Medicaid Expansion Eased Financial Strain During COVID

In the crucible of COVID, the Medicaid expansion that was part of the Affordable Care Act made a difference to older Americans, who were more vulnerable to becoming seriously ill or hospitalized from the virus.

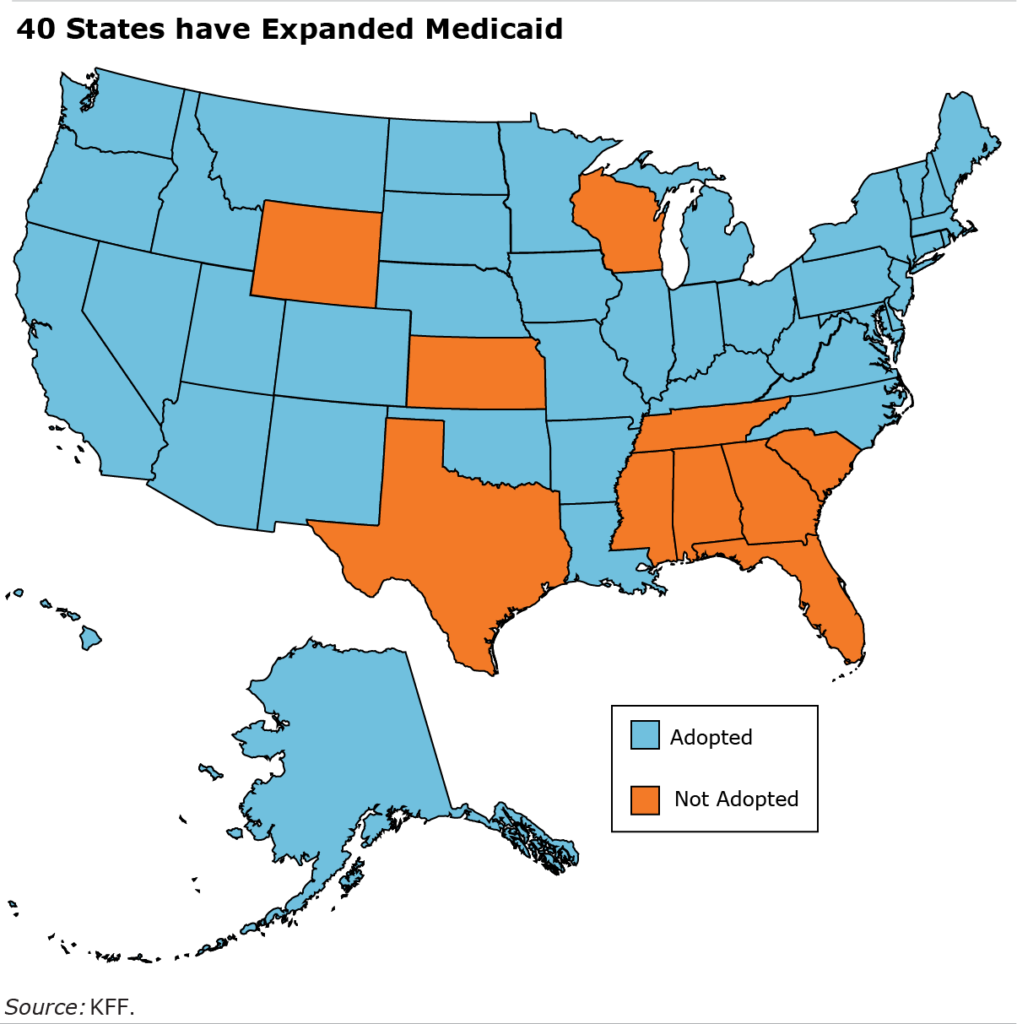

In the states that chose to expand the low- or no-cost Medicaid health insurance program to more of their low-income residents, researchers at the University of Wisconsin found that people between the ages of 45 and 64 were better off financially than similar people in the non-expansion states.

“The COVID-19 pandemic highlights the importance of the safety net,” the researchers said, “in improving the economic security of households.”

By expanding Medicaid, many states made it easier for individuals to qualify by increasing the income limit used to determine eligibility for the program to 138 percent of the federal poverty level. In the non-expansion states, the ceiling remained at the federal poverty level.

In March 2020, as the virus raged and hospitalizations were soaring, Congress also required all the states to maintain their enrollment of Medicaid recipients to ensure that they had coverage during the pandemic.

But in the states that had expanded Medicaid, the researchers found, older households’ finances during the pandemic were in better shape: they were more likely to have the money to pay an unexpected $400 expense than similar households in the non-expansion states.

In the non-expansion states, on the other hand, older residents reported having more difficulty paying their regular household expenses early in the pandemic. And they generally had a tougher time managing their finances than their counterparts in the expansion states. These comparisons controlled for race, employment status and other factors that can also influence a household’s finances.

But prior to COVID, the researchers did not find compelling evidence that Medicaid reduced out-of-pocket medical expenses or medical debt when they compared the finances of older adults in the expansion versus non-expansion states in 2013 through 2019.

Still, they said, the benefits of Medicaid’s expansion may extend beyond the pandemic years, and future research could hone in on what those benefits are. “More work is needed,” they said.

To read this study by Katie Fitzpatrick and Keisha Solomon, see “Health, Health Insurance, and Financial Security.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy