Inflation Is on the Way Out, But High Prices Make Life Seem “Unaffordable”

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The way back to “affordability” is not for prices to drop but for wages to rise, and they have.

The public dialogue about the economy seems to confuse “inflation” with “high prices.” The inflation problem is largely solved, but the price problem remains – making many feel that things are no longer affordable. The fact is that prices are not going to fall to pre-inflation levels – nor would that be a good signal for the economy. Instead, the way back to affordability is rising wages. Here, we have made a lot progress, but still have a way to go.

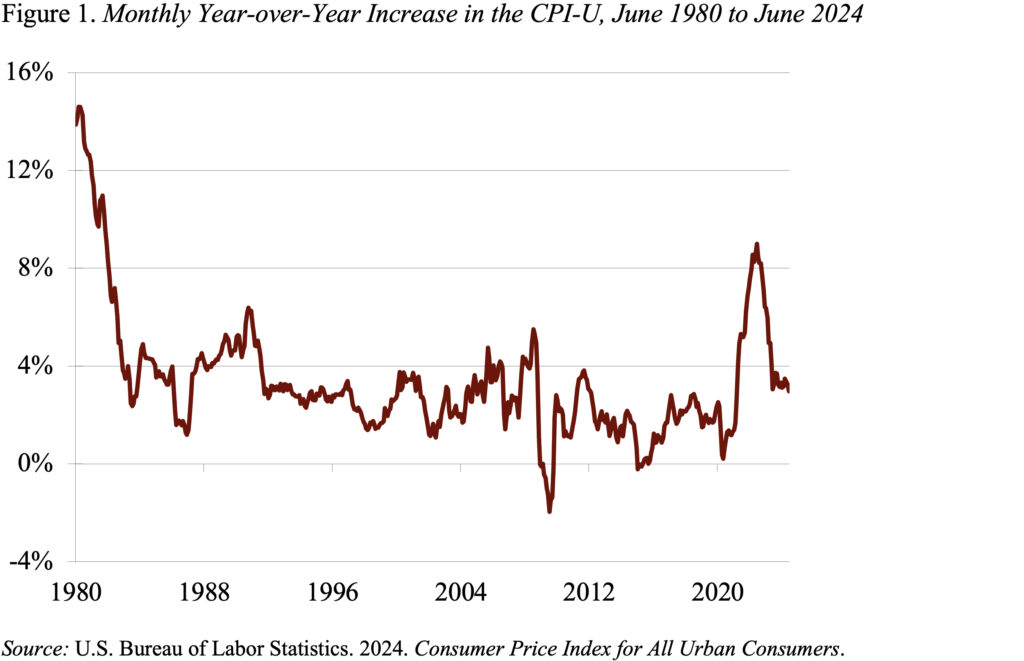

Inflation is a process that involves rising prices and wages, and the inflation rate is the percentage change in goods and services over a period of time. While experts look at a variety of inflation measures, the most common is the Consumer Price Index for all Urban Consumers (CPI-U). Inflation, after four decades of relatively steady prices, took off in mid-2021 and hit a peak of 9 percent in June 2022 (see Figure 1). Since then, however, the rate of inflation has declined sharply, and in the most recent report stood at 2.9 percent. While this rate is still higher than the Fed’s 2-pecent target, we are conquering inflation.

