A Start on Estimating Retiree Medical Costs

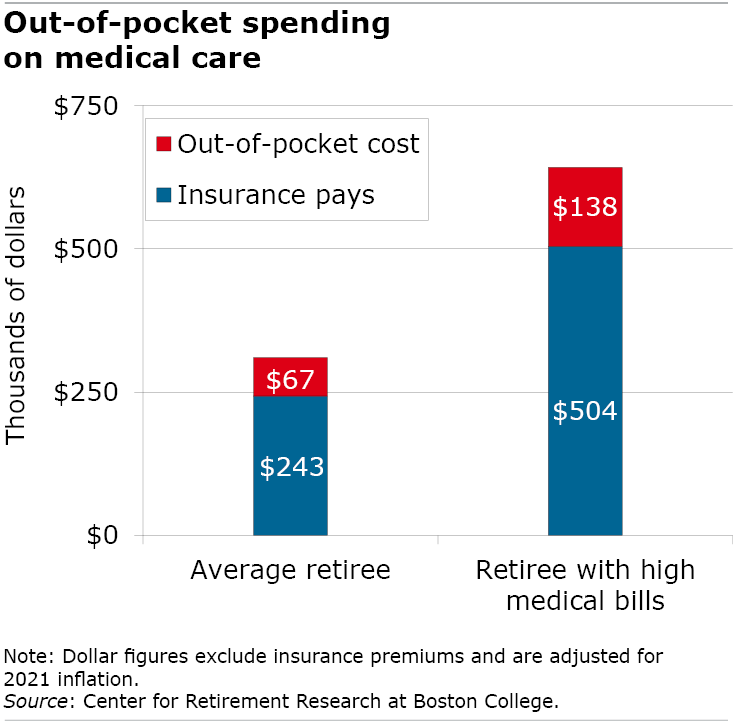

New Medicare enrollees can expect their uncertain medical expenses to take roughly $67,000 out of the household budget, on average, over the rest of their lives.

Since this estimate is only an average, some retirees will pay less and some will pay much more. And the estimate, revealed in a new brief by Karolos Arapakis at the Center for Retirement Research and based on a larger study, includes only the copayments and cost-sharing charges paid by retired households over 65. It excludes their single largest medical expense – monthly insurance premiums.

The estimate is, nevertheless, a useful benchmark for older workers and retirees who want to get a better handle on their health care spending, which is very difficult to plan for. The study takes into account the unexpected cost of things like a broken arm, as well as the cost of managing chronic medical conditions, which accumulate over the years.

The estimate is, nevertheless, a useful benchmark for older workers and retirees who want to get a better handle on their health care spending, which is very difficult to plan for. The study takes into account the unexpected cost of things like a broken arm, as well as the cost of managing chronic medical conditions, which accumulate over the years.

To estimate total medical costs, the researchers linked a periodic survey of retirees that includes out-of-pocket spending to their Medicare insurance records – for Parts A, B and D, and Medicaid – and to a separate data source that tracks private insurance policies such as Medicare Advantage plans and other smaller public and private sources.

The various government and private insurers pay around 78 percent of older households’ total lifetime health care costs, excluding premiums, the researchers found. The retirees pay the remaining 22 percent, or about $67,300 for an older household with average spending for medical care.

However, retirees with the most serious medical problems will spend two times more out-of-pocket during their lives, and relatively healthy people will pay less.

Health care is a major uncertain expense for older Americans but it could be worse because insurers pay much more for the care than the retirees themselves pay.

The study highlights the importance of insurance programs that sharply reduce the risk the care will be unaffordable, the researchers conclude.

To read this research brief, authored by Karolos Arapakis, see “How Much Do Retirees Spend on Uncertain Health Costs?” The brief is based on a study by Arapakis, Eric French, John Bailey Jones and Jeremy McCauley, “On the Distribution and Dynamics of Medical Expenditure among the Elderly.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Excellent article,

Kudos to your effort in helping others provide the insights that will get the best knowledge on retiree medical costs. There are so many factors in it that one can get confused, but with your guide, it’s simple and easy to understand. It’s an important decision to manage expenses, and we must plan early for our retirement. 401K is one option, but we have to look at other things too. On top of that, we never know when a medical emergency can be there. We are pretty sure that your article will be a problem solver for many. Keep up the excellent work.