Defined Benefit Plans Earn Higher Returns than Defined Contribution Plans

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

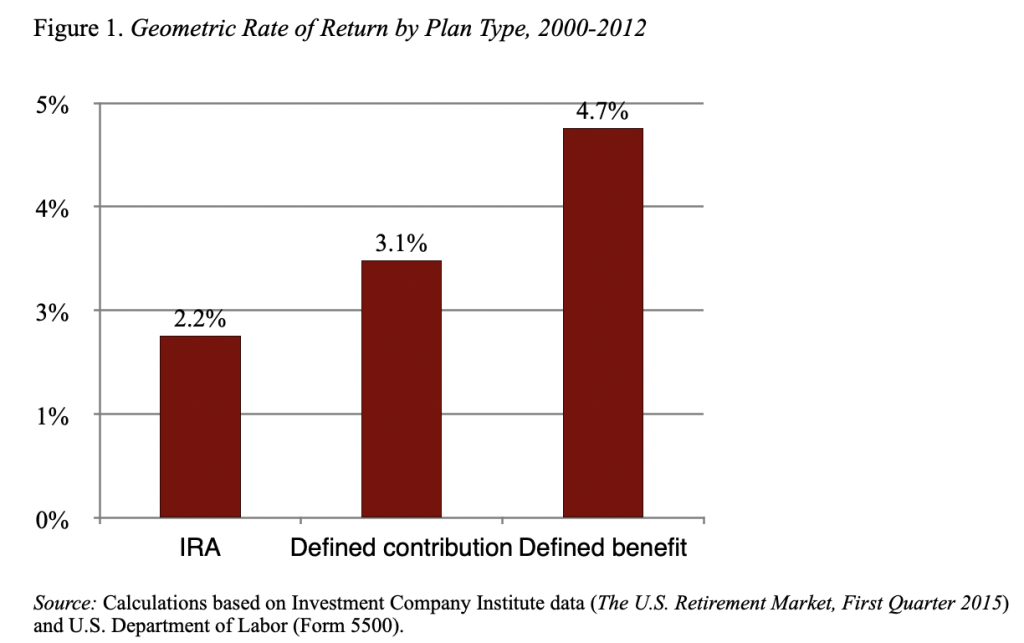

And defined contribution plan assets often move to IRAs, which earn even lower returns.

Pension coverage in the private sector has shifted from defined benefit plans where professionals make investment decisions to 401(k) plans where participants are responsible for their own investment strategy. The supposition is that individuals are not very good at investing their own money and face high fees. The question is whether this supposition is borne out by the facts. That is, are returns on defined contribution plans markedly lower than those on traditional defined benefit plans?

A new study compares the returns from private sector defined benefit and defined contribution plans over the period 1990-2012. It uses data from the Department of Labor (DOL)’s Form 5500. It also compares returns on IRAs, based on data from the Investment Company Institute, to those on employer sponsored plans from 2000-2012.

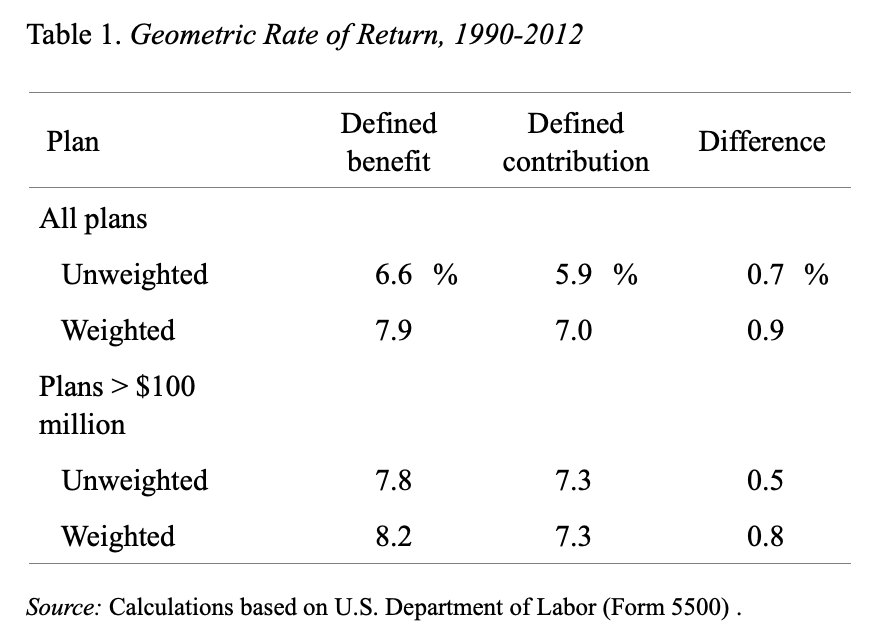

Whether looking at reported data or estimating equations that control for asset allocation and size, the bottom line is that, during 1990-2012, defined benefit plans outperformed defined contribution plans by about 0.7 percentage point. The results are not very sensitive to the exclusion or inclusion of small plans and whether or not the plans are weighted by their asset holdings (see Table 1).

Some researchers have suggested that the differential between defined benefit and defined contribution plan returns has declined over time, but the data show that the differential is generally larger after 2002.

Investment fees, which typically account for 80-90 percent of total expenses, are the most likely explanation. The reason for the higher fees is that defined contribution plans invest through mutual funds, while defined benefit plans do not. When weighted by assets invested, fees for equity funds, bond funds, and hybrid funds, while declining over time, accounted for – on average – about 0.80 percent of assets under management between 2000 and 2014 and were probably substantially higher before that time. Of course, defined benefit plans also have some investment fees, but these are small compared to those associated with defined contribution plans.

The comparison of IRA returns with those for defined benefit and defined contribution plans is particularly alarming. While individuals holding IRAs do not have to fill out a Form 5500, the Investment Company Institute provides data on beginning-year assets, year-end assets, contributions, rollovers, and withdrawals for IRAs that make it possible to calculate the aggregate average return for the period 2000-2012. Over that period, the results show that IRAs produced substantially lower returns than defined contribution or defined benefit plans (see Figure 1).

Foregoing returns over long time periods means that assets at retirement will be sharply reduced. Saving is too hard to have fees eat up such a large portion of investment earnings.