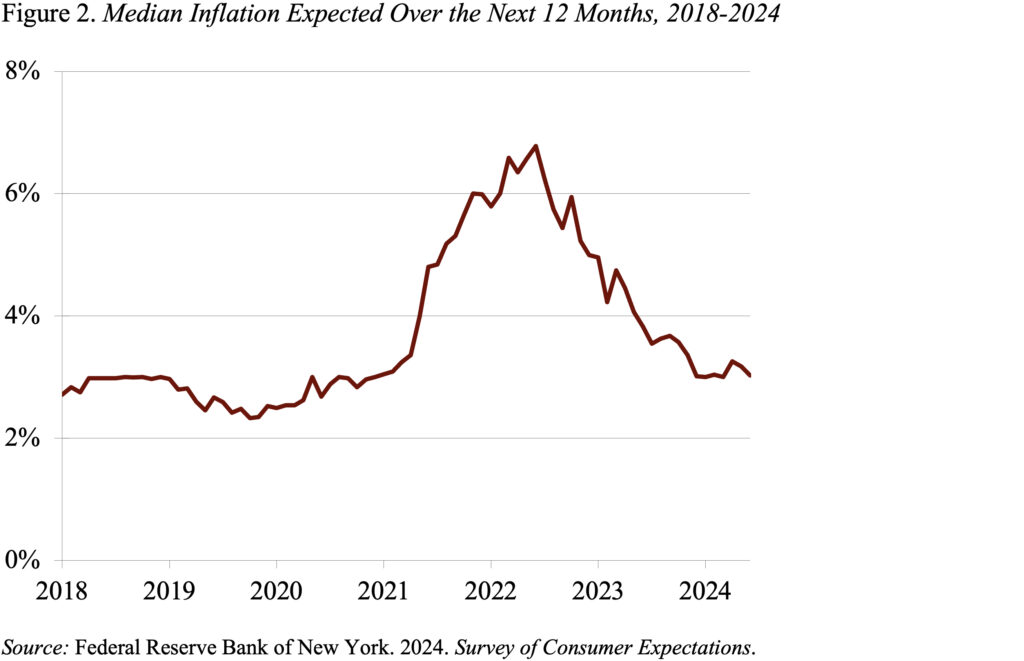

And Americans do recognize the rate of inflation has declined. Surveys show that expectations of future price increases are almost back to what they were before the recent spurt (see Figure 2).

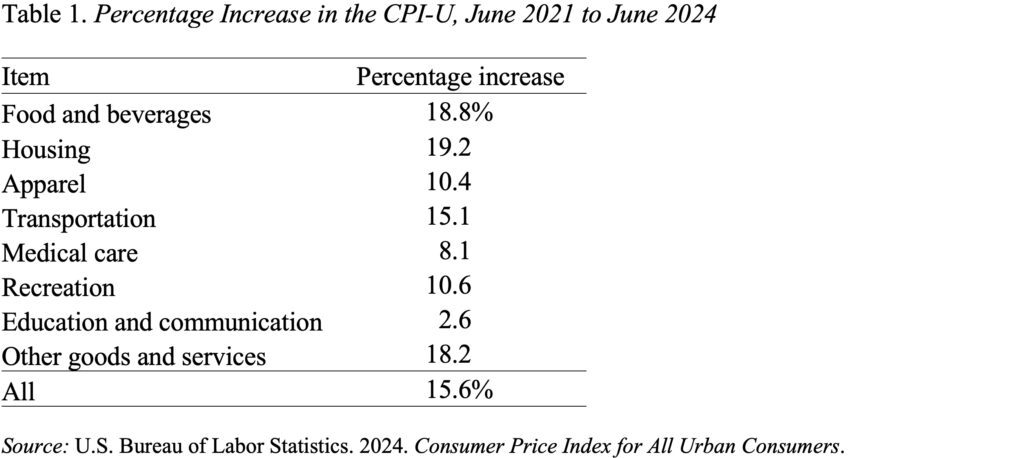

But knowing that the inflation rate has declined doesn’t compensate for the fact that the prices have ended up considerably higher than they were before the spurt in inflation. Table 1 shows that the expenditure-weighted increase in prices between June 2021 and June 2024 was about 16 percent.

As noted, prices are not going to go down. The main reason is that a big fall in prices requires a big decline in wages and employers are very reluctant to cut wages. They believe that cutting wages would damage morale and that the cost of that damage would exceed any savings in wage expenditures.

