A Lot of People Aren’t Covered by a Pension of Any Sort

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

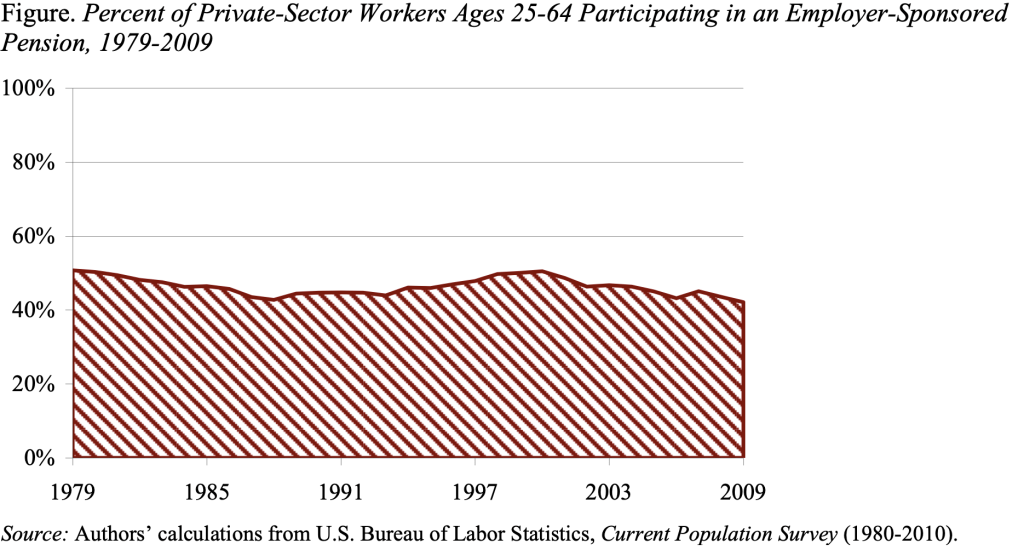

When thinking about how secure people are going to be in retirement, we tend to put a lot of emphasis on the shift in pension type from the old-fashioned defined benefit plan (where people receive a benefit for life based on final earnings and years of service) to 401(k) plans (where the employee, and usually the employer, contribute a percentage of earnings into an account). It’s easy to forget that, at any given moment in time, only about half of private sector workers are covered by an employer-sponsored plan of any sort (see Figure). Moreover, the share with pension coverage has declined over the last three decades.

This lack of coverage has two implications. First, a substantial proportion of households – roughly one third – ends up with no pension coverage and must rely exclusively on Social Security during retirement. Second, with average job tenure of about 4 years, many employees move in and out of coverage so that they end up with inadequate 401(k) balances.

Policymakers seem to recognize that the lack of pension coverage is a problem. Since most of those without coverage work for firms with less than 100 workers, much of the effort over the years has been aimed at making pensions easier for small businesses. But these efforts really haven’t worked. That’s not surprising given that administrative costs aren’t the real barrier. The real issues are that business owners often worry that they might not have the money to make contributions, and many lower-paid workers prefer cash today over benefits tomorrow.

Given how hard it has been to get small employers to introduce plans, the Obama administration has proposed “Automatic IRAs.” Workers without workplace retirement plans would be automatically enrolled in IRAs through payroll contributions. The contributions would be voluntary – employees would be free to opt out – and matched by the Savers Tax Credit for eligible employees.

The question is whether providing additional savings opportunities only for those without coverage is sufficient. Given the decline in replacement rates under Social Security and the modest balances in 401(k)s, a case could be made that both those with and without coverage will need additional retirement saving. Therefore, a more comprehensive solution would provide an additional tier of retirement saving for all workers.