How Will the Coronavirus Pandemic Affect Social Security Finances?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Will it shift the long-run curves or accelerate the date of depletion of the trust fund?

A frequent question from the press is how the COVID-19 pandemic will affect Social Security finances. (This topic was not covered in the Trustees Report released last week, as the report was prepared before the pandemic). Of course, no one knows the answer, because no one knows how long it will take to get the virus under control and how long it will take the economy to recover from the shutdown. That said, two pictures offer a useful way to think about the question.

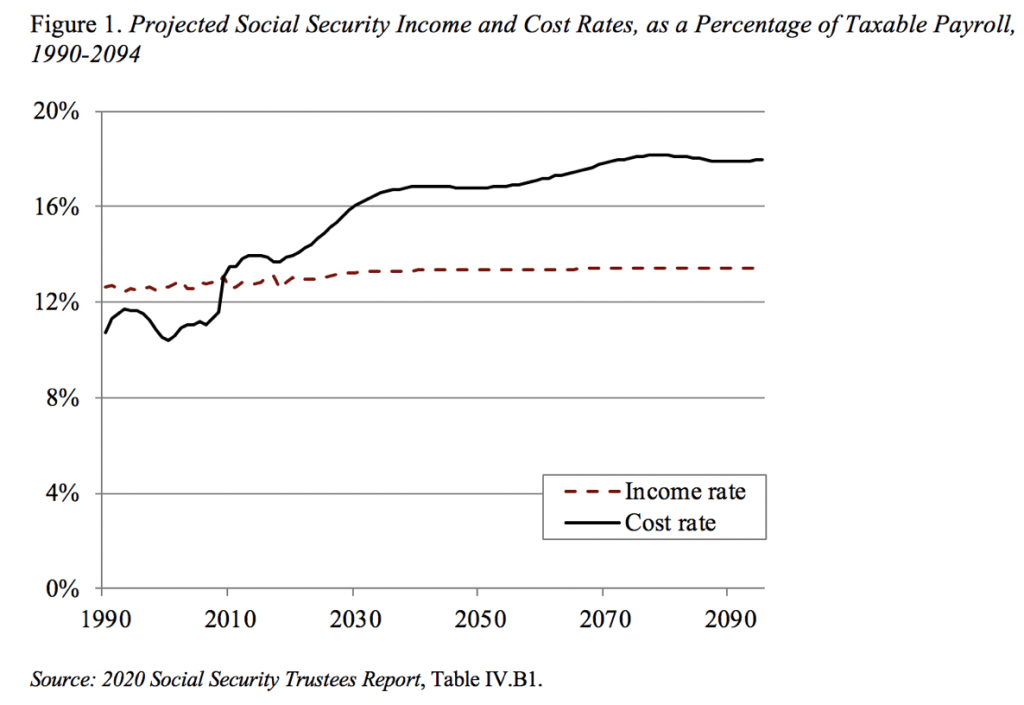

The first is the conventional figure showing the program costs and income as a percentage of payrolls over the next 75 years (see Figure 1). Clearly the system faces a problem since the cost rate exceeds the income rate. Before COVID-19 and our economic collapse, the Social Security system in 2020 was not bringing in enough tax revenue to cover promised benefits. Yet no one was concerned about benefits not being paid in full.

The reason for the lack of concern is the fact that Social Security has a pile of assets in its trust fund that it can use to cover the gap between cost and income for some period of time. In the 2020 Trustees Report, that period extends to 2035, at which point the trust fund is depleted and income and payroll taxes can cover only about 75 to 80 percent of benefits going forward.

So the impact of COVID-19 on Social Security finances could come through two routes. The pandemic could: 1) shift the long-run cost and income lines shown in Figure 1; or 2) push forward the date when the trust fund runs out of money.

