Health and Wealth Drive Retirees’ Spending

Previous research has shown that spending drops immediately at the moment the paychecks stop, and a few studies have found that households, once retired, reduce their consumption over time.

But a new study that also takes the long view suggests that the spending decline is not what retirees want to do but what is necessitated by their financial and health constraints.

The analysis, which used data from two national consumption surveys, divided retired households into groups to get a sense of what goes into their spending decisions. The researchers compared the consumption patterns of retirees at three different wealth levels over a 20-year period and then compared consumption for three states of health.

The evidence that financial resources drive behavior is that the wealthier households’ consumption was relatively constant, declining just one-third of 1 percent a year.

While these retirees have the financial wherewithal to largely maintain their spending, retirees in the bottom wealth tier saw bigger drops of 1 percent a year. When accumulated over 20 years, the declines produced much lower spending levels than when they first retired.

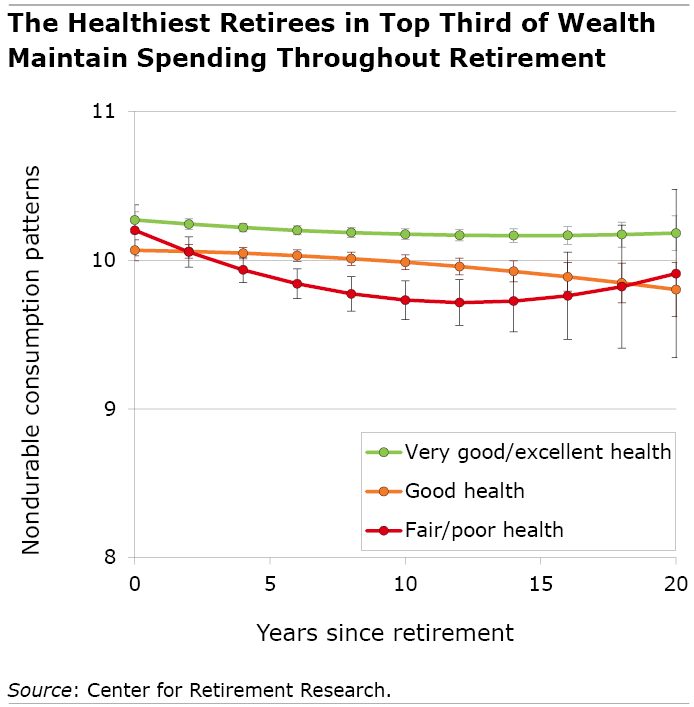

Health is a second factor in retirees’ decisions. Again, the extremes tell the story. Spending in the top tier – very good or excellent health – held fairly flat, while the retirees in fair or poor health saw relatively large declines. Even if they can afford to travel or eat out frequently, health problems may be preventing them from enjoying their money.

This study doesn’t contradict prior research showing that the retired population as a whole decreases spending over time. However, the healthier and wealthier retirees’ ability to maintain their consumption levels may be an indication that’s what retirees would prefer.

Further support for this conclusion can be found in the behavior of the healthiest households in the top third of wealth – their retirement spending is even flatter.

Both health and wealth “are important determinants of consumption paths in retirement,” the researchers concluded.

To read the study on which is article is based, see “Do Retirees Want Constant, Increasing, or Decreasing Consumption?” authored by Anqi Chen and Alicia Munnell.

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.

Comments are closed.

The least healthy are also plagued by high out-of-pocket health care costs that limit their ability to spend on things they might wish to do. If Medicare was permitted to negotiate drug prices, that would do wonders to allow retirees to enjoy life more.