How Satisfied Are Retirees with the Social Security Claiming Process?

The brief’s key findings are:

- Despite Social Security’s online tools, many retiring workers still contact an agency representative for help.

- Both online and in-person applicants report high satisfaction with the process of claiming benefits.

- Interestingly, lower satisfaction often stems from those who would prefer to use online tools, but ultimately do not.

- This result suggests that continued improvement in, and promotion of, online services could further boost overall satisfaction.

Introduction

Retiring baby boomers are increasing the demand for Social Security Administration (SSA) services at a time when budget constraints and retiring staff are limiting the agency’s capacity to deliver them. Online services offer a way for SSA to meet increased demand with fewer resources. However, even as SSA has shifted more personalized information and services online to its my Social Security platform, research shows that many people still do not use this tool to view their Social Security Statement or apply for benefits. As such, this brief explores recent retirees’ satisfaction with the claiming process amidst the shift to online tools and the continued desire by some for in-person or phone services.

The discussion proceeds as follows. The first section describes the CRR’s 2021 survey on individuals’ claiming process, which is the source of data for this analysis. The second section documents survey respondents’ reported claiming satisfaction and finds that it is generally high, with some small differences by race/ethnicity and claiming process (i.e., online vs. offline). The third section explores the extent to which a claimant’s degree of satisfaction with the process is associated with their reasons for contacting SSA. The fourth section describes survey respondents’ open-ended suggestions for improving the claiming process. The final section concludes that, overall, recent retirees report being very satisfied with their experience and that continued improvements in online services could potentially further boost satisfaction for those who prefer to use online tools.

Data and Prior Research

In May 2021, the CRR surveyed about 1,600 older individuals regarding their recent experience claiming Social Security retirement benefits.1Specifically, the CRR survey was administered to older individuals in NORC’s AmeriSpeaks Survey Panel from May to June of 2021. The survey targeted individuals ages 62-70 who claimed Social Security retirement benefits in the last five years (recent retirees) and those ages 57-70 who intend to apply within the next five years. In total, the survey contained about 1,600 recent retirees and 1,000 near retirees. Importantly, the survey sample adequately reflects the national demographics for older individuals in America (based on a comparison to the 2020 Current Population Survey). See Aubry and Wandrei (2021) for more details. The survey included questions on the overall claiming process of respondents (including their interactions with SSA leading up to – and shortly after – claiming) and their satisfaction with the process. As a result, the survey provides a comprehensive picture of the claiming experience of respondents: the claiming path taken, the obstacles encountered, the self-reported reasons for their chosen path, overall satisfaction with the process, and respondents’ suggestions for improvement.2For example, the survey captures whether a respondent communicated with SSA online, on the phone, or in-person before, during, and/or after claiming their benefit, and the specific reasons why they did so. Also, if a respondent claimed online, the survey asks whether they did so at home, at a field office using an SSA desktop or kiosk, or at a public location (e.g., a library). And, for those who did not claim online, the survey prompts respondents for specific reasons – such as an error involving their name, age, and/or work history in the SSA system or simply a lack of awareness of the online option – as well as allowing for open-ended responses.

