Cap on Retirees’ Part D Spending May Push Up Premiums

2025 will be a banner year for retirees. In January, a hard $2,000 cap on how much they spend out of their own pockets for medications kicks in.

Retirees should welcome the new, much lower spending limit, which will protect them from extraordinary costs, especially if they develop an illness that requires an expensive medication like the rheumatoid arthritis drug Humira or the cancer drug Revlimid.

But the monthly premiums on stand-alone Part D plans could cause some sticker shock.

The premiums, which average $43, increase modestly in a typical year. But 2025 looks different because the Inflation Reduction Act of 2022 that reduced retirees’ out-of-pocket spending will also require insurance companies to pick up more of the total cost of their medications.

“That’s going to put pressure on the premiums,” said Juliette Cubanski of KFF, a healthcare policy and research organization.

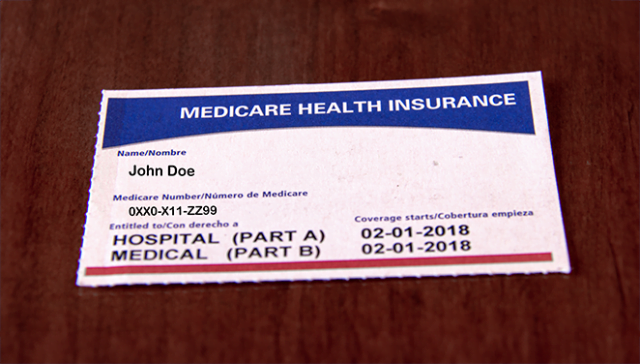

The $2,000 cap on retirees’ out-of-pocket spending, starting in January, is down from an effective cap this year of around $3,500. A typical retiree pays much less than $3,500 for their drugs, so these spending limits mainly are there to protect retirees taking expensive medications. Part D premiums do not count toward the spending caps.

In mid- to late September, the Centers for Medicare and Medicaid Services (CMS) will release the information about Part D plan options in 2025. Cubanski said retirees don’t have to understand the complicated changes being made to how Medicare manages their drug costs. But they do need to shop around for the best price on a plan that covers their medications.

Without getting into the weeds of Medicare’s extremely complex cost structure, the changes next year will put pressure on premiums because insurers will start paying a larger share of the total cost of a retiree’s medications. Insurers currently are responsible for 20 percent of drug costs above an $8,000 cap on spending, which is a combination of the $3,500 limit on retirees’ out-of-pocket costs and a drug manufacturers’ discount that covers the remaining amount up to $8,000.

Starting next year, insurers will pay 60 percent of the cost above the new, lower $2,000 cap. (The manufacturers’ discount in the new formula was retained but will be applied differently.)

“The redesign is intended to give insurers a greater incentive to manage drug costs for Medicare enrollees,” explained Cubanski, who is deputy director of KFF’s program on Medicare policy. But the changes have “introduced a lot of uncertainty for plans in terms of what they expect their costs to be next year.”

And that translates to more premium uncertainty for retirees who buy stand-alone Part D plans. Medicare Advantage plans, which have grown to about half of the retiree market, also have a drug benefit. But they aren’t expected to be affected to the extent Part D plans are. While the medications covered by Advantage plans operate under the same Medicare cost structure, their premiums are much lower – or non-existent – because of Medicare’s generous reimbursements to Advantage plans.

It’s difficult to predict the premium levels next year on stand-alone Part D plans, Cubanski said. But the government has put some measures in place to help keep them in check.

First, the Inflation Reduction Act limited to 6 percent the increases in what’s known as the base premium. The premiums retirees see when they’re shopping for a drug plan vary widely because every individual plan has a different combination of deductibles, copayments, and benefits. But the base premium is the standard by which all Part D and Advantage plan premiums are set.

Second, CMS will test a new program that provides generous premium subsidies specifically for Part D plans. The program is voluntary, and it’s not yet known how many insurers will participate or how much their participation will mitigate the upward pressure on premiums. But premiums in certain cases could conceivably go down for the Part D plans offered by insurers that take part in the demonstration, Cubanski said.

When the 2025 plan details are released next month, she said, what retirees should be asking “is how much is my plan charging vs. other plans? And if I switch, can I find another plan with better coverage for the drugs I’m taking at a premium I can afford?”

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

How will this affect Medicare Advantage retirees?

I’m dropping $250+ a month for Ozempic even with the plan.

This is outrageous that Medicare is providing ever larger subsidies to Advantage Plans while making traditional Medicare recipients face ever higher premiums for Part D. It appears that the private insurers behind Advantage Plans have paid off Congress and the President so his Trustee appointees allow private insurers to scam Medicare for ever more money. Medicare Advantage Plans are part of the healthcare racket plaguing America and driving up government & individual costs while enriching healthcare organizations which are degrading US healthcare. Total corruption. Advantage Plans are already defrauding Medicare of somewhere between $25 and 140 billion/yr. with cooperation of our politicians. They should be prosecuted as co-conspirators.

My premium for Part D is Forty cents per month. A six percent rate hike on that could not be much. I have AARP United Healthcare.