Average Retirement Age Holds Steady

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

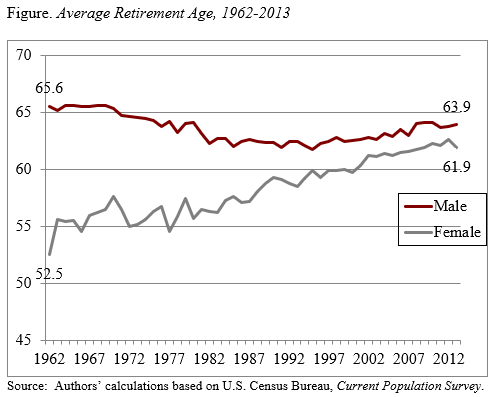

Men are retiring at 64; women at 62.

Since working longer is the key to a secure retirement for the vast majority of older Americans, it is useful to take a look at recent labor force trends. From the beginning of the 20th century, labor force participation of older men had declined steadily until the mid-1980s, when it gradually began to increase. As a result, for men the average retirement age – the age at which the labor force participation rate drops below 50 percent – has slowly increased from a low of 62 in 1985 to about 64 in 2008, where it has since held steady (see Figure).

Reporting trends in the average retirement age for women is more complicated, because women’s work patterns reflect both their increasing participation over time and the factors that affect retirement behavior. Nevertheless, using the same measure for women as men, their average retirement age reached about 62 in 2008, where it still remains in 2013.

Several factors have contributed to the rise in the retirement age since the mid-1980s.

- Social Security: Changes made work more attractive relative to retirement. The liberalization, and for some the elimination, of the earnings test removed what many saw as an impediment to continued work. The delayed retirement credit, which increases benefits for each year that claiming is delayed between the “Full Retirement Age” and age 70, has also improved incentives to keep working.

- Pension type: The shift from defined benefit to 401(k) plans eliminated built-in incentives to retire. Studies show that workers covered by 401(k) plans retire a year or two later on average than similarly situated workers covered by a defined benefit plan.

- Education: People with more education work longer. Over the last thirty years, education levels have increased significantly.

- Improved health and longevity. Life expectancy has increased and – despite the growth in the number of individuals receiving Disability Insurance benefits – much of the evidence suggests that people are healthier as well. The correlation between health and labor force activity is very strong.

- Less physically demanding jobs: With the shift away from manufacturing, jobs now involve more knowledge-based activities, which put less strain on older bodies.

- Joint decisionmaking. More women are working, wives on average are three years younger than their husbands, and husbands and wives like to coordinate their retirement. If wives wait to retire until age 62 to qualify for Social Security, that pattern would push husbands’ retirement age towards 65.

- Decline of retiree health insurance. Combine the decline of employer-provided retiree health insurance with the rapid rise in health care costs, and workers have had a strong incentive to keep working and maintain their employer’s health coverage until they qualify for Medicare at 65. (This incentive may be reduced by the Affordable Care Act, which is designed to make it easier for individuals to obtain health insurance on their own.)

- Non-pecuniary factors. Older workers tend to be among the more educated, the healthiest, and the wealthiest. Until recently, at least, their wages were lower than those earned by their younger counterparts and lower than their own past earnings. This pattern suggests that money may not be the only motivator.

These factors all explain the gains since the mid-1960s. The interesting question is whether they have played themselves out or whether the increase in labor force activity will rebound.