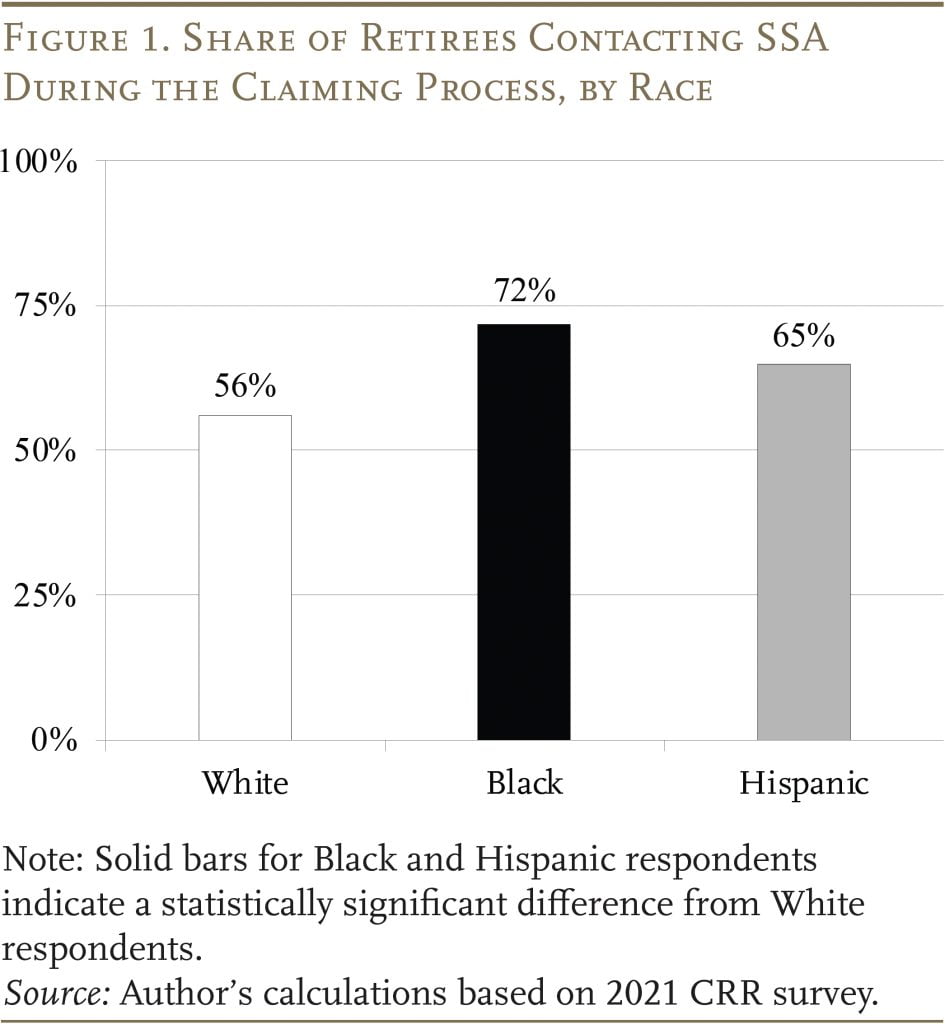

The CRR’s initial analysis of the survey responses found that almost 60 percent of recent retirees contacted SSA at some point during the claiming process and that those who contacted SSA were more likely to be non-White (see Figure 1).3Aubry and Wandrei (2021). The solid bars for the Black and Hispanic categories indicate a statistically significant difference from Whites. Given the racial differences in claiming completely online, this brief uses the survey to examine the general claiming satisfaction of recent retirees, as well as differences in satisfaction by both claiming process (i.e., completely online or not) and race.

