What Will COVID-19 Mean for Social Security Claiming?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The pandemic will inevitably lead to more claiming at age 62.

It’s inevitable that many older workers – either fearful of returning to work or unable to find employment – will claim their Social Security benefits early as a result of COVID-19. While claiming early locks beneficiaries into actuarially reduced monthly payments, it offers a safety net for unemployed older workers.

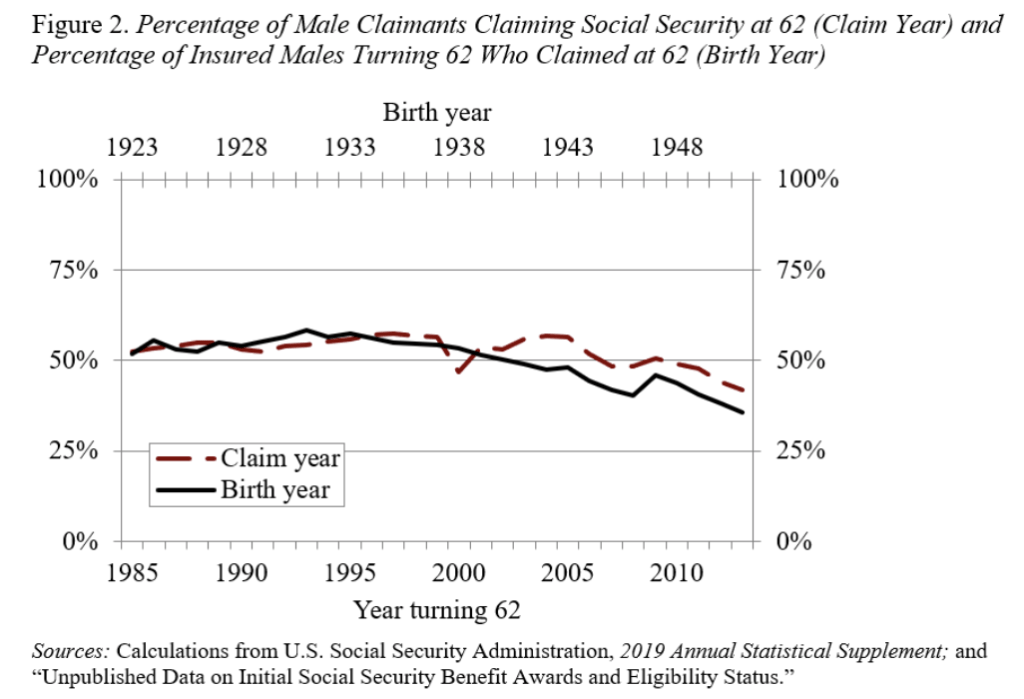

In preparation for looking at the trends in Social Security claiming, we updated data on the percentage of people who claim at age 62, the earliest age at which benefits are available. This number comes in two flavors. The first is the data published each year by the Social Security Administration that show, of all workers claiming benefits in a given year, the percentage who are 62, 63, 64, etc. The problem is that, when the size of the population turning age 62 is increasing, as it has been for more than two decades, these data will show that 62-year-old claimants make up a larger portion of new claimants even if a smaller percentage of 62-year-old workers claim immediately.

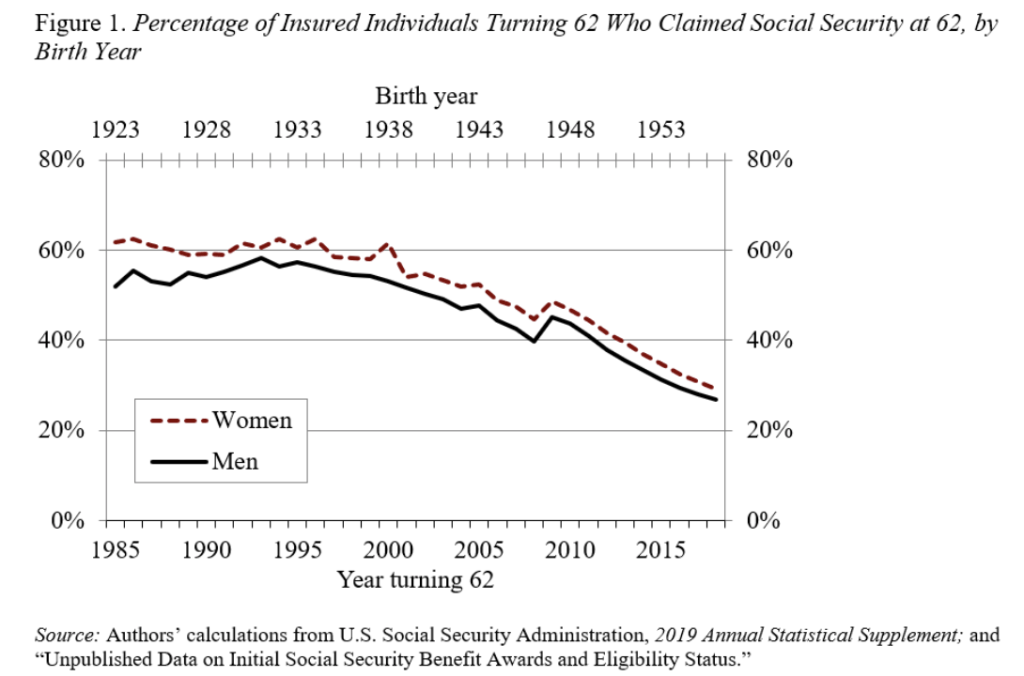

To accurately characterize claiming behavior, it is necessary to look at the second type of data: claiming information by cohort. Such data show, of the potential claimants turning 62 in a given year, the percentage who claim benefits as soon as possible. This calculation is possible because SSA provides unpublished data on the number of people eligible for retired-worker benefits by birth year. The task is then to allocate cohort totals among claiming ages based on SSA’s published data. For example, the unpublished data show that 864,596 men born in 1923 turned 62 and became eligible for benefits in 1985. The published data show that 448,630 men claimed benefits at 62 in 1985, all of whom by definition must be 1923-cohort men. Similarly, the published data show that 82,900 men claimed benefits at 63 in 1986, 110,580 claimed at 64 in 1987, etc., so the published data make it possible to follow the claiming activity of the 1923 birth cohort over time. The process produces data on the percentage of each cohort claiming at each age, which are shown separately for men and women in Figure 1.

Figure 2 compares the percentage of men claiming at 62 on a claim-year and cohort basis. The two approaches provide very similar results until 1997; afterward the two series start to diverge. The cohort data show a much greater decline over the 32-year period than the claim-age data published annually.

In terms of examining the impact of COVID-19 on claiming behavior, Social Security administrative data will not be published until the fall of 2021. Therefore, short-term information about trends in retirement behavior will have to be gleaned from surveys. The pandemic and economic collapse will certainly reverse the downward trend in the percentage claiming at 62, as did the 2008-09 crisis. Once the economy recovers, however, the percentage claiming early hopefully will continue its decline.