401(k) Balances Not a Cause for Celebration!

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Retirement saving is too low no matter how you slice it

Fidelity announced with great fanfare in mid-February that the average 401(k) balance hit a record high of $77,300 by the end of 2012. It is good news that balances are up from a year earlier, but $77,300 does not indicate success in retirement saving. There is nothing encouraging about this number.

For most private sector workers, their 401(k) will be their only supplement to Social Security. Social Security benefits will be less generous in the future than in the past even under current law. Four things are happening. First, as the full retirement age moves from 65 to 67, the benefit at 65 is declining. Second, rapidly rising Medicare premiums are deducted from the check before it goes in the mail. Third, benefits for the typical worker will eventually be taxed under the personal income tax. Fourth, couples get relatively lower benefits than they used to, as working wives increasingly receive benefits based on their own earnings instead of the 50-percent spouse’s benefit. Again, all of these reductions occur under current law.

In addition, Social Security faces a deficit over the next 75 years, and the time is coming when Congress will be forced to decide the role that tax increases and benefits cuts should play in restoring balance. Benefit cuts will almost certainly be part of any solvency package. So, the message is that people will get much less from Social Security relative to their pre-retirement earnings going forward.

The only real supplement for most private sector workers will be their 401(k) plan. A balance of $77,300 would produce a monthly income of about $360. That’s an alarmingly small amount. Combine that with diminished Social Security benefits and most American households are going to face hard times once they stop working.

Now $77,300 is not really the right number to look at. On the one hand, it is an average; a median would be lower. On the other hand, it is calculated for all 401(k) holders; balances for those approaching retirement are higher. In addition, a lot of 401(k) money has been rolled over into Individual Retirement Accounts (IRAs), and those balances should be added when evaluating the financial preparedness of those approaching retirement.

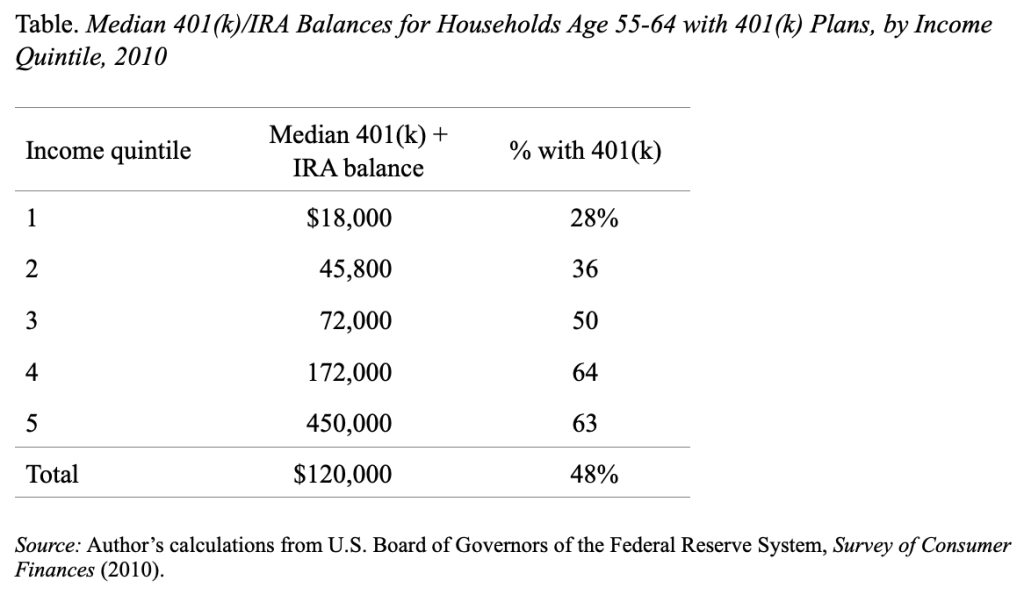

The latest source of nationally representative 401(k)/IRA balances is the 2010 Federal Reserve’s Survey of Consumer Finances. The table below shows the median combined 401(k)/IRA holdings for households approaching retirement by their place in the income distribution.

Two factors stick out. First, holdings are small even when viewed on a household as opposed to an individual basis, looking at people just before retirement when their balances should be largest, and including IRAs as well as 401(k)s. Second, even in the middle group, only half of households have a 401(k). It’s not Fidelity’s job to point out the lack of universal coverage. But it is their job to put the modest balances in perspective. There is nothing to celebrate here.