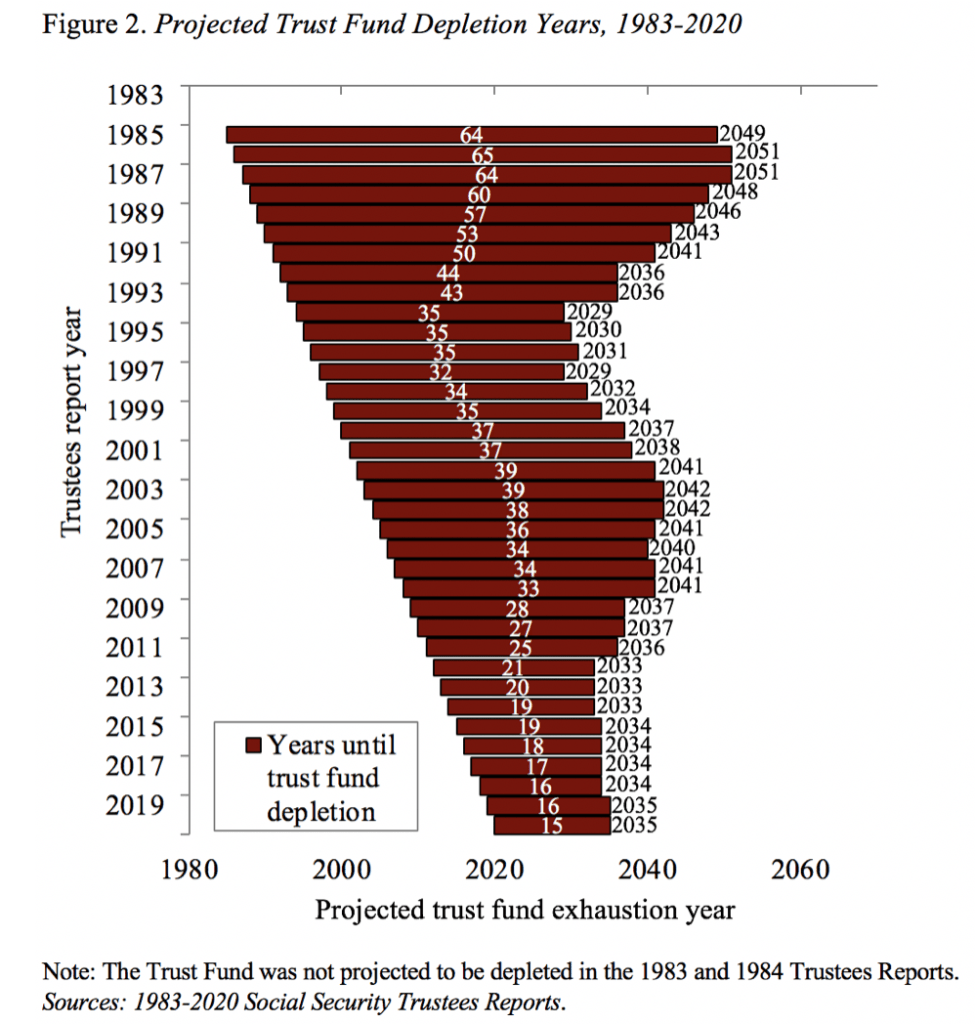

My sense of the 75-year cost and revenue lines is that they are not easily moved. It’s not impossible, but it’s not the first place I would look for action. The more likely route would be the depletion date for the trust find. To get a sense of that, I asked my colleague Anqi Chen to plot the projected depletion dates over time. She came up with the most extraordinary picture (see Figure 2).

Before speculating about the impact of COVID-19, note what has happened between the 1983 legislation, which initiated the buildup, and the present. We used to have 65 years to figure out what to do once the trust fund was depleted; we now have 15. It’s pincer movement as time has moved forward on the one hand and the date of exhaustion has moved towards the present on the other.

With regard to the impact of COVID-19 on the trust fund assets, the effect is unlikely to be dramatic. The trust fund is about $3 trillion, about two and a half times annual benefits. Social Security is currently using the interest on trust fund assets to bridge the gap between cost and income and is scheduled to start drawing on the assets next year. If the COVID-19 economic collapse causes payroll taxes to drop by, say, 20 percent for two years, the depletion date would move up by about two years. That means we may soon be within 10 years of depletion.

As soon as we get the immediate issue of the pandemic off our plate, it would be a good idea to take steps to ensure that people retiring in the mid-2030s and later do not see a 20-25 percent cut in benefits.