The Psychology Behind Starting Social Security at 62

Social Security supplies a substantial share, and often the majority, of a retiree’s income. For these older workers delaying signing up for their benefits is often a smart strategy.

For every year they wait, the delay will increase the size of their monthly checks by 7 percent or more.

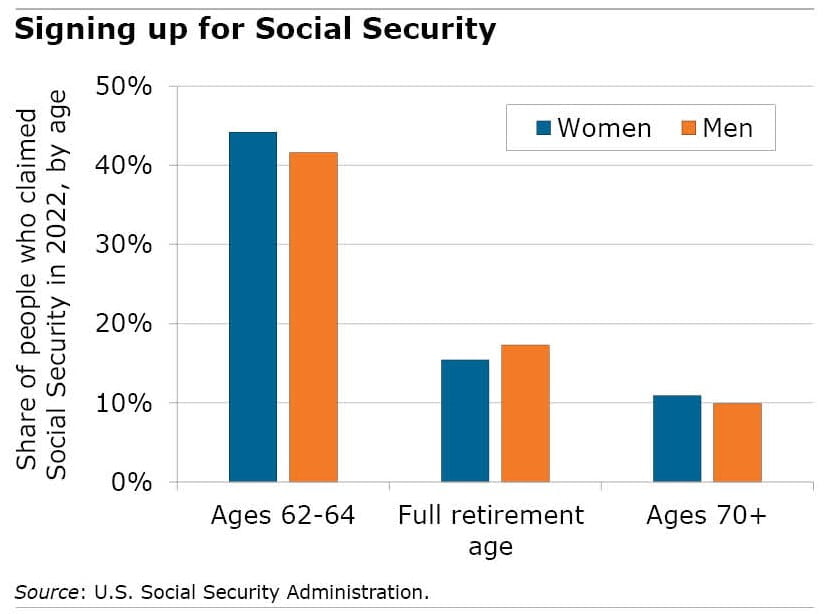

But, as researchers Suzanne Shu and John Payne point out in a newly published study, that is not what many people do. They explored the reasons so many sign up soon after they turn 62 and become eligible. They also may have found a way to present information about benefits that helps workers make the smarter choice.

People may be starting their benefits early for sound financial reasons. In a Great Recession survival strategy, for example, laid-off baby boomers were claiming their benefits early. But there are also psychological reasons for prematurely starting Social Security even when it doesn’t make financial sense. That’s what this study investigates.

One reason is that workers, after years of payroll taxes being deducted from their paychecks, feel a sense of ownership about their future benefits – and they are eager to claim what is theirs. The individuals in this study who said in an online survey that they intend to start Social Security on the earlier side expressed a strong feeling of ownership, agreeing with the statement they had “earned these retirement benefits.”

Another important reason people sign up sooner is the natural human aversion to losing, which this survey gauged by asking the participants to choose what type of gamble they would be willing to take. They were considered to be more loss averse if they chose a gamble that would have a high probability of either a $400 gain or a $400 loss over the riskier gamble in which they could either win $800 or risk a larger $600 loss.

One group with the opposite tendency – a willingness to delay benefits – was people who predicted they would live longer. In this case, the reasoning might be that, given the low balances in workers’ 401(k) accounts, they may be concerned about running through that source of income quickly in retirement. Lacking adequate savings to get through old age, the larger check that comes with delaying Social Security will help.

Delaying as long as possible is probably the right strategy for workers who haven’t saved enough on their own. But how to convince them? To try to influence the decision, the researchers tested a couple of ways of presenting their future benefit information to the workers in their study.

One group saw a chart that listed how much a hypothetical worker could expect in his monthly Social Security check, ranging from $1,339 at age 62 to $2,395 at 70.

A second group’s chart totalled up the lifetime benefits. The retiree who signed up for the $1,339 check at 62 would accumulate a total of $353,500 in benefits if he lived to 85. But if he waited until 70, the $2,395 benefits paid every month would add up to $402,360.

The people who saw the larger lifetime totals said they would claim their benefits much earlier.

The reason they were put off by the larger amount may come back to the psychological phenomenon of loss aversion. Seeing that larger dollar figure apparently heightened their fear of loss.

Perhaps seeing the totals made them “more impatient for receiving it,” the researchers said.

To read this study by Suzanne Shu and John Payne, see “Social Security Claiming Intentions: Psychological Ownership, Loss Aversion, and Information Displays.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Interesting, I wonder if mortality beliefs were more fully explored as a factor in decision-making. The potential rationale for delayed claiming was mentioned. However, there are also legitimate rationales for early claiming. For example, after a lifetime of physically taxing work and knowledge of one’s family health history, it might be perfectly rational and in one’s self interest to claim at 62.

