A “First Look” at Alternative Investments and Public Pensions

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Alternative investments do not appear to have helped state and local pension portfolios.

My co-authors – JP Aubry and Anqi Chen – and I have been laughing at ourselves over a recent brief. We were concerned that our topic and findings were explosive! So we had it reviewed by everyone under the sun, and still nervous, we titled it “A First Look at …”. Similarly, it starts, with “this brief begins to explore …” And it concludes with “while the focus on returns and volatility may be too narrow and the time periods analyzed too short to draw any definitive conclusions – the relationship between alternatives and public plan performance merits further analysis.”

Long story short – the brief landed with a thud. Nobody has said anything positive or negative. Perhaps all those cautionary and equivocating statements drove people away! Well it’s not a boring topic, and we did find somewhat astounding results.

Since the financial crisis, public pension plans – like other large institutional investors – have moved a significant portion of their portfolios into investments outside of traditional equities, bonds, and cash. These alternative investments include a diverse assortment of assets – private equity, hedge funds, real estate, and commodities. The more than doubling of the allocation to alternatives (from 9 percent to 24 percent) between 2005 and 2015 reflects a search for greater yields and less volatility.

Were the plans successful? We estimated four separate equations that test the relationship of alternative investments to observed portfolio returns and volatility.

The first equation relates the average after-fee portfolio returns for 160 state and local plans over the periods 2005-2015 and 2010-2015 to the percentage of the portfolio held in alternatives, controlling for other factors that could have affected returns. The results of the regression equation show that, relative to traditional equities, holding 10 percent more of the plan’s portfolio in alternatives is associated with a lower return of 32 to 44 basis points, all else equal.

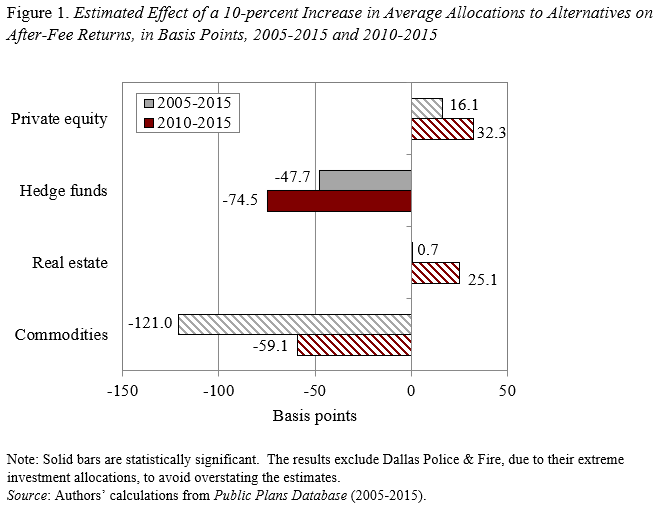

Yes, we know that alternatives are not a single homogeneous asset class, so we estimated an equation that relates the average portfolio returns to holdings in the four major alternative asset classes. The results show that the negative relationship between alternatives and overall portfolio returns stems primarily from hedge funds, which have experienced low returns relative to other asset classes since the financial crisis (see Figure 1). No alternative had a statistically significant positive impact on returns.

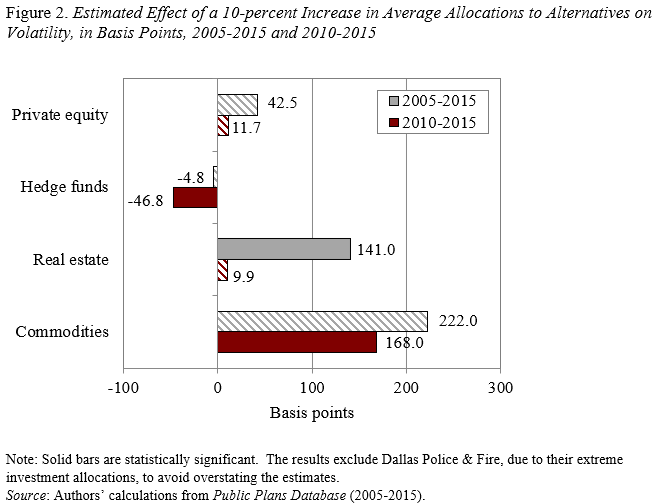

How about volatility? A third regression relates holdings in alternatives to the volatility (standard deviation) of overall portfolio returns. The results show that, as a group, alternatives did not have a statistically significant effect on volatility in either the 2005-10 or 2010-15 period. The reason for the lack of impact on volatility is that while larger holdings of hedge funds reduce volatility, this effect is offset by the greater volatility associated with real estate and commodities (see Figure 2).

Yes, this analysis should be viewed as preliminary and the periods under examination may be too short to fully evaluate performance of some alternative asset classes. Nonetheless, a “First Look” does raise some interesting questions!