401(k) Balances Increased Very Little in the Last 10 Years

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Even when accounting for IRA assets, retirement savings are typically still modest.

Vanguard recently released its 2019 edition of how “How America Saves.” This excellent publication summarizes the statistics for the defined contribution plans that the company administers. Vanguard tends to administer larger plans, so the plans are better designed than average and participants have higher incomes. In other words, it presents the best face of the 401(k) system.

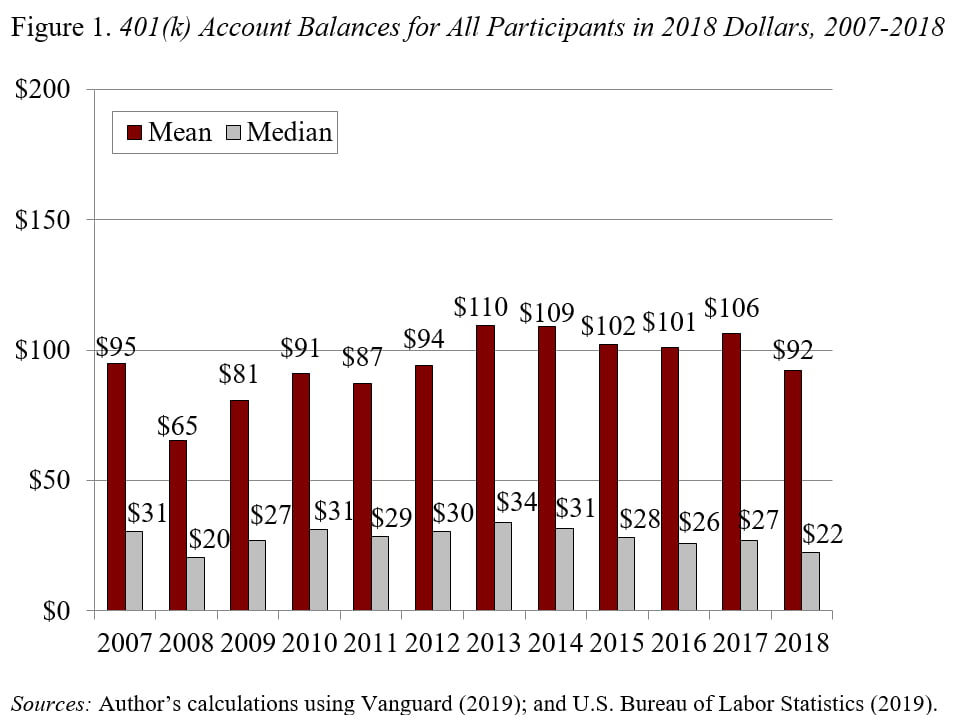

In 2018, the average account balance was $92,148; the median was $22,217. The big difference between the median and the average is due to a small number of accounts that have really big balances. Average balances are more typical of long tenured more affluent participants, while the median balance represents the typical participant.

Figure 1 shows average and median balances for the last 12 years in 2018 dollars. In terms of medians, 2018 is actually lower than 2007. This pattern could well reflect the expansion of auto enrollment, which increases participation but also produces smaller balances. That is, more people save, but because employees are typically enrolled at a default contribution rate of 3 percent the accumulations are small. It also could be explained by the age distribution of the participants, since the percentage of young participants, who have small balances, has increased over time.

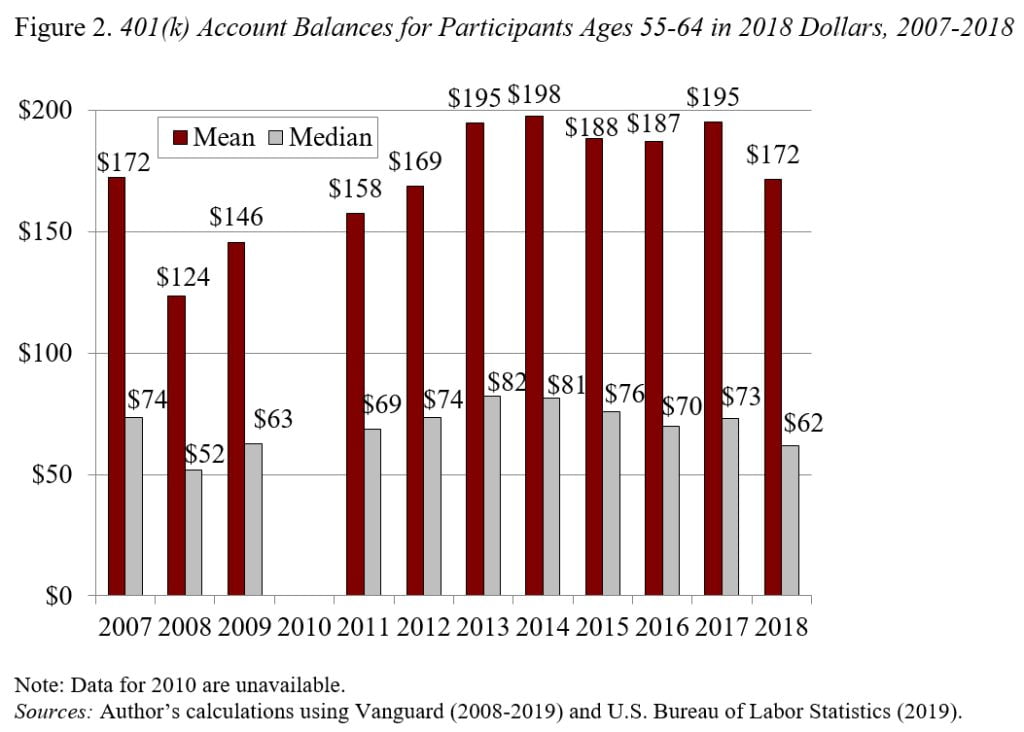

To get away from the impact of more young participants, it’s useful to look at balances for those ages 55-64, a group approaching retirement. As one would expect, these balances are much larger than those for the participant population as a whole. But the pattern is quite similar: 2018 median balances are lower than those in 2007, and mean balances equal $172,000 in both 2007 and 2018.

Clearly, we have not made a lot of progress in terms of 401(k) saving. And Vanguard balances are probably higher than average given that it administers a large number of big plans. On the other hand, many people approaching retirement have moved some 401(k) balances over to Individual Retirement Accounts (IRAs). In 2016, the date of the latest Federal Reserve Survey of Consumer Finances, the median 401(k)/IRA holdings of working households with a 401(k) approaching retirement (55-64) were $135,000. So the picture is somewhat less bleak than the Vanguard data alone would suggest. But bleak, nevertheless.