How Did the Stimulus Checks Affect Household Finances?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

First check improved assessment of ability to cover $400 expense, and later payments may be building balance sheets.

Before the COVID-19 pandemic, despite a booming economy, about 40 percent of households said they would have trouble paying a $400 unexpected expense. About half of these households really didn’t have $400, and the other half had $400 but were burdened by credit card debt. When households are operating under such tight budgets, saving for long-term goals such as retirement can be challenging.

The question is how did COVID, with its extensive job losses, roaring stock market, and multiple stimulus checks, affect household balance sheets. While full information about the longer-term impact of the stimulus payments will not be available for a few years, recent research using early data provide some indication of the current state of play.

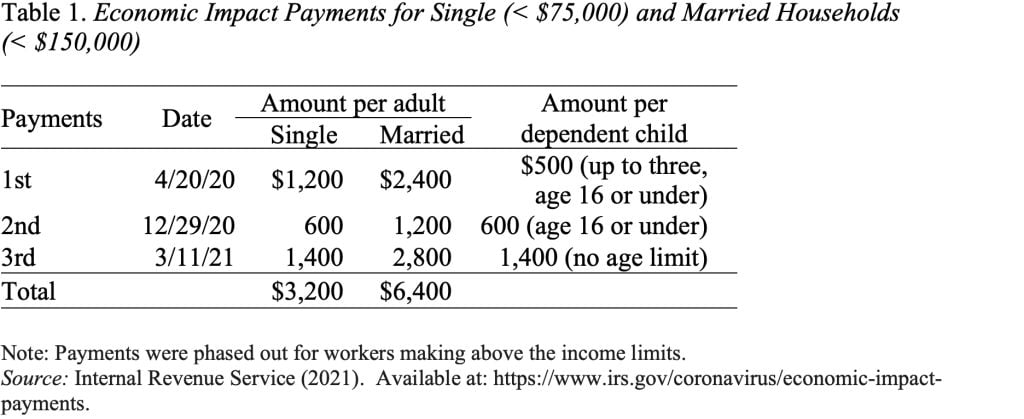

Clearly those with substantial assets benefited from a roaring stock market, but, without help, the pandemic would certainly have increased the share unable to cover a $400 emergency expense. Fortunately, Congress provided most households – regardless of employment status –

with three rounds of Economic Impact Payments (EIPs), and the amounts were substantial (see Table 1).