Claiming Satisfaction

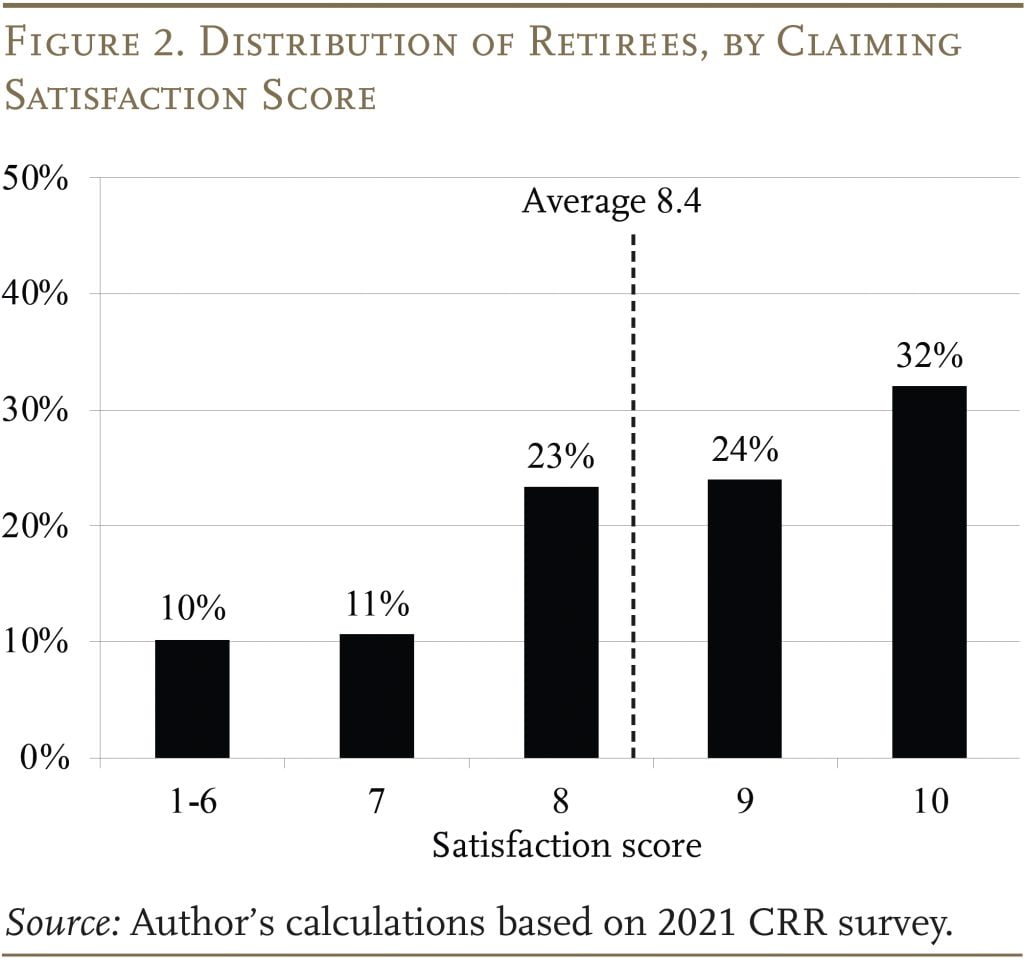

In the survey, recent retirees were asked to rate their overall satisfaction with their claiming process on a scale of 1 to 10, with 10 being the highest level of satisfaction. The average satisfaction score was 8.4, with about 80 percent of respondents reporting a score of 8 or more (see Figure 2). This finding reflects claiming of retirement benefits only – it does not capture disability benefit applications, a process that faces well-known challenges such as case backlogs. The high satisfaction scores for retirement services in our survey also align with results from SSA’s Overall Customer Service Satisfaction Survey, which has consistently shown roughly 80 percent of survey respondents rating SSA services as “excellent,” “very good,” or “good.”4The survey uses a six-point scale consisting of: “excellent,” “very good,” “good,” “fair,” “poor,” or “very poor.” Those who contacted SSA during their claiming process report slightly lower satisfaction than those who claimed completely online – 8.3 vs. 8.7 – a difference that was statistically significant.

