Auto-IRA Programs Are Closing the Coverage Gap

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Initiatives in California, Oregon, and Illinois show programs can work.

Only about half of private sector workers are covered by employer-sponsored retirement savings plans at any given time, and few workers save without one. As a result, roughly a third of retired households are solely reliant on Social Security benefits for income, with many ending up on safety net programs such as Medicaid. In the absence of federal action to close the coverage gap, a number of states have passed legislation to implement mandatory auto-IRA programs, which expand coverage by requiring employers who do not offer a retirement plan to automatically enroll their workers in an Individual Retirement Account (IRA).

Auto-IRA programs are now up and running in California, Illinois, and Oregon, and the three states ( as well as Connecticut, Maryland, New Jersey, and Colorado, which have enacted the legislation and are preparing to launch) have adopted the same basic program design.

- Employers that do not sponsor a tax-qualified retirement plan must automatically enroll each of their employees in a private sector payroll deduction Roth IRA. The employer has no fiduciary responsibilities and makes no contributions. The programs generally phase in over time, beginning with larger employers.

- As in 401(k) auto-enrollment, employees may at any time opt out or opt for a higher or lower contribution rate than the default of 5 percent. The default investment is a private sector target date fund, but employees may opt instead for any of a handful of alternative investments.

- The state contracts for a private sector recordkeeper/third-party administrator to provide the IRAs and manage the program and contracts with private sector asset managers to provide the target date fund and other investment options.

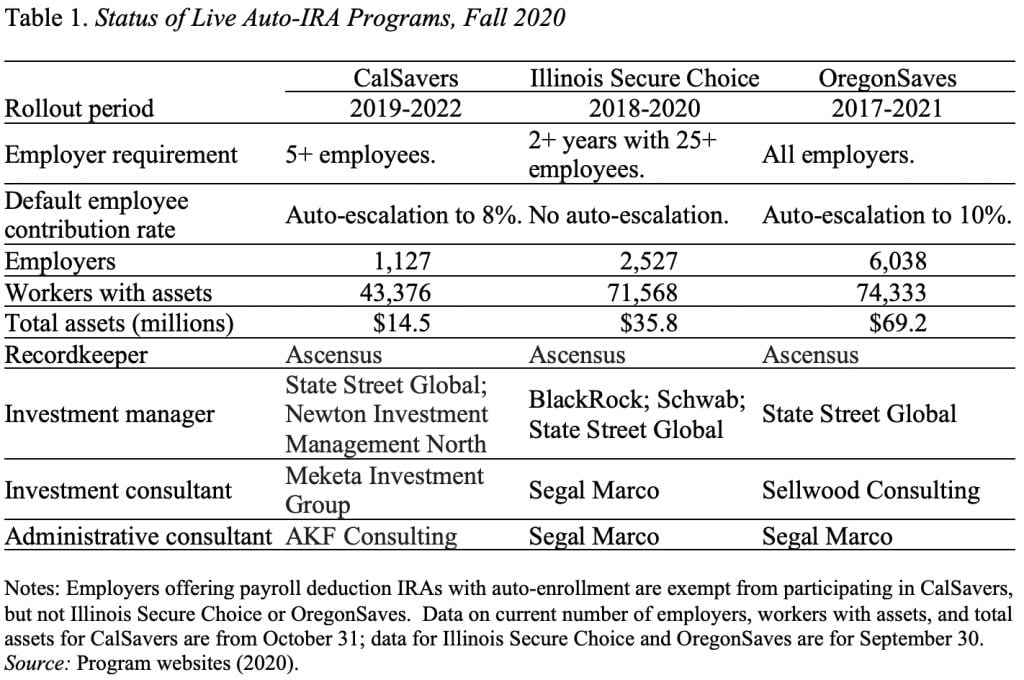

Table 1 summarizes the particulars. California’s CalSavers is still rolling out to the largest employers, but eventually it will be the largest among the auto-IRA states. Illinois was the first state to pass legislation and the second to go “live,” in 2018. Unlike Oregon and California, where enrollment is starting with large employers, Illinois applies only to all employers with 25 or more employees. Oregon was the first state to go “live” in 2017. It is completing implementation of the program for employers with 5 or more employees and will soon implement for the smallest employers. As it was the first program to start up, it currently has the most assets and participants. Interestingly, all three states have chosen Ascensus as their recordkeeper and State Street Global as at least one of their investment managers.

In short, state auto-IRA programs are a reality. And even in the wake of COVID-19, they continue to grow. The time has come to establish a national auto-IRA program so that workers in all states have a way to save for retirement – and have money on hand in case of emergencies.