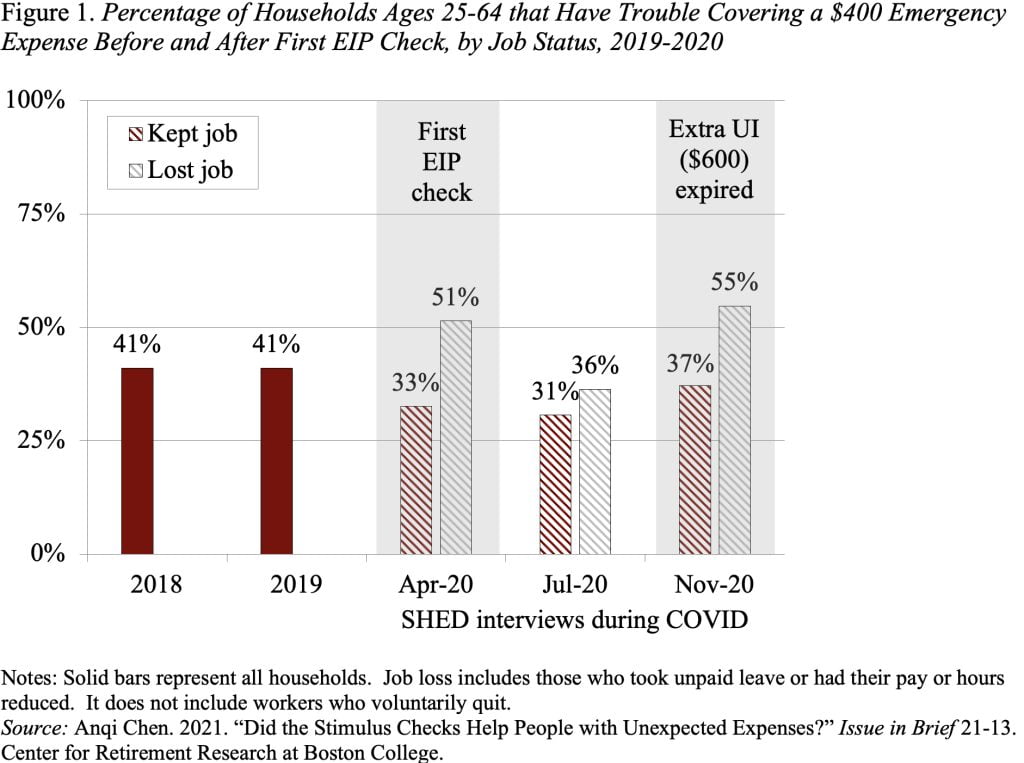

The Federal Reserve’s 2020 Survey of Household Economics and Decisionmaking, which was conducted in November 2020 (with prior supplements in April and July), shows how the first payment affected households’ assessment of their ability to cover a $400 emergency expense. Not surprisingly, the responses differ by their employment experience.

For those workers (about a quarter) who either lost their jobs, were asked to take unpaid leave, or had their pay cut, the first EIP provided some temporary relief. Among this group, the percentage unable to cover a $400 expense dropped from 51 percent to 36 percent between April and July 2020. However, this beneficial effect evaporated before the end of 2020, potentially because the initial UI supplement of $600 per week expired. By comparison, among workers who kept their jobs, the share reporting difficulty covering a $400 expense dropped to a third early in the pandemic from the pre-pandemic level of about 40 percent – and stayed roughly in this range through the rest of the year.

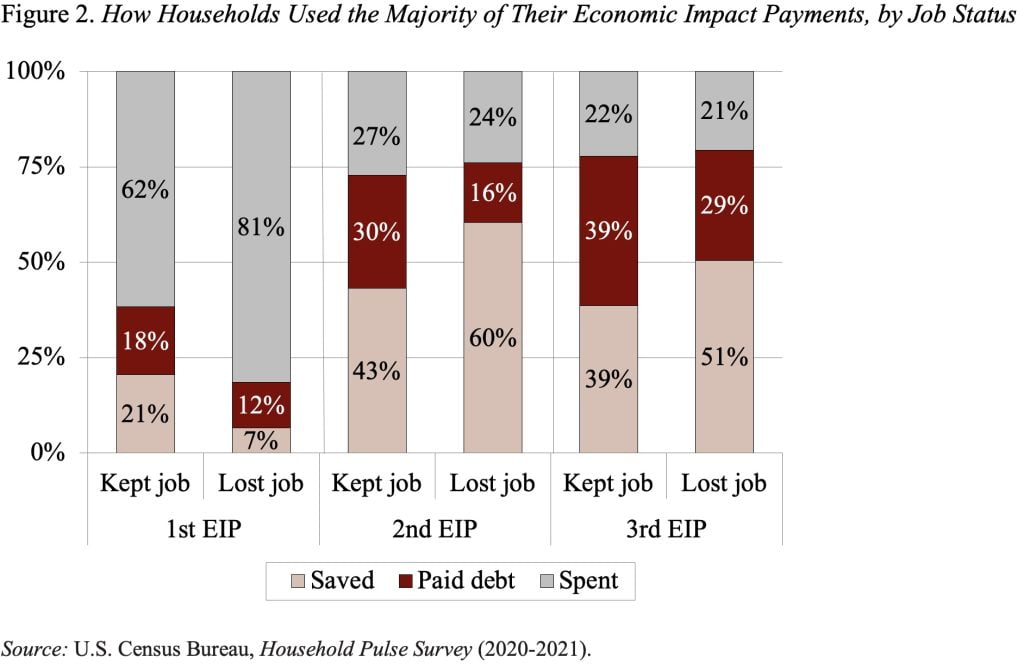

While the first EIP mostly allowed those households that lost their jobs to make ends meet, early indicators from the Census Bureau’s Household Pulse Survey (which has been conducted almost weekly since April 2020) suggest that the second and third EIPs helped many improve their balance sheets. About three-quarters of households saved their second and third EIP checks or used them to pay down debt, regardless of job loss status (see Figure 2). Extended regular and new supplemental unemployment benefits also likely contributed to this outcome.

In short, early indicators suggest that the first payment served as a much-needed lifeline for workers who lost their jobs and helped those who kept their jobs build precautionary savings and pay off some debt. Moreover, many workers, even those who lost their jobs, were able to save or pay off debt using their second and third payments. The question is how long these favorable balance sheet developments will last.