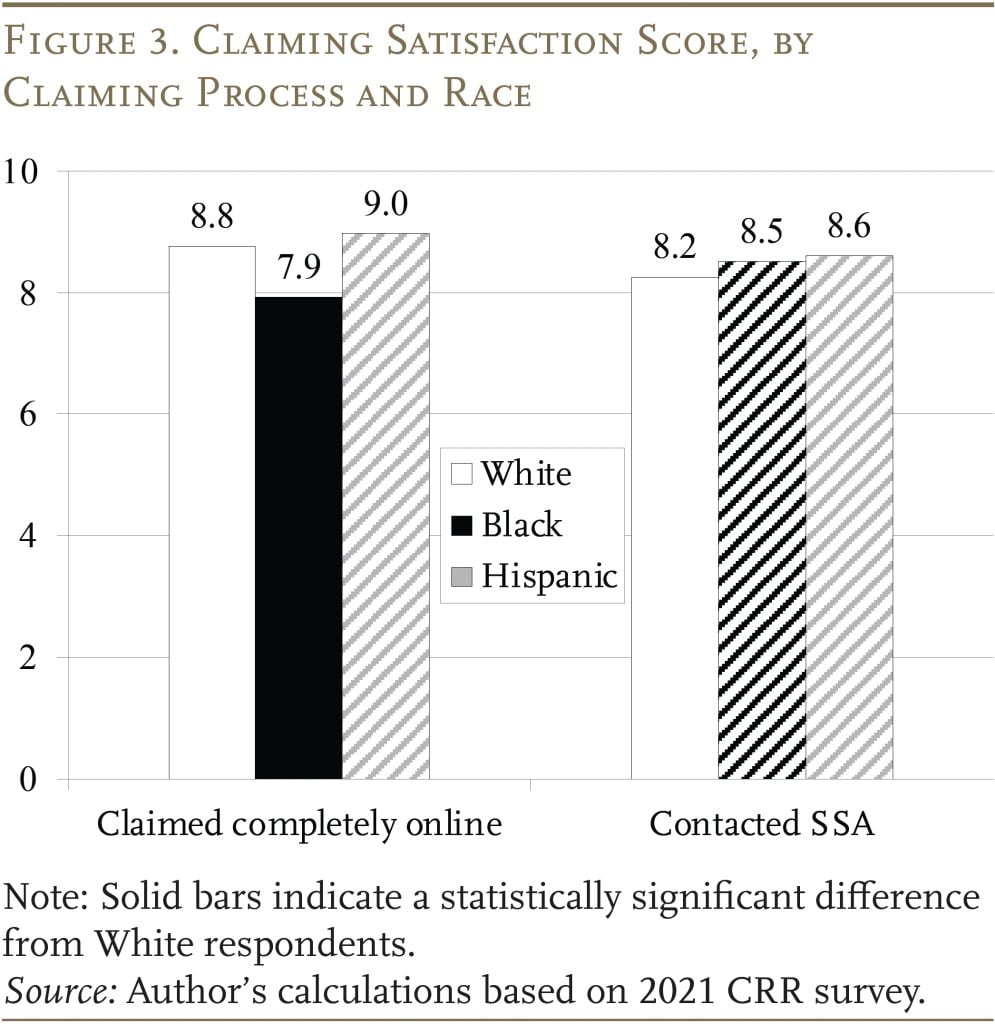

A closer look at satisfaction by claiming process and race reveals some interesting differences (see Figure 3).5Multiple studies in the last 10 years have highlighted racial differences in sources of information about Social Security and knowledge of Social Security rules that could contribute to differences in the claiming experience. See Carman, Atshan, and Williams (2023); Knapp and Perez-Arce (2022); Peterson, Smith, and Guan (2019); Rabinovich, Peterson, and Smith (2017); and Yoong, Rabinovich, and Wah (2015). First, both Whites and Hispanics who claimed completely online report higher satisfaction scores than those who contacted SSA when claiming. In contrast, Blacks who claimed completely online report lower satisfaction scores than their counterparts who contacted SSA. Second, though generally not statistically significant, Hispanics report higher satisfaction scores than either Black or White respondents, whether they claimed completely online or not.6Interestingly, results from SSA’s Retirement Applicant Satisfaction Survey consistently show a statistically similar or higher share of Spanish speakers rating SSA services as “excellent”, “very good”, or “good” relative to English speakers.

Does Satisfaction Vary by Reason for Contacting SSA?

