Retirees Don’t Live on ‘Fixed Incomes’

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Timing, index questions, and a huge Medicare premium increase should not cloud value of Social Security’s COLA.

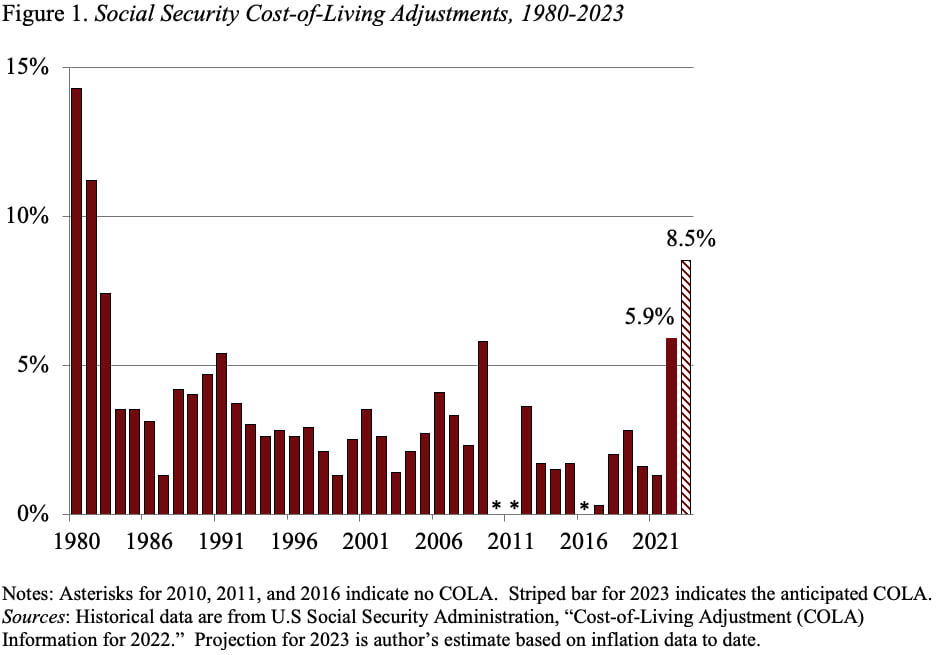

I recently talked to one more reporter who commented that our current inflation situation must be particularly hard for retirees who “live on fixed incomes.” The fact of the matter is that Social Security is the major source of retirement income for most Americans, and Social Security provides an automatic cost-of-living adjustment (COLA) to reflect increases in the Consumer Price Index (CPI). The COLA for 2022 was 5.9 percent, one of the largest since the 1980s (see Figure 1). And the COLA for 2023 could well be in the 8- to 9-percent range.

Yet the press and the public do not appear convinced that retirees are protected against the erosive impact of inflation. The skepticism may revolve around three issues: 1) the COLA is backward looking and may not reflect current levels of inflation; 2) Social Security may not be using the right index to calculate the COLA; and 3) Medicare Part B premium increases offset the COLA. It is worth addressing each of these issues.

Timing of the COLA. Since the COLA first affects benefits paid after January 1 for the next year, Social Security needs to have figures before the end of the previous year. As a result, the adjustment for 2022 was based on the increase in the CPI for the third quarter of 2021 over the third quarter of 2020. This backward-looking calculation means that, when inflation starts to rise, the COLA will be less than the inflation that people are experiencing. Indeed, that is true this year; benefits were increased by 5.9 percent, but year-over-year inflation is running between 8 and 9 percent..

Two counterpoints are relevant here. First, it makes sense to base the COLA on actual data rather than a forecast, which could involve constant corrections for over- or under-predicting. Second, while the COLA under-compensates when inflation starts to rise, it will over-compensate as inflation falls. Over the full inflation cycle, the COLA adjustments match the inflation rate.

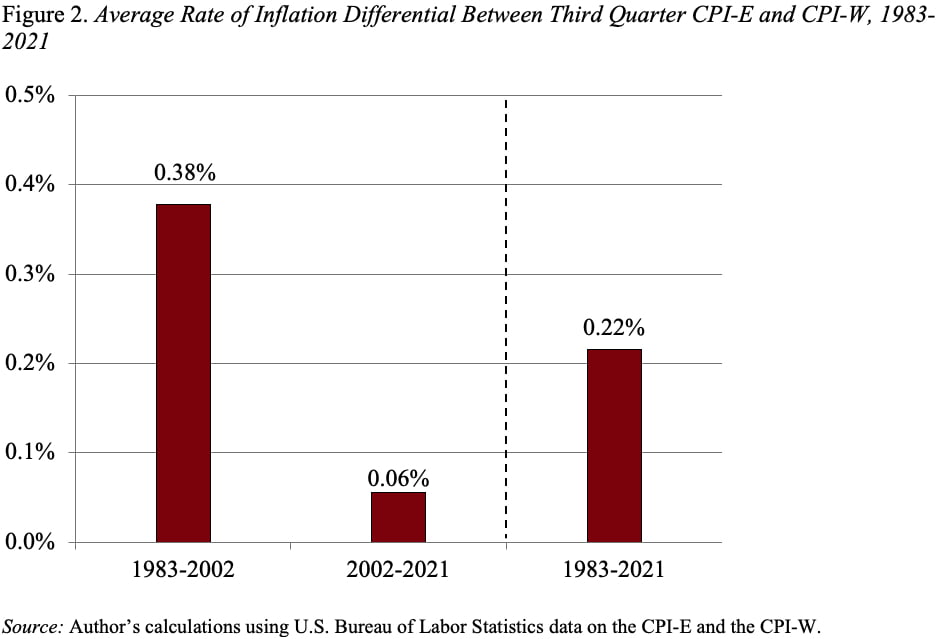

Appropriate Price Index. Some critics contend that the CPI-W – the price index for urban wage earners and clerical workers, which is currently used to determine the COLA – understates inflation for retirees because the elderly spend more of their money on medical care. Interestingly, though, in the last two decades the difference between the rate of increase in the CPI-W and the CPI for the elderly (CPI-E) – has nearly disappeared (see Figure 2). One obvious reason is that the rate of increase in the price of medical care has slowed. Another is that the population is aging so retirees constitute a much larger share of the sample.

Part B Premiums. The skepticism about being protected from inflation may have gotten a special boost this year, as retirees faced a 14.5-percent hike in their Medicare Part B premium. Roughly half of this increase was designed to create a contingency reserve to cover significantly higher expenditures associated with Aduhelm, Biogen’s controversial new Alzheimer’s drug.

Ultimately, Medicare administrators decided to limit Medicare’s coverage of the new drug to those enrolled in clinical trials, greatly restricting its use; and they plan to incorporate the savings in the 2023 premium.

So, two points are relevant here. First, even the unusually high Part B premium offset less than 25 percent of the Social Security COLA. Second, the 2023 Part B premium increase should be quite low, which will help retirees cover some of the higher prices they face due to nationwide inflation.

The bottom line is that retirees do not live on fixed incomes; their monthly benefits go up when prices rise.