Why Do So Many Households Find It Difficult to Cover a $400 Emergency Expense?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Without such a buffer, it’s pretty hard to save for retirement.

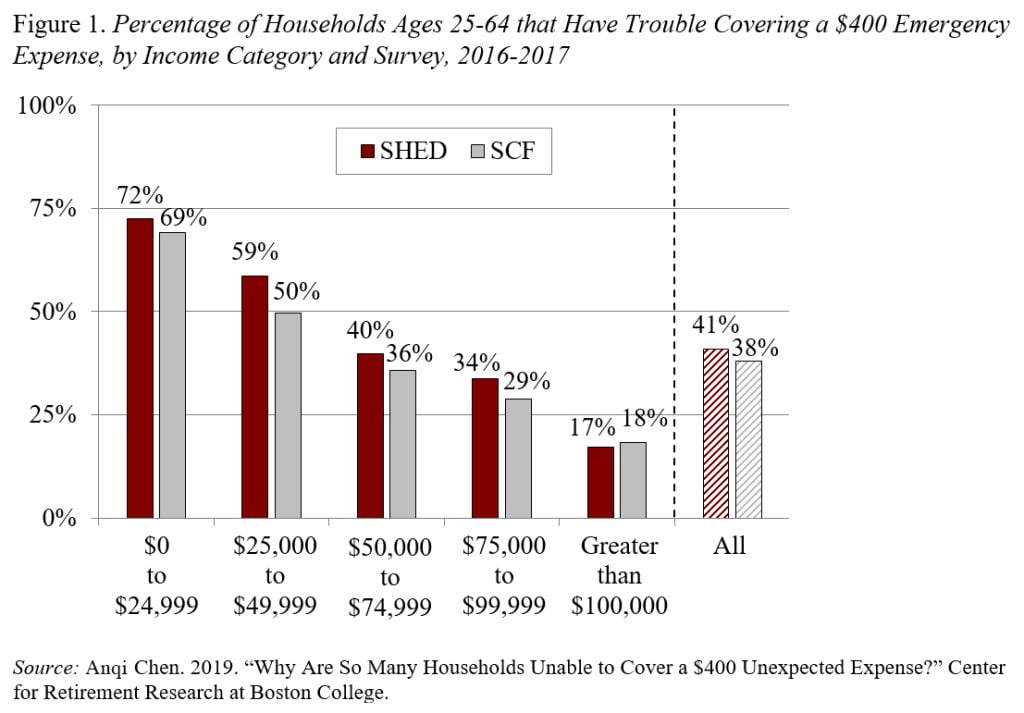

Despite a strong economic recovery, about 40 percent of households in 2017 still said they would have trouble paying for a $400 unexpected expense. A recent study from the Center for Retirement Research uses data from two Federal Reserve surveys – the Survey of Household Economics and Decisionmaking (SHED)and the Survey of Consumer Finances (SCF) – to understand why so many households say they are unable to come up with $400.

Every year since 2013, the SHED asks over 12,000 households about subjective and objective measures of their financial well-being. The specific question regarding precautionary saving is: “Suppose that you have an emergency expense that costs $400. Based on your current financial situation, how would you pay for this expense?” Households that say they would need to “borrow, sell, stop paying other bills, or just would not be able to pay” are the 41 percent deemed unable to cover such an expense. Even 17 percent of households with over $100,000 in income say that they would have trouble meeting such an expense.

The SCF, which is based on households’ actual resources, tells a very different story. It finds that only about 20 percent of households have less than $400 in their checking/savings accounts, and this group is much more concentrated among the lower income. The question is how to bridge the difference between the two surveys. Unpaid credit card debt is a key factor. Although some households have at least $400 in their bank accounts, they also have outstanding credit card debt of an equal or greater amount. Combining a) those SCF households that have less than $400 in cash on hand (21 percent) and b) those that would have less than $400 in cash once they paid off their credit cards (17 percent) produces a picture very similar to that reported in the SHED (see Figure 1).

Why are so many households, especially middle- and high-income households, unable to cover a relatively small unexpected expense? Latent class analysis is a useful tool to identify common characteristics among these households.

The results show that many households are living on tight budgets for two main reasons. The first is that they are less advantaged; they either recently lost their job, are low earners, or have a high school degree or less. A second reason is debt. Many of these households may have enough liquid assets to cover a modest emergency expense but they also have mortgages, student loans, and/or other installment loans. These loan payments, which constrain their household budgets, could explain why so many middle- and higher-income households do not have precautionary savings.

In short, many households simply do not have the resources to cover modest unexpected expenses – such as a car repair or a leaky roof. Without such a buffer, it’s hard to figure out how they can accumulate assets for retirement.