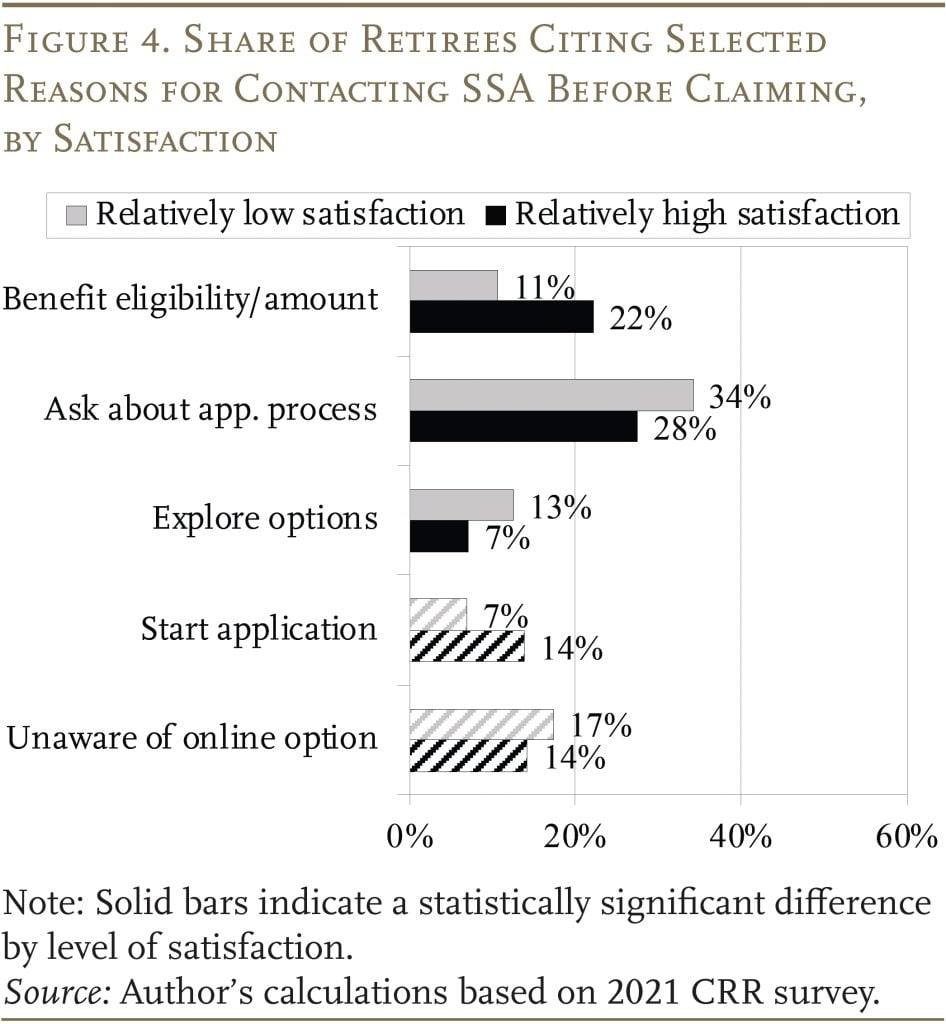

As noted above, a substantial number of retirees contact SSA at some point during their claiming process, often to get more information before applying for benefits. It is possible that the reason they contact SSA before claiming could be associated with their degree of satisfaction with the experience. Figure 4 compares some common reasons given by individuals with a satisfaction score of 8 or above (black bars) to those with a score below 8 (gray bars). Those who report higher satisfaction scores are more likely to have contacted SSA to ask whether they were eligible for retirement benefits or what amount they would receive, and those who report lower scores are more likely to have contacted SSA to ask about the steps in the application process or to explore their options (e.g., how claiming at different ages would affect their benefits).

