Index Update Shows More Retirement at Risk

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New numbers suggest caution about cutting future Social Security benefits

Now that the election is over, it’s time to pay attention to some of the nation’s underlying problems. One important concern is the inadequacy of the nation’s retirement income system. The National Retirement Risk Index (NRRI) shows the share of working households who are “at risk” of being unable to maintain their pre-retirement standard of living in retirement even if they work to age 65 – which is above the current average retirement age – and annuitize all their financial assets, including the receipts from a reverse mortgage on their homes.

The NRRI was originally constructed using the Federal Reserve’s 2004 Survey of Consumer Finances (SCF). The SCF is a triennial survey of a nationally representative sample of U.S. households, which collects detailed information on households’ assets, liabilities, and demographic characteristics. The 2007 SCF did not allow for a meaningful update, because stock market and housing prices plummeted right after the survey interviews were completed. Thus, the 2010 survey is the first opportunity to see how the financial crisis and ensuing recession have affected Americans’ readiness for retirement.

Constructing the National Retirement Risk Index involves three steps: 1) projecting a replacement rate – retirement income as a share of pre-retirement income – for each member of a nationally representative sample of U.S. households; 2) constructing a target replacement rate that would allow each household to maintain its pre-retirement standard of living in retirement; and 3) comparing the projected and target replacement rates to find the percentage of households “at risk.”

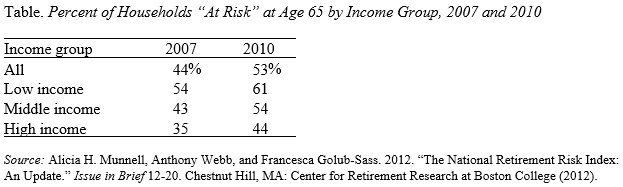

Not surprisingly, the NRRI increased sharply between 2007 and 2010 from 44 percent to 53 percent. Those in the bottom third experienced the smallest increase, mainly because they rarely hold equities and rely primarily on Social Security benefits, which were unaffected by the financial collapse.

A number of factors contributed to the decline: 1) the gradual increase in the Social Security Full Retirement Age; 2) the decline in the stock market; 3) the decline in the housing market; and 4) the decline in annuity rates; less 5) the increase in the percent of the value of the house that can be borrowed on a reverse mortgage. About half of the increase in the percent at risk was the result of the decline in house prices, reflecting the fact that housing is most households’ largest asset.

The NRRI shows that, as of 2010, more than half of today’s households will not have enough retirement income to maintain their pre-retirement standard of living. The NRRI clearly indicates that this nation needs more retirement saving. Social Security, which serves as the backbone of the nation’s retirement system, will provide less replacement income even under current law as the Full Retirement Age increases, deductions for Medicare premiums increase, and more households find themselves subject to taxation of their benefits. Whether Social Security is part of the current budget deal or not, it will require adjustments sometime in the future. When the time comes, policymakers should be very cautious about cutting benefits when so many households are at risk under current benefit levels.