After reading this excellent paper, I came away with a question related mostly to my own subjective decision to delay claiming until age 70. My wife is five years younger and a big part of my calculus involves the realization that I am quite likely to die before she does. As the higher earning partner, it is in both of our interests for me to delay claiming. The inclusion of a marital status variable and analogous subjective estimates of spousal longevity might increase your explainable variance on actual claiming behavior. Thank you for an excellent contribution to this body of research.

Do not overlook the fact that many people work in physically demanding jobs and may simply be unable to work until 70. It is easy for an accountant or librarian to stay working full-time until 70 but not so easy for a roofer or custodian.

Many of the retirees I know had physically demanding occupations such as linemen, construction, trucking, etc., and they were just worn out by 62, and continuing to work in their occupations would be exceedingly taxing, and dangerous due to declining abilities. In fact, more than a few of them didn’t live to collect their benefit at 62, no less waiting until 70. Work like that can take years off a life.

Longevity and spousal considerations are certainly significant factors and don’t require trying to figure out “why people do what they do” (psychologically speaking).

Also… “The retiree who signed up for the $1,339 check at 62 would accumulate a total of $353,500 in benefits if he lived to 85. But if he waited until 70, the $2,395 benefits paid every month would add up to $402,360.” That $1000.00 more per month doesn’t sound like that much when you consider 8 more years of working to get it. (Especially if longevity is not expected)

My husband retired from a lifetime job of teaching at 59 years/7 months, was diagnosed with ALS at 61years/2months and passed 5 days after his 62nd birthday. I say retire early and spread the experience, knowledge and enthusiasm for life you have gained through gratitude, to do good things. In his short retirement time, volunteering became his greatest happiness.

I agree Mary, as someone who has also been affected by the loss of a loved one to ALS. Enjoy life all along the way, it’s shorter than we think. Thanks for sharing.

No one ever considers the growth of the portfolio. I retired in 2020 and started collecting at 62 the growth in my IRA has exceeded the delay credits I may collect less from SSI but my investments will be greater

I’ve seen enough of my peers/family pass away in their 60s and 70s.

This was a very interesting article discussing the psychology of why many claim their Social Security benefits at the age of 62. While I’m only 58 years old, I have been giving this subject much more thought as I’m closing in on my own retirement. I believe that I read once that the accumulated Social Security benefits of claiming at 62 versus 70 are roughly “equal” at the age of 80. If you are relatively healthy and longevity runs in your family, it’s a no-brainer to hold off and claim at 70 to maximize your benefits. However, if you have faced serious health issues (like me) claiming earlier might make the most sense. My spouse and I are the same age and will have roughly equal social security benefits. She plans on waiting until 70 to claim, whereas I plan to claim my benefit early. Each personal and family situation is so different that it’s critical to look at all options and rationale before claiming your Social Security benefits.

That’s me. I worked unskilled hard labor all my life so I was ready to retire at 62. Another factor, I was one of the last to also collect a defined benefit pension. So I knew ahead what my monthly pension and Social Security would be. Plus I live in Pennsylvania. They don’t tax pensions or social security. 401K’s are a joke.

If you estimate that inflation-adjusted SS benefits will decrease substantially sometime in the 2030s, it may be a rational decision to begin benefits earlier, especially if you can convert some of those benefits into assets that hold value over the long-term.

401(k)s are a joke only if you’re unable to fund them while you’re working.

At 66, I am receiving two small pensions as I work p/t. The SS website shows how my future SS benefits will be reduced by the pension income. I need to talk to a financial advisor.

Darcy, we are not financial planners and do not give advice but I can provide a little information that might be useful. Financial planners are expensive, so be sure to know what you’re getting into in terms of how the fees work.

First, if your Social Security benefits are reduced under the Earnings Test, you get the money back later, as we’ve written: https://crr.bc.edu/explaining-social-securitys-earnings-test/

Also, if you have savings, this calculator from Vanguard can give you a rough idea of how long it will last: https://retirementplans.vanguard.com/VGApp/pe/pubeducation/calculators/RetirementNestEggCalc.jsf

Finally, a reminder of the benefits of delaying Social Security is to look at the size of your monthly check at various claiming ages: https://www.ssa.gov/myaccount/

Yeah, I don’t think it has anything to do with psychological loss aversion. Referring your example: “The retiree who signed up for the $1,339 check at 62 would accumulate a total of $353,500 in benefits if he lived to 85. But if he waited until 70, the $2,395 benefits paid every month would add up to $402,360”

I think it’s simply math/logic – 50k more for 8 more years work and to benefit you have to get to 85!