Why Roll 401(k)s into IRAs?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Participants, Who Rarely Mess with Their 401(k)s, Are Putting Their Money in Harm’s Way

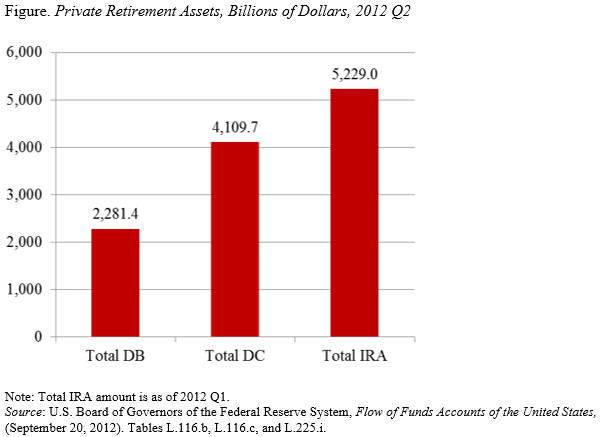

Usually people writing blogs know the answer to questions they pose in titles, but I am actually baffled by the fact that Individual Retirement Accounts (IRAs) now hold more assets than 401(k) plans (see Figure).

The great bulk of IRA balances are rollovers from 401(k) plans. This rollover behavior is extraordinary given that participants are typically passive in their interactions with their 401(k) plan. They rarely change their contribution rate or rebalance their portfolios in response to market fluctuations or as they age. Because inertia has been identified as a major problem, reforms have focused on automatic mechanisms, such as automatic enrollment, automatic increases in the default contribution rate, and target date funds.

One would think that the force of inertia would lead participants to leave their balances in their 401(k) accounts until they draw down their accumulations in retirement. My understanding is that departing employees can leave their balances in their employer’s plan until the plan’s retirement age – typically 65.

The fact that they actually take the trouble to move their funds suggests a strong motivating force. My sense is that employers do not urge employees to move their money, but I could be wrong. The motivating force is more likely advertisements from financial service firms urging participants to move their funds out of their “old”, “tired” 401(k) plan into a new IRA with a much larger range of investment options.

The assumption by participants must be that the financial service firms are operating in the participants’ best interest, but such an assumption is not necessarily correct. In fact, participants are moving from being protected by a fiduciary to an environment with much less stringent standards. The Department of Labor has proposed extending fiduciary standards to IRAs, but has met a storm of protest from the broker-dealer community. And even though fees remain high in 401(k) plans, the Department of Labor is shining a spotlight on the problem; no one is monitoring fees in the IRA world.

No one ever envisioned that IRAs would be the main retirement account for people. But that is what has happened. Policymakers are now playing catch-up and trying to make IRAs be more like 401(k)s. Another approach would be simply to say that people cannot roll over their 401(k) balances at least until the plan’s retirement age. A further step would be to say that 401(k) plans must continue to retain all balances until the participant withdraws them for consumption in retirement. Then, the goal would be to make the 401(k) system work as well as possible.