Lack of Federal Action has Spurred State Pension Initiatives

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But a national program would clearly be more sensible than 50 state pension plans.

At any given moment, only about half of private sector workers are covered by any sort of employer-sponsored retirement plan. This lack of coverage has two implications. First, a substantial share of households – roughly one-third – end up with no coverage at all during their worklives and must rely exclusively on Social Security in retirement. And, even under current law, Social Security will provide less in the future relative to pre-retirement earnings than it has in the past. Second, with median job tenure of about four years, many employees move in and out of coverage so that they end up with inadequate 401(k) balances.

Since most of those without coverage work for small employers, policymakers for decades have tried to solve the problem by introducing simplified retirement plans. But these initiatives have not improved coverage because plan administration costs are only one of several reasons that small businesses do not offer plans. Equally important considerations include too few employees, lack of employee interest, and unstable business income. Recognizing the difficulty in getting small businesses to adopt plans, the Obama Administration proposed “Automatic IRAs” in 2009 to cover the uncovered, and others have come up with alternative proