Don’t Mess with the WEP and GPO!

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The real answer is that all state and local workers should be covered by Social Security.

A new report from the Congressional Research Service appears to have rekindled the controversy surrounding the Windfall Elimination Provision (WEP). This provision reduces Social Security benefits for workers receiving significant government pensions from jobs not covered by Social Security. A companion provision – the Government Pension Offset (GPO) – makes similar adjustments for their spouses and survivors.

The WEP and GPO infuriate state and local employees, who feel like they are unfairly being denied benefits. My view is that these provsions are well-intentioned – albeit imperfect – attempts to solve an equity issue that arises because about 25-30 percent of state and local workers are not covered by Social Security.

Exclusion from Social Security creates two types of problems. First, employees lacking coverage are exposed to a variety of gaps in basic protection – most notably in the areas of survivor and disability insurance. Second, uncovered state and local workers can gain minimum coverage under Social Security and – until the introduction of the WEP in 1983 – could profit from the progressive benefit structure, which was designed to help low-wage workers.

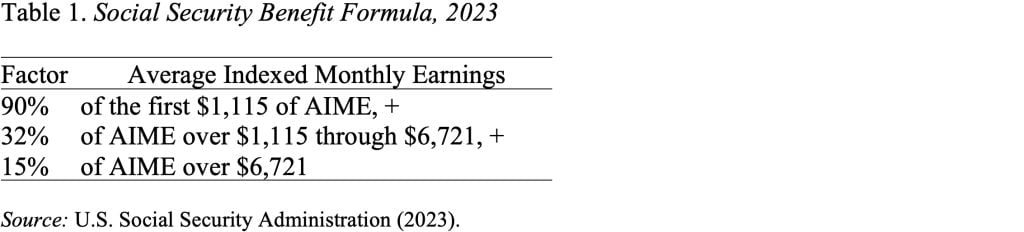

To see how that happens, look at the Social Security benefit formula. It applies three factors to the individual’s average indexed monthly earnings (AIME). Thus, a person’s benefit would be the sum of 90 percent of the first $1,115 of AIME, 32 percent of AIME between $1,115 and $6,721, and 15 percent of AIME over $6,721 (see Table 1).

Since a worker’s monthly earnings are averaged over a typical working lifetime (35 years), a high-wage earner with a short period of time in covered employment looks exactly like a low-wage earner. Both would have 90 percent of their earnings replaced by Social Security.

Similarly, a spouse who had a full career in uncovered employment – and worked in covered employment for only a short time or not at all – would be eligible for the spouse’s and survivor’s benefits.

The WEP is designed to eliminate these inequities by reducing the first factor in the benefit formula from 90 percent to 40 percent; the 32 percent and 15 percent remain unchanged. It is not a perfect solution – the benefit cut is proportionately larger for workers with low AIMEs, regardless of whether they were a high- or low-earner in their uncovered employment. Albeit, the WEP does guarantee that the reduction in benefits cannot exceed half of the worker’s public pension, which protects those with low pensions from uncovered work. (It is also worth noting that the WEP does not affect benefits for survivors.)

To make the WEP fairer, Rep. Kevin Brady (R-TX) has repeatedly introduced legislation with a new formula. First, the regular Social Security factors would be applied to all earnings – both covered and uncovered – to calculate a benefit. The resulting benefit then would be multiplied by the share of the AIME that came from covered earnings. Such a change would produce smaller reductions for the lower paid and larger reductions for the higher paid. And individuals would receive the higher of their benefit under a current law WEP or the proportional formula. That is a better approach. Rep. Richard Neal (D-MA) introduced a similar bill in 2021. While the WEP could be improved, the forces for eliminating it are formidable. This standoff raises the question whether it is worth the trouble of creating a whole new procedure when the real answer is to extend Social Security coverage to all state and local workers. Universal coverage would offer better protection for workers, eliminate the equity problem, and allow us to put this contentious issue behind us.