Correcting Misperceptions about Social Security’s Fate

Once a year, Social Security reports on the program’s financial outlook but the bottom line doesn’t change: the reserve in the trust fund is running out of money. Many workers and retirees go straight to the inaccurate worst-case scenario: retirement benefits will cease when the reserve is depleted.

In fact, if Congress doesn’t address the looming shortfall – and there’s still time for that – the payroll taxes that fund benefits will keep flowing into the program. But the reserve is shrinking because it is being used to cover part of the benefits being paid to the growing ranks of retiring boomers.

Once the reserve depletes, benefits will not be eliminated, though they will have to be reduced if Congress doesn’t act.

A new study gets at one reason for the public’s inaccurate belief that their benefits will stop completely. It comes down to the way Social Security’s finances are presented to them.

The finances are complex, and the average person has a tough time translating what they hear in the dire media reports about trust fund depletion into what that means for benefits. Sensational headlines about the program’s future “insolvency” or “bankruptcy” don’t help.

But the researchers were able to improve workers’ understanding of Social Security by emphasizing the reliable flows into the program – the payroll tax revenues being deducted from workers’ paychecks – rather than the shrinking balance in the trust fund.

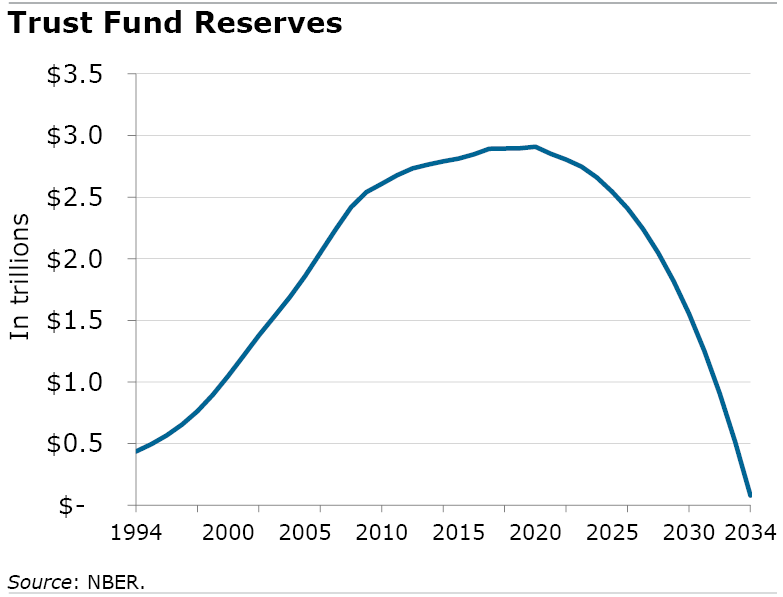

To that end, the adults who participated in the researchers’ online survey were presented with two fairly simple graphs. The first tracked the balance in the trust fund’s reserve between 1994 and 2034. The balance peaked in 2020 and will eventually run dry, like a bathtub after the plug is pulled.

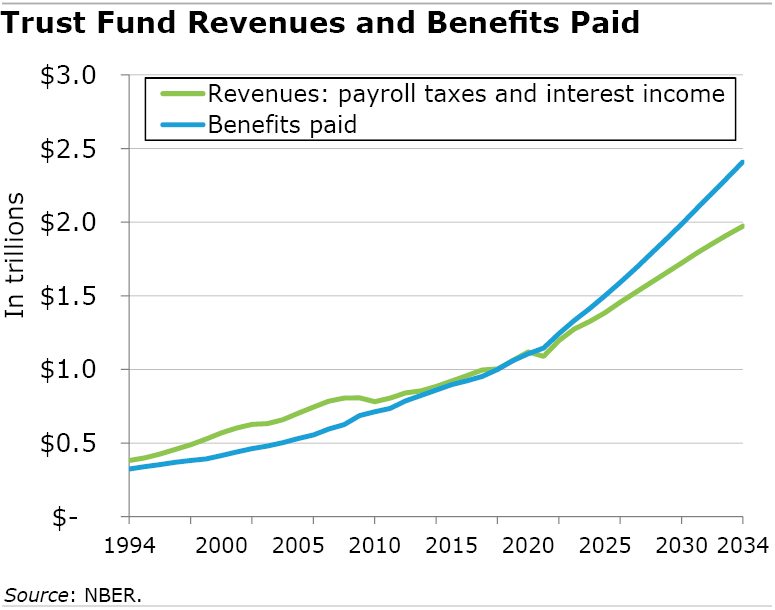

A second graph showed two lines – one for the tax revenues and interest income coming in every year and one for the benefits being paid out. The lines have already crossed, and the program’s tax revenues are now falling short of benefit payments. The outflows are expected to deplete the trust fund in about 10 years.

More of the people who saw the trust fund balance had an inaccurate view of Social Security’s finances: two out of three believed the program “will no longer be able to pay out benefits” after depletion. That dropped to about 56 percent for the people who saw the graph showing the payroll taxes continuing to roll in.

But that still leaves more than half who don’t understand how Social Security works. So, what else could be done to help the public understand what’s going on?

In a follow-up study, the researchers used the same two charts. But they prompted the participants to reflect on some issues before answering the central questions about the fate of future benefits. The first prompt was: would the payroll taxes continue after the trust fund depletes? The second was: what would Social Security do with those revenues?

After reflecting on these prompts, 43 percent of the people who saw the revenue and benefits chart thought Social Security would stop paying benefits. This is a considerable improvement over the 56 percent who held this misperception in the first study, though 43 percent is still a lot of workers who think retirees would not be paid.

But the researchers, by making clear that payroll taxes would continue, have uncovered a promising way to tackle a common misunderstanding that Social Security benefits will dry up.

To read this study by Megan Weber, Hal Hershfield, Stephen Spiller and Suzanne Shu, see “The Role of Stock-Flow Reasoning in Understanding the Social Security Trust Fund.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

Great article. Would be nice to be able to download it to a PDF file.

I use Linux, not Windows, and this works for me. It should work in Windows as well. While the article is open, press Ctrl-P (or choose File, then Print in your browser’s menu bar). There should be an option to “Print to PDF” or something to that extent, where you choose where to send the print job. Hope this helps!

It also depends on if you are using a mac or PC. Here are more instructions: https://www.consumerfinance.gov/consumer-tools/save-as-pdf-instructions/