was the most comprehensive plan, and it was dropped in 2010. Also in 2010, Plan N was added. Plan N has some cost-sharing, meaning copays, but it has a lower premium. It may serve as competition to Advantage plans.

Q: Where do you see things going in the future?

In 2020, Plan F, which is now the most comprehensive and expensive plan in terms of the premium, will be eliminated for new Medicare enrollees. If you’re already on a Plan F, you can keep it. But if you turn 65 in 2020, you’re not going to be eligible for that plan. The reason the comprehensive plans are being eliminated – this is subject to debate – is they feel people are more likely to overuse the Medicare system if they have a plan that covers everything than if they have skin in the game. Plan F pays virtually everything that Medicare doesn’t pay. People will be forced to buy some Medigap plan where they have some out-of-pocket costs.

Q: How do the plans vary geographically, say New England versus the South or California?

Premiums are really the biggest difference. The premiums for Medigap plans are generally lower in rural areas and in the Midwest, South or Southeast than they are in the Northeast. The Medicare Advantage plans vary tremendously, even by county, so when you purchase an Advantage plan, it’s based on the county you live in. California is so large it has several geographic areas. In some California counties, there are tons of Advantage plans that are pretty competitive – and this competition is good for consumers. In other areas, there are only a few Advantage plans, and Medigap might be a better choice.

Q: It’s early September. Is it too early to start the research for the Oct. 15 enrollment period?

The plans do not get finalized until Oct. 1. You can review the plans now on Medicare’s website but you’re reviewing the plans that might no longer be eligible or that will change. However, people can start now getting an idea of what’s out there. One big thing people who are already on Advantage plans should consistently be doing is checking with the doctors they would likely use to see which Advantage plans they’re in network with, because those networks change over time. That is not an issue with the Medigap plans, which don’t have a network.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

You did not mention High Deductible F. Is it going to end as well? We have had that for years and most years are not near the deductible. In years where we are, the premium difference to regular F is so great it is about the same as the regular F in total cost. Also, the premiums hardly ever go up and to the extent they do it is very tiny due to the very low premiums – around $40 per month. In five years the premiums have increased about $4 per month total for each of us.

what is your deductible currently?

Benefits for Hi-Ded. Plan F do not start until you exceed $2,200 in out-of-pocket expenses for Medicare Part A and/or B services for 2017. What many miss is Medicare A and B pay first, so you aren’t “out” the deductible before you get any help with your medical costs. If Medicare generally pays 80 percent, you’d have to incur a total of $11,000 in Medicare approved charges to meet the $2,200 deductible. Medicare would have paid the other 80 percent or $8,800 of this amount. At that point, Hi-Ded. F is as good as regular Plan F. The deductible “resets” Jan. 1 each year (calendar year deductible same as Medicare).

I have only read standard Plan F is being eliminated for new Medicare beneficiaries in 2020. As the article stated, people who already have Plan F can keep it, so you don’t have to worry about your current plan ending.

Hi-Deductible Plan F is an interesting choice. While premiums haven’t gone up much at all, the deductible has increased. Of course, this is what also helps keep premiums low.

After 2020 the participants in plan F will lower each year as the participants die off. Will this cause increasing premiums for those remaining in Plan F? If so, will the government allow a move to another Medigap plan without health questions like when we first signed up?

Hi Sheila,

Good question. While there is no way to know with absolute certainty what will happen to Plan F rates after 2020, most analysts agree that rates will likely go up more on that plan vs. other plans. With an aging customer base that is not offset by new 65-year-olds joining the plan, the claims ratios on Plan F will likely be higher each year after 2020.

With other plans that have been eliminated (i.e. Plan J in 2010), rates have gone up at a higher percentage in most cases.

I have not seen anything to indicate that there will be a “guaranteed issue” move to other Medigap plans for people that have ‘F’ after 2020. That has not happened in the past (with other plan eliminations), and I would not expect/count on it to happen here.

As a side note, Plan F rates already increase at higher percentages than several of the other plans due to them being “guaranteed issue” in certain situations. This causes them to attract people who cannot “qualify” for other plans, and average annual increases on Plan F are a couple of percentage points higher than on Plan G or N, for example.

My experience with Advantage plans is they attract enrollments at the higher and lower end of the income spectrum, but not so much for middle level incomes.

This article, like many, focused differences around premiums and costs. It will be interesting to see what the second installment discusses. For me, the prime reason to go with an Advantage plan is the actual care itself and how the enrollee views Managed Care, which many Advantage plans excel at.

If viewed a benefit (which it should be) vs. the challenges of managing your own care, that is a big plus. Premium and costs become much less important. Should you think managed care solely as a gatekeeper to deny you access, the cost of Medigap is not driving your decision.

Advantage plans are ahead of the curve in my view in harnessing technology, people and caring to help members enjoy better outcomes and health. They are moving to paying doctors for outcomes and quality, not number of visits or procedures done.

I’m pre-65, disabled, from Indiana and was on disability with Medicare A & B primary & ATT retiree secondary. ATT forced me to have part A&B when I became disabled. Last year ATT dropped retirees & I went with my husband’s employer plan in 2017. I did NOT drop Part B. I plan to stay on his employer coverage until my 65th birthday in July 2018. At that time, I was hoping to drop my existing coverage through husband’s employer & apply for a Medigap plan during SEP without underwriting. Since I did NOT drop my Medicare Part B last year, is this going to cause problems for me 3 months prior to my 65th birthday? …when I was hoping to have no problems underwriting for a Medigap policy. I’m currently in Medicare A& B & and have been since my disability date.

You gave a platform to an insurance salesman. The real choice people face is between 1. Medicare Advantage 2. Medicare plus Medigap and 3. Medicare only. For many, 3 is the best choice. It is also the cheapest choice for the taxpayer.

Further, Medigap policies cost more than the expected value of claims. If they didn’t, then insurers would go bust. They may make sense for really risk-averse types, or for people who know they are going to run up high expenses, for much the same reasons as first dollar coverage may make sense for some homeowners and car drivers. But most people are probably better off saving the money. I am not aware of any calculations of how much of a sick scaredy cat you would have to be justify buying a policy.

Medicare deductibles are there for a reason – to discourage frivolous use of care. Medigap frustrates that purpose, drives up care use, resulting in higher Medicare spending and premiums for everyone.

Hi Cathy,

Thanks for the question. The Medigap open enrollment period – during which there is no underwriting – begins the first day of the month that you are BOTH 65 or older and enrolled in Medicare Part B. In other words, you will be eligible to sign up for a Medigap plan to start 7/1/18 without any underwriting or health questions. It would be crucial to do it during that 6-month window, as you would have to answer medical questions after that time period.

The Medicare “Choosing a Medigap Policy” booklet (https://65medicare.org/choosing-a-medigap-policy-2017/) explains your rights on page 14. Hope this helps!