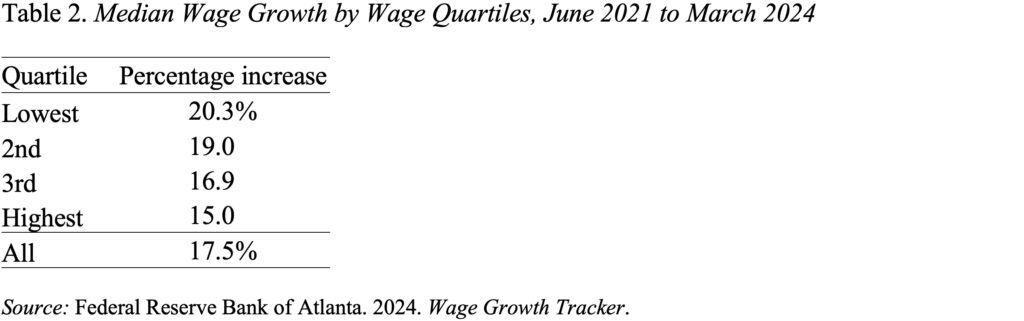

Since prices are not going back down, the only way for things to become affordable again is for wages to increase. That is, if – over the period June 2021-June 2024 – the price of food, housing, transportation, etc. has gone up 16 percent, wages need to increase by 16 percent for households to replicate old spending patterns. Data from the Atlanta Fed suggest that wages across the board have grown more than 17 percent, with the greatest gains for the lowest paid (see Table 2).

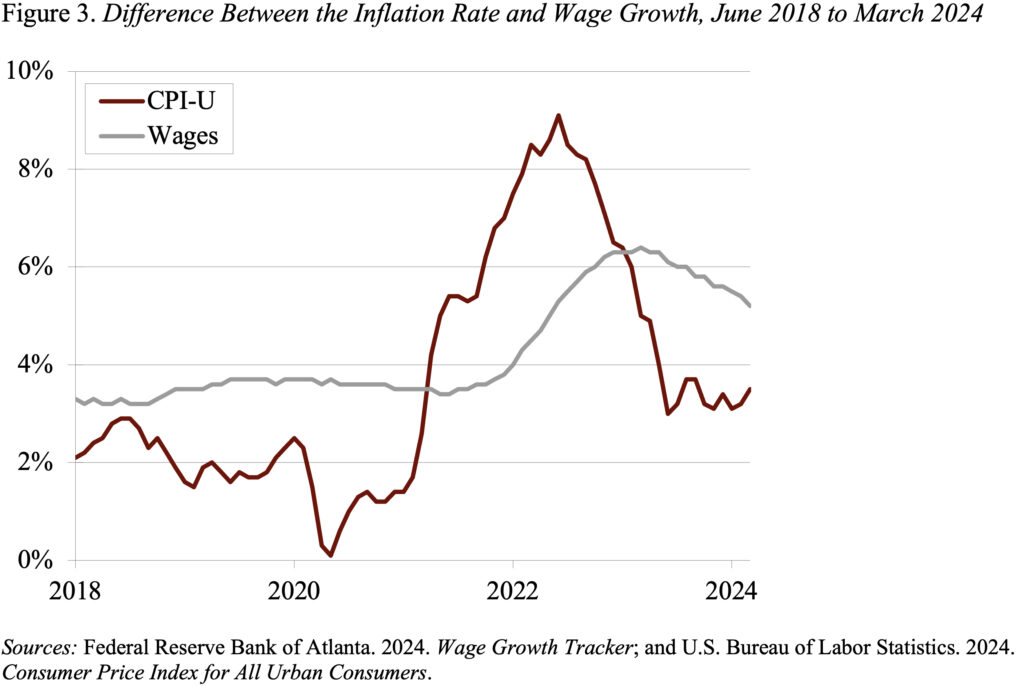

With wage gains exceeding price increases, people, on average, should be able to duplicate their old spending patterns. But standing still is not enough; most would like to see their standard of living improve over a three-year span. Here too the outlook is good. While wage gains typically lag inflation early in the cycle, they have now pulled ahead (see Figure 3). Now most people should start to experience improvements in their standard of living.

But this whole story seems like a hard sell.