Congress Has the Chance to Pass Meaningful Retirement Reform

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Adding a provision to SECURE 2.0 to move toward a refundable Saver’s Credit would make for a bill worth enacting.

In June, the relevant Senate Committees approved their versions of the House bill called “Securing a Strong Retirement Act of 2022” (SECURE 2.0). Specifically, the Health, Education, Labor and Pensions Committee advanced the “Rise and Shine Act” on June 14, and the Finance Committee passed the separate EARN Act on June 22. These two bills are expected to be merged together to form the Senate companion to SECURE 2.0.

In my view, the House SECURE 2.0 Act is not worth enacting. It’s an industry bill that primarily provides goodies for high earners by increasing the age for required minimum distributions, which only the wealthy can afford to take advantage of; increases catch-up contribution options, which only benefits high earners; and increases the limits for qualified charitable distributions, which only helps those with substantial assets.

SECURE 2.0 does a little for middle earners by requiring auto-enrollment – but only for new 401(k)s; treating student loan payments as if they were contributions to the 401(k); and creating a national online lost-and-found for retirement plans.

But SECURE 2.0 shamefully neglects low earners, where the majority are not offered a retirement plan at work and many cannot contribute enough to accumulate meaningful savings. What this group needs is a national auto-IRA program with a substantial refundable Saver’s Credit. Yes, SECURE 2.0 raises the credit rate in the Saver’s Credit to 50 percent, for everyone who is fully eligible, but not until 2027; and it does not make the credit refundable.

The exciting part about the Senate legislation, which, to be fair, also includes a lot of the goodies for high earners, is that – in addition to raising the credit rate in the Saver’s Credit – it moves toward making the Credit refundable. That’s a big deal.

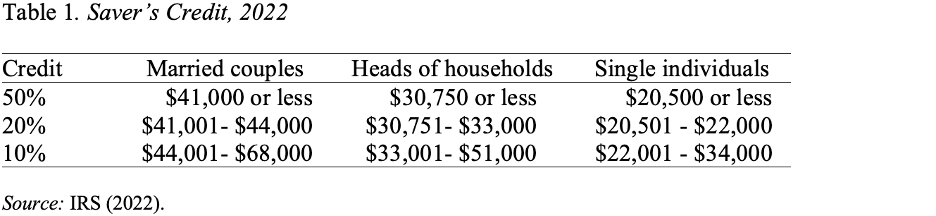

Under current law, depending on adjusted gross income (AGI), a household can claim the Saver’s Credit for 50 percent, 20 percent, or 10 percent of the first $2,000 contributed during the year to a retirement account (see Table 1).

In theory, workers could gain a lot from the Saver’s Credit. A married couple with combined income of $41,000 who each contributes $2,000 to his/her retirement plan is eligible for a $1,000 credit each, for a total of $2,000. That is, they pay $2,000 less in federal income taxes than they would have otherwise.

In practice, the Saver’s Credit does not work so smoothly. First, the credit is nonrefundable, which means that it can reduce the required tax repayment to zero but not below. So, if the couple had a tax liability of only $750, their credit would be limited to that amount. Second, because of interaction with the Child Tax Credit, the Saver’s Credit is often not usable for taxpayers with children. Finally, the design is a little crazy. As couples move from an AGI of $41,000 to $41,001, their credit rate drops from 50 percent to 20 percent. Finally, many people do not know about the Saver’s Credit.

SECURE 2.0 takes a small step to improve the Saver’s Credit by creating one credit rate of 50 percent, as opposed to the current tiered percentages, with the rate phased out as income rises. It also includes some money for the Treasury to increase public awareness about the availability of the credit.

The Senate proposal in the EARN Act is much more ambitious. It would move toward making the Saver’s Credit refundable. That is, it would change the provision from a credit used to reduce a tax liability to a government matching contribution that would be deposited in the taxpayer’s retirement plan. As in the House bill, the credit would be equal to 50 percent of a taxpayer’s contribution up to $2,000 per person. So, the net result would be that a $2,000 account balance would become a $3,000 balance after the match.

A 50-percent government match for low and middle earners would be wonderful in general and would be particularly helpful in enhancing balances in the state-initiated Auto-IRA programs, up and running in California, Illinois, Oregon, and elsewhere. Now, all we would need is a national Auto-IRA program and we would be on our way to a really good system.