As Super Rich Exploit IRAs, Congress Contemplates Changes

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

IRAs are supposed to provide retirement security for the middle class, not tax avoidance for the wealthy.

One would think that a proposal to limit accumulations in Individual Retirement Accounts (IRAs) would not be very controversial. The favorable tax provisions accorded retirement saving are designed to encourage rank and file workers to save – not to make the rich richer.

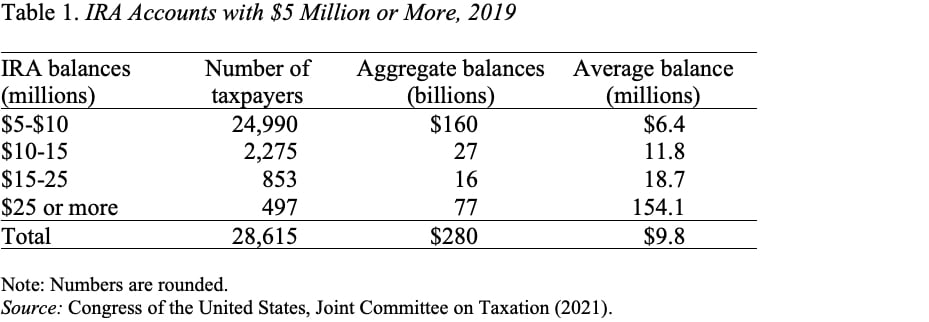

But, the website Pro-Publica recently reported that billionaire Peter Thiel has a Roth IRA with a value of more than $5 billion. The problem is that Peter Thiel and other entrepreneurs are able to buy a large number of shares at a fraction of a penny per share and put them in an IRA where they can grow in value untaxed. And, according to the Joint Tax Committee, roughly 28,615 taxpayers have IRAs with more than $5 million (see Table 1). Together these accounts hold $280 billion.

Not surprisingly, Members of Congress are up in arms and want to prevent such abuses. Anthony Scaramucci, former White House communications director, is not surprised that Congress wants to take action. He told CNBC: “A threshold will likely be imposed after a story like this, because I think the goal for this stuff was to help middle-income people have a nest egg for their future.” Introducing some threshold certainly sounds like a reasonable response to me.

But the headline of a recent article by my friend Mark Warshawsky cautioned: “If plans to cut IRAs succeed, the middle class will be collateral damage.” His argument is that a well-paid police chief could easily receive a benefit of $230,000 – the current IRS limit – from a state or local pension plan. With post-retirement cost-of-living-adjustments and today’s negative real interests rates, such a pension could be worth $10 million. Hence, the argument goes, placing a $5-million cap on IRA balances for people with all their retirement saving in an IRA would disadvantage them relative to the police chief.

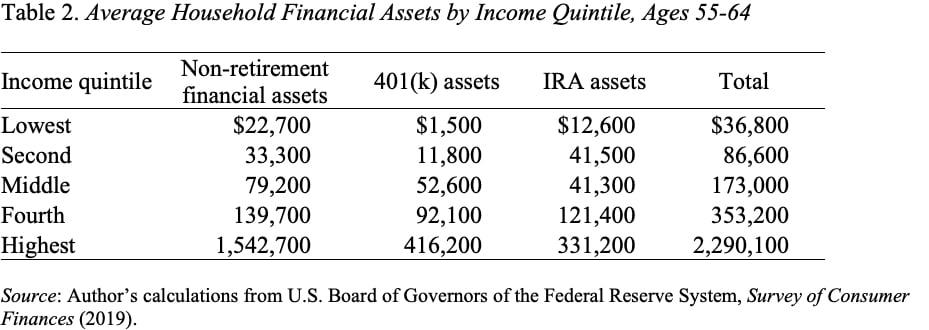

If Mark is arguing that the threshold should be $10 million instead of $5 million to make things consistent with limits on other types of plans, that would be fine with me. Not that anybody has asked! But let’s be clear, neither threshold –$5 million or $10 million – has anything to do with the “middle class.” Even for the top quintile of the income distribution ages 55-64, the average of retirement and other financial assets is only $2.3 million (see Table 2).

The tougher issue is how to implement a new program that would prevent further abuse of IRAs. How about the following, assuming a $10 million threshold?

For new IRAs, Congress could ban all non-publicly traded shares from IRAs.

For existing traditional IRAs:

- Less than $10 million, contributions and appreciation could continue.

- When account reaches $10 million, contributions must cease and any amount over $10 million would be deemed a distribution and taxed as ordinary income.

- For accounts already in excess of $10 million, any increment over their value in 2021 would be deemed a distribution and taxed as ordinary income.

For existing Roth IRAs (where contributions are made from after-tax income):

- Less than $10 million, contributions and appreciation could continue.

- When account reaches $10 million, contributions must cease and any amount over $10 million would be removed from the IRA and would no longer be eligible for tax-free appreciation.

- For accounts already in excess of $10 million, any increment over their value in 2021 would be removed from the IRA and would no longer be eligible for tax-free appreciation.

In short, it is really annoying to see the super wealthy exploit IRAs, and Congress should take action!