Do Millennials Really Deserve a “Gold Star” for Retirement Saving?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Is $6,933 the new goal for 22-37-year-olds?

A recent New York Times op-ed argued that the Millennial generation, contrary to popular reports, “gets a gold star for retirement preparedness.” This argument was based on comparing 401(k) holdings at ages 22-37 of $6,933 for Millennials to $3,970 for Gen Xers.

I would be delighted if Millennials were doing well in terms of saving, but I don’t think they are. All workers face a world in which Social Security will provide less relative to pre-retirement earnings, 401(k) balances are generally meager, and – at any given time – half the private sector workforce does not have an employer-sponsored retirement plan. They will also face much longer periods of retirement due to rising life expectancy, high and rapidly rising health care costs, and historically low interest rates. In addition to these general headwinds, Millennials also have substantial student debt, began their careers in the tough job market following the Great Recession, and are less likely to have workplace retirement and health benefits.

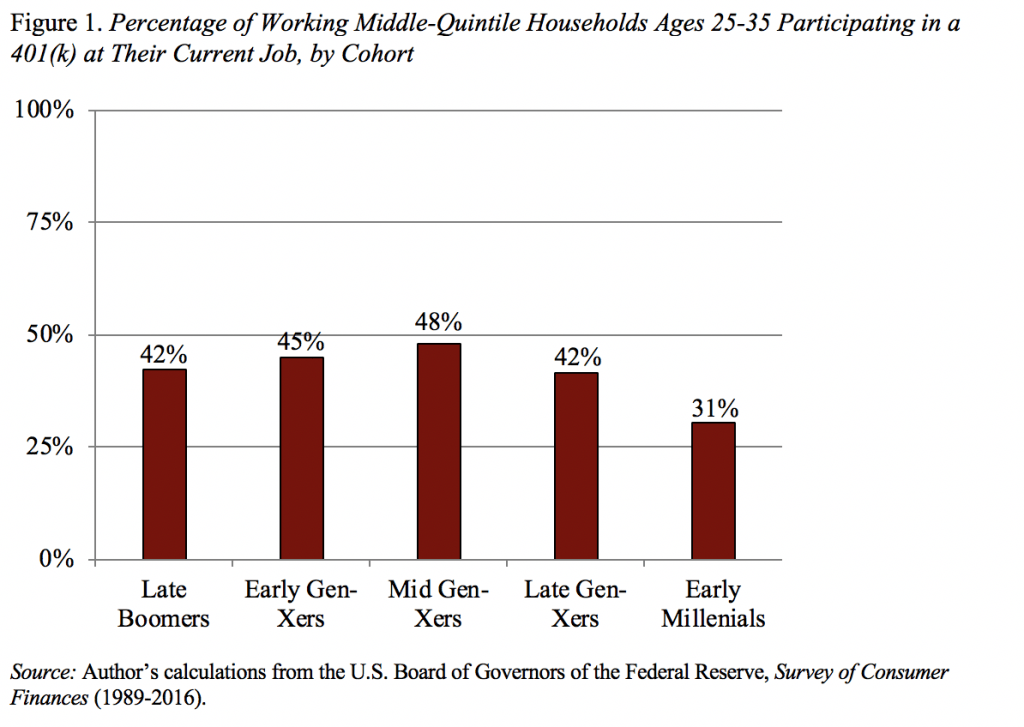

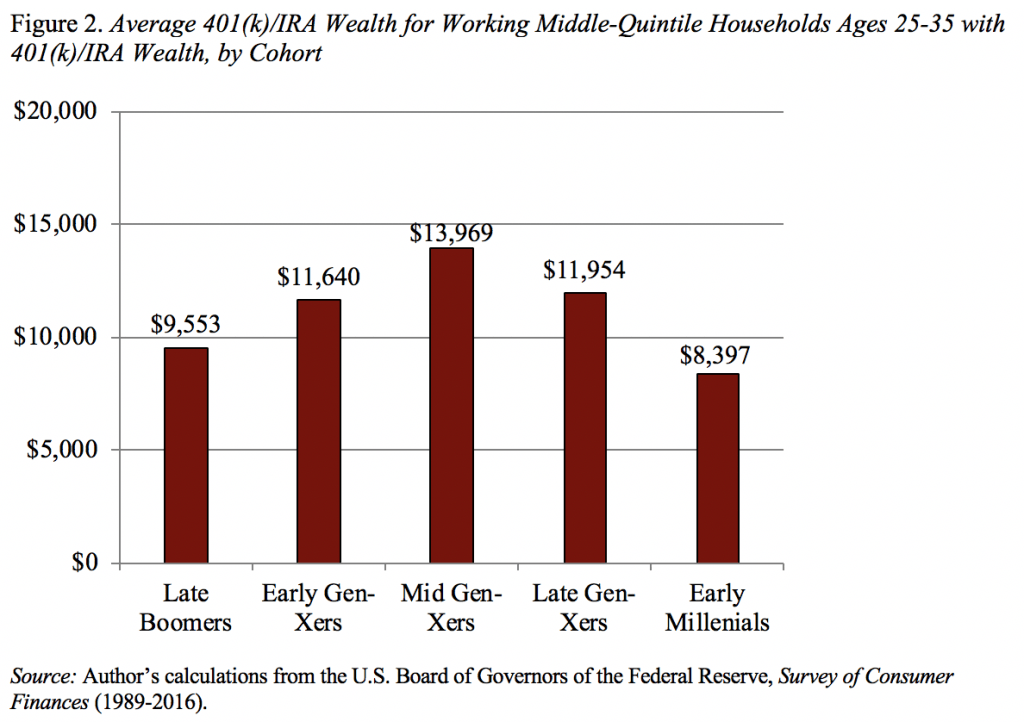

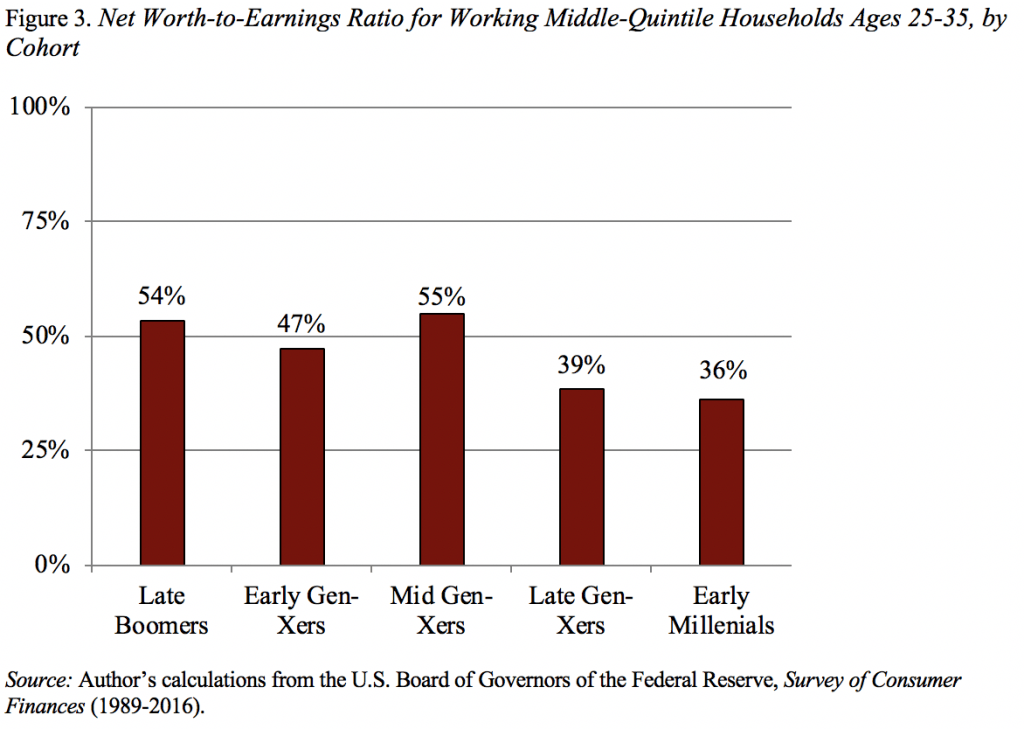

The Federal Reserve’s 2016 Survey of Consumer Finances (the most recent available) documents the challenges that Millennials face. Fewer Millennial households are covered by a retirement plan (see Figure 1); Millennials with 401(k) and/or IRA assets have lower total balances than earlier cohorts (see Figure 2); and, overall, Millennials have much lower wealth-to-income ratios than their older counterparts (see Figure 3). In short, Millennials are behind.

This picture may change with the release of the 2019 Survey of Consumer Finances this September, but at this point no one has any basis for making such a prediction.

Finally, have we really lowered the retirement-saving bar so much that we are giving out “gold stars” for balances of $6,933?