Are Fears of a Retirement Crisis Overblown?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The data don’t really speak for themselves.

My friend, and occasional collaborator, Andrew Biggs recently argued that “fears of a retirement crisis are overblown – and these numbers prove it.” That got my attention. If real data showed that most people will be fine in retirement, that’s great news. I’ll spend more time in Tuscany!!

But from everything I know, the financial aspect of retirement will be a challenge for a lot of households. So I’m really interested in data that show the contrary. Biggs breaks his argument into two parts: 1) retirees are doing increasingly well, and 2) retirees recognize that things are improving. Because the subjective data were more readily accessible, I started there.

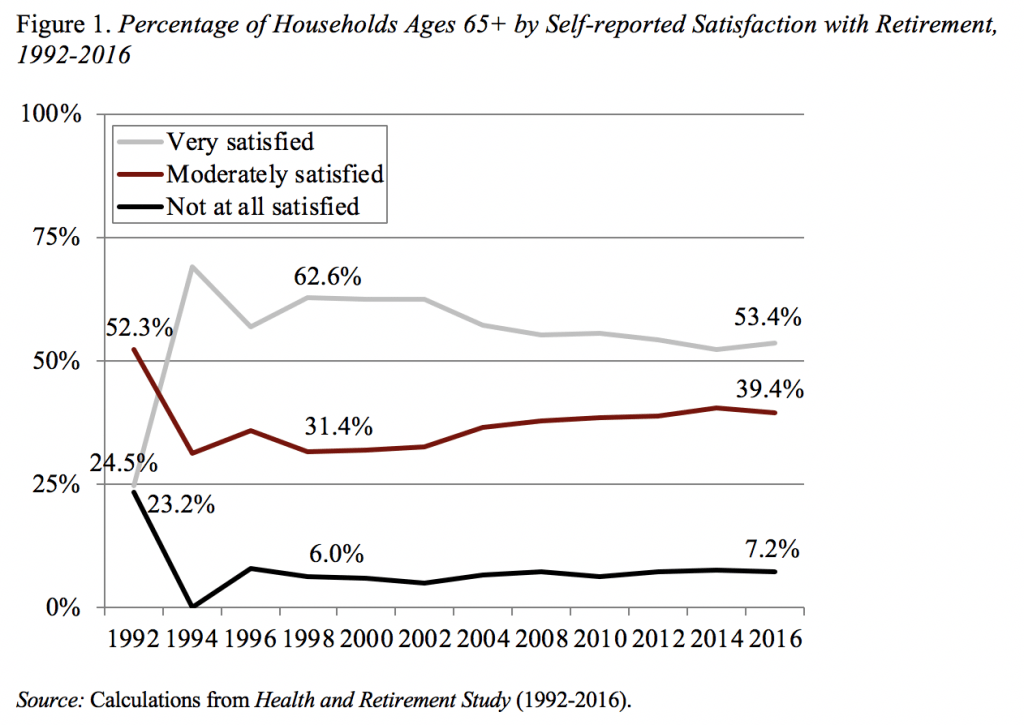

Using data from the Health and Retirement Study, Biggs reports that “93% of seniors described their retirement as ‘very’ or ‘moderately’ satisfying in 2016 versus only 77% in 1992.”

I (or at least my colleague Anqi Chen) can duplicate those numbers, and they are shown in Figure 1. Indeed, adding together “very satisfied” and “moderately satisfied” produces 77% in 1992 and 93% in 2016. But those 1992 numbers look weird. It turns out that the sample consisted of only 300 households, and some categories had less than 25 households. So 1992 should not be the starting point for any comparison.

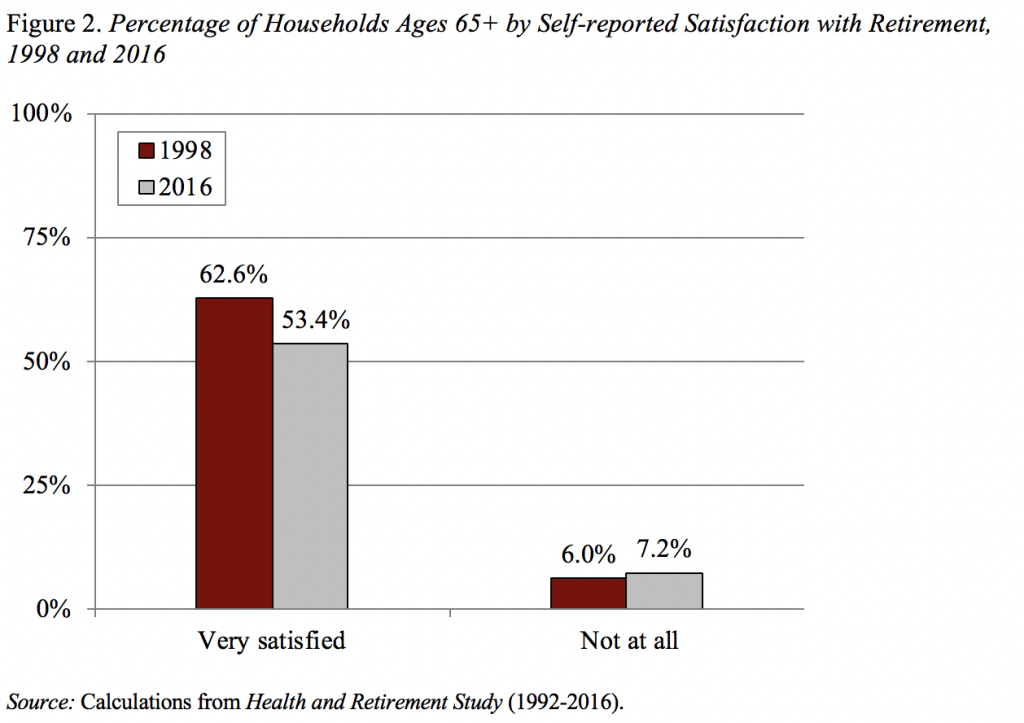

In fact the sample size remained small until 1998, so it makes more sense to start there. If I were in a snarky mode, I might be tempted to say between 1998 and 2016, the percentage “not at all satisfied” increased from 6.0 percent to 7.2 percent, and the percentage “very satisfied” declined from 62.6 percent to 53.4 percent (see Figure 2). That would suggest that things were getting worse.

But my main point is that, once the sample size got large enough, the numbers have held steady. They do not show any upward trend in satisfaction. Moreover, the question relates to all aspects of retirement, not just finances.

I’m going to look at all the data, but so far I’m not persuaded.