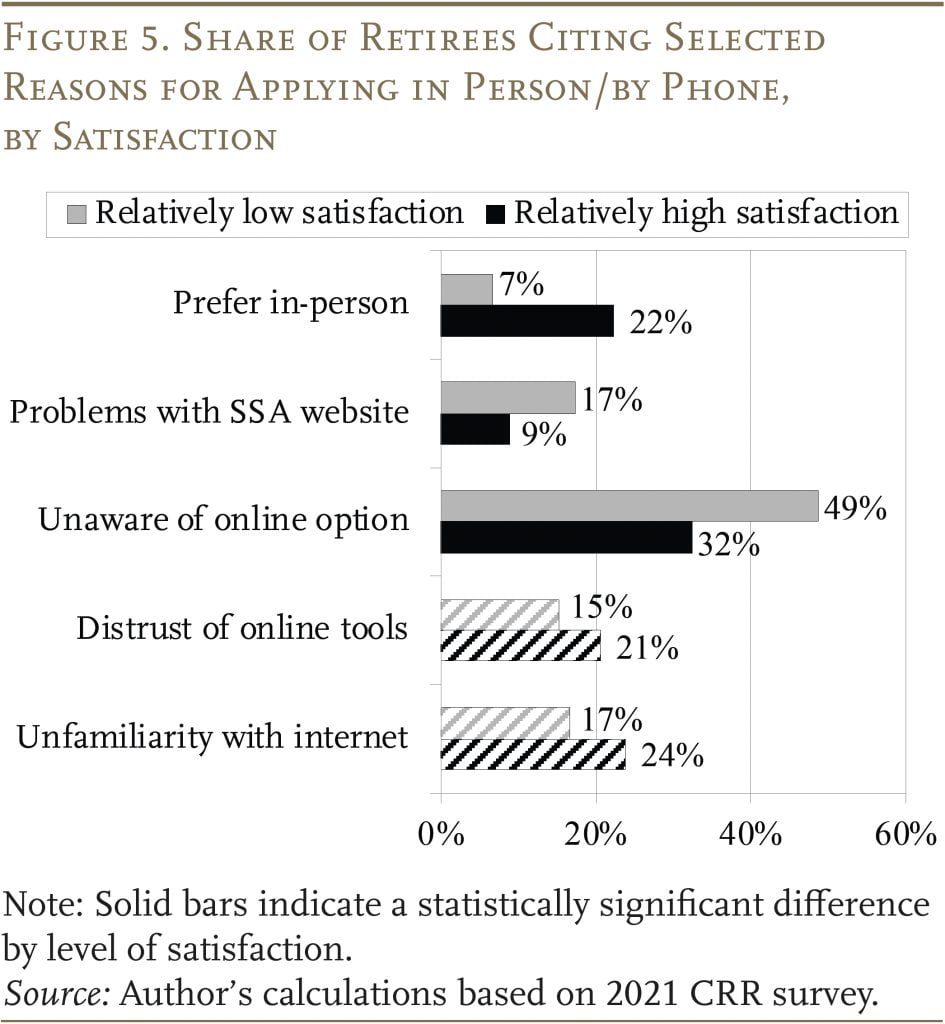

Shifting from pre-application to the actual application, the results show that – for those who claimed their benefits in person or by phone – the respondents reporting higher satisfaction scores are more likely to prefer applying in person (see Figure 5). In contrast, those with lower satisfaction scores were more likely to have contacted SSA due to problems with the SSA website or because they were unaware of the online option. This finding suggests that lower satisfaction often stems from those who might prefer to use online tools, but ultimately do not. Conversely, it also suggests that continued efforts to communicate the availability of online tools and improve the online claiming portal could decrease the number of retirees who are less satisfied with their claiming experience.

How Would Retirees Improve the Claiming Experience?

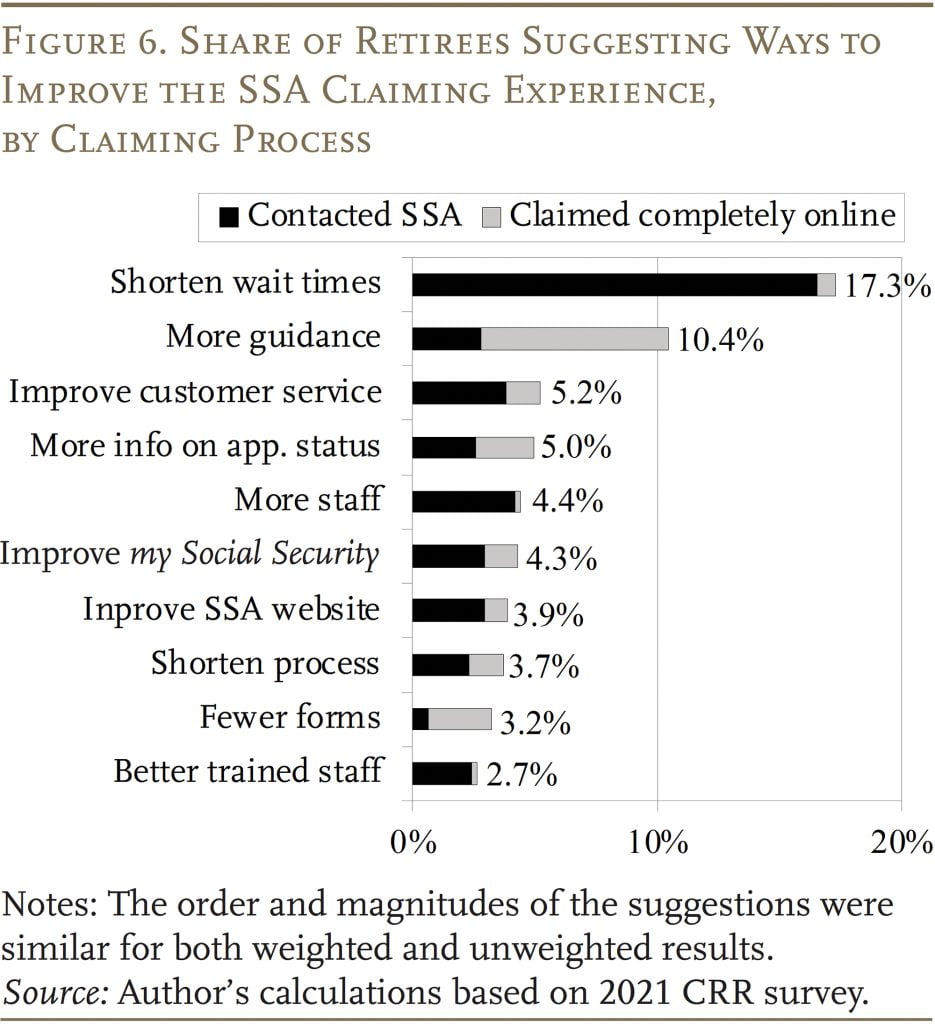

The CRR also asked retirees to suggest how to improve the claiming experience. Not surprisingly, given the overall high satisfaction scores, just over 20 percent of retirees – about 435 respondents – offered suggestions for how SSA might improve its services. (Another 15 percent simply provided positive feedback on their experience.) While no statistical differences existed by race in the likelihood of offering suggestions, those who contacted SSA during the claiming process were more likely to offer a suggestion.

When dissecting the suggestions provided by recent retirees, most included an idea that could be easily categorized. Unsurprisingly, the suggestions varied somewhat by whether a retiree claimed completely online or not. For example, one of the most common suggestions – given mostly by those who contacted SSA – was to shorten wait times, followed by providing more guidance to retirees on the process – given mostly by those who claimed completely online (see Figure 6). Only a small percentage directly cited SSA’s online information and services.

Conclusion

Providing online services offers a way for SSA to meet increased demand with fewer resources. However, even as SSA has shifted more personalized information and services to the my Social Security online platform, research shows that many still do not use it to view their Statement or apply for benefits.

This brief explored recent retirees’ satisfaction with their claiming process amidst the shift towards online tools and the continued desire by some for offline services. Overall, the results suggest that SSA is providing solid customer service to retirees whether they choose to use online tools or contact SSA – with both groups reporting an average satisfaction score of more than 8 out of 10. In addition, the findings suggest that continued improvements in, and promotion of, online services could potentially further boost satisfaction of those who would prefer to use online tools.

References

Aubry, Jean-Pierre and Kevin Wandrei. 2021. “How to Increase Usage of SSA’s Online Tools.” Working Paper 2021-15. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Carman, Katherine, Samer Atshan, and Jhacova Williams. 2023. “Disparities in Social Security Knowledge and the Role of Social Capital.” Working Paper 2023-458. Ann Arbor, MI: University of Michigan Retirement and Disability Research Center.

Knapp, David and Francisco Perez-Arce. 2022. “Racial and Ethnic Disparities in Knowledge about Social Security Programs.” Working Paper 2022-449. Ann Arbor, MI: University of Michigan Retirement and Disability Research Center.

Peterson, Janice, Barbara A. Smith, and Qi Guan. 2019. “Hispanics’ Knowledge of Social Security: New Evidence.” Social Security Bulletin 79(4): 11-23.

Rabinovich, Lila, Janice Peterson, and Barbara A. Smith. 2017. “Hispanics’ Understanding of Social Security and the Implications for Retirement Security: A Qualitative Study.” Social Security Bulletin 77(3): 1-14.

Yoong, Joanne, Lila Rabinovich, and Saw Htay Wah. 2015. “What Do People Know About Social Security?” Working Paper 2015-022. Los Angeles, CA: University of Southern California, Center for Economic and Social Research and Schaeffer Center.

Endnotes

- 1Specifically, the CRR survey was administered to older individuals in NORC’s AmeriSpeaks Survey Panel from May to June of 2021. The survey targeted individuals ages 62-70 who claimed Social Security retirement benefits in the last five years (recent retirees) and those ages 57-70 who intend to apply within the next five years. In total, the survey contained about 1,600 recent retirees and 1,000 near retirees. Importantly, the survey sample adequately reflects the national demographics for older individuals in America (based on a comparison to the 2020 Current Population Survey). See Aubry and Wandrei (2021) for more details.

- 2For example, the survey captures whether a respondent communicated with SSA online, on the phone, or in-person before, during, and/or after claiming their benefit, and the specific reasons why they did so. Also, if a respondent claimed online, the survey asks whether they did so at home, at a field office using an SSA desktop or kiosk, or at a public location (e.g., a library). And, for those who did not claim online, the survey prompts respondents for specific reasons – such as an error involving their name, age, and/or work history in the SSA system or simply a lack of awareness of the online option – as well as allowing for open-ended responses.

- 3Aubry and Wandrei (2021).

- 4The survey uses a six-point scale consisting of: “excellent,” “very good,” “good,” “fair,” “poor,” or “very poor.”

- 5Multiple studies in the last 10 years have highlighted racial differences in sources of information about Social Security and knowledge of Social Security rules that could contribute to differences in the claiming experience. See Carman, Atshan, and Williams (2023); Knapp and Perez-Arce (2022); Peterson, Smith, and Guan (2019); Rabinovich, Peterson, and Smith (2017); and Yoong, Rabinovich, and Wah (2015).

- 6Interestingly, results from SSA’s Retirement Applicant Satisfaction Survey consistently show a statistically similar or higher share of Spanish speakers rating SSA services as “excellent”, “very good”, or “good” relative to English speakers.