Examining the Black-White Wealth Gap

The Black Lives Matter protesters have brought renewed attention to the enduring economic inequality that separates Black and white America.

Homeownership is at the heart of this disparity.

For many Americans, their largest source of wealth is the value they have built up in their homes over time. The house is also traditionally the primary way for moderate- and middle-income parents to pass wealth on to their children.

But less than half of African-Americans own homes, and the ones who do have a fraction of the equity whites have due in large part to the nation’s long history of segregated housing, economists say.

Further, the tidal wave of foreclosures a decade ago reduced the already low homeownership in minority communities, which felt the brunt of the housing market collapse. The Black homeownership rate is just 42 percent – 5 percentage points lower than it was in 2000. White homeownership remained stable throughout the crisis and is now around 72 percent, the Urban Institute said.

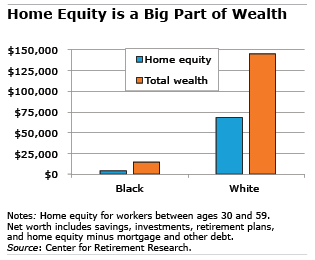

The upshot of this combination of fewer Black owners and less equity for those who own a house is that the typical African-American worker has $4,400 in home equity, compared with $67,800 for whites. The home equity gap accounts for about half of the Black-white disparity in total wealth.

The upshot of this combination of fewer Black owners and less equity for those who own a house is that the typical African-American worker has $4,400 in home equity, compared with $67,800 for whites. The home equity gap accounts for about half of the Black-white disparity in total wealth.

A web of systemic reasons explain the home equity gap. Black homebuyers have more debt, in part because they are twice as likely to receive a mortgage with a high interest rate as white buyers with comparable incomes.

And while overt segregation has eased since the Housing Act of 1968 made it illegal for real estate agents to refuse to sell houses in white neighborhoods to Black families, whites still live in predominantly white neighborhoods, a Brown University study found. And white neighborhoods have dramatically higher house prices than the more diverse neighborhoods where Black people live.

Neighborhood composition affects house prices, because white homeowners tend to have higher incomes that support higher house prices and also lend stability when the housing market declines. And the contrast in incomes between Black and white neighborhoods is stark: the average affluent Black household lives in a poorer neighborhood than the average lower-income white resident, the Brown study found.

The 2008 housing crisis dramatized the additional risk of buying in a more diverse neighborhood. When the U.S. housing market eventually recovered, Black homeowners did not see the rebound in prices that white homeowners did. In the lower-income Black neighborhoods on Chicago’s South Side, for example, house prices are still only half of their values prior to the crisis, according to a 2018 study by the Federal Reserve Bank of Chicago. In contrast, prices in the tony Lincoln Park neighborhood have surpassed their previous peak.

Other factors also weaken prices and reduce equity in Black neighborhoods, including less access to local businesses and less tax revenue to fund public schools. The cumulative effects of these factors, combined with lower incomes, reduce the average Black owner’s house price by $48,000, compared with white owners, according to the Brookings Institution.

Less home equity has a domino effect on the traditional avenues of upward mobility. Less home equity means fewer Black homeowners are able to borrow money or even sell a house to raise capital and “start and invest in business enterprises and afford college tuition for their children,” Brookings said.

Housing is a major factor in wealth inequality. Will growing support for the Black Lives Matter movement bring real change?

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

One more measure of the systemic effects of racism in American. We must also acknowledge the health disparities, which are often tied to financial disparities. It has been shown that Black and Hispanic Americans die much more often than white Americans from COVID-19, and the maternal death rate is much higher in African-American women, even adjusting for incomes and educational level. We must not let this inequality persist.

A video on Race and Vitamin D.

https://www.youtube.com/watch?v=l4a-3S33Kho

I guess now that everyone realizes that housing is overpriced again, someone wants to have Black Americans borrow federally-backed money to over pay and buy it again. That sure worked out great for them last time.

Perhaps a better question is who really benefitted from federal policies to re-inflate the housing bubble? Sellers, who tend to be older people, and their lenders. At the expense of later-born buyers, and others who did not already own.

https://larrylittlefield.wordpress.com/2017/12/09/fannies-mae-and-freddie-macs-stealth-economic-war-on-the-millennials/

The real problem here few want to talk about is the poor public education system in the US for 50 years all controlled by the DEMS and unions that destroy it. The US spends nearly 700 billion a year on education, almost as much as the defense budget with dismal results. Look up PISA testing and you can see the bad results of our high school students on an international test given every two years in 180 countries. The US has been dropping for 30 years in ratings.

Black home ownership and wealth creation was rising in the 50s and 60s until bad welfare policies (and, perhaps, the 60s sexual revolution) had a devastating effect on Black family formation and stability. The largest determinants for wealth creation: growing up in a stable 2-parent household, completing one’s education, and full-time employment. It’s not a secret, and until these factors are addressed, other solutions will simply be ameliorative, not curative – like placing bandaids on skin cancer.

Now that we’ve identified the problem, consider another perspective for the solution. Averages paint a dismal picture, but opportunity lies within. Here in Philadelphia, we have 10’s of thousands of row homes owned outright by black community members. Yes, gentrification and predatory financial rules are stripping them away but that’s about to change, thanks to the DeFi revolution.

Homeowners can use their equity like cash to escape crushing consumer debt and foreclosures. Not HELOC!! Liquid shared equity, so homeowners buy back equity with deposits, while leasing their partners’ share of the home. Keeping 100% control to pass homes through generations.

By getting out of the debt spiral and realizing multigenerational gains from increased property values, black families and communities can break the trend.