Don’t Confuses Public Pension Cost with Generosity

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

States and localities are paying less for benefits than in the past.

In a recent editorial, The Wall Street Journal reports on state and local pension liabilities as a percentage of state GDP and concludes that politicians have made excessive pension promises. In fact, pension costs are going up, but the question is whether the rising costs are a result of benefit generosity or of underfunding. The answer is underfunding.

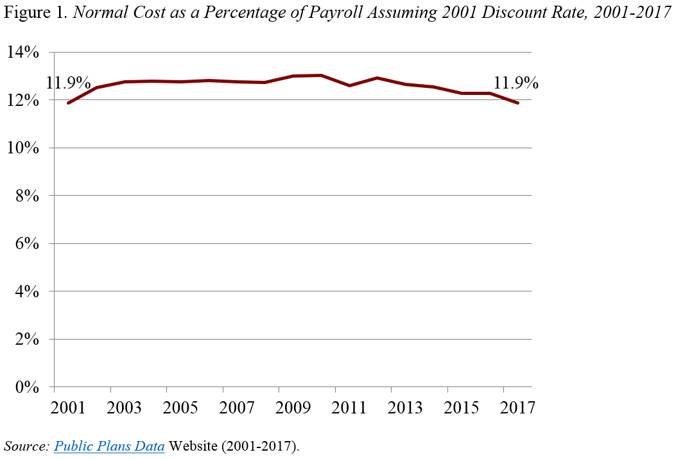

Pension costs consist of two components: the normal cost, which is the value of benefits earned in a given year, and the amortization payment, which is the annual amount required to pay off the unfunded liability (a liability built up because of past underfunding and optimistic assumptions). The reason pension costs are rising is that the amortization payments are increasing. Normal costs are not increasing (see Figure 1). Calculating the normal cost using a consistent interest rate across time shows that the average normal cost has remained virtually unchanged at 11.9 percent of payrolls – that is, plans are not increasing benefit levels.

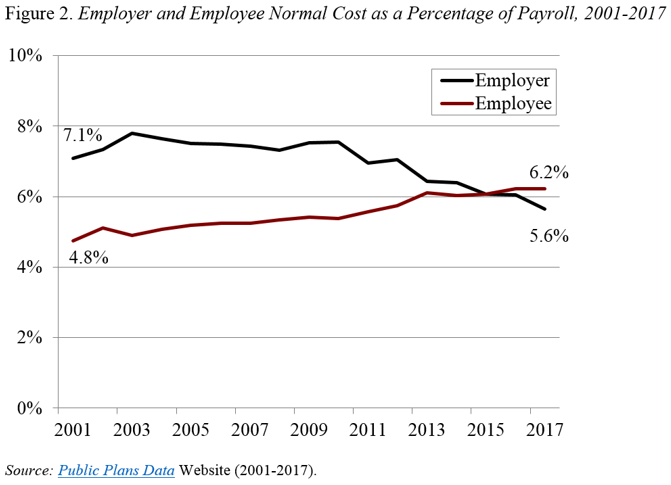

But even that constancy overstates the generosity of pensions for two reasons. First, the employer’s contribution to the normal cost is declining. At this point, the employer pays 5.6 percent of payroll, while the employee pays 6.2 percent (see Figure 2).

The second reason why the available normal cost data overstate benefits is that most state and local governments have cut back on benefits for new employees (see Figure 3). As new hires become an increasing share of the workforce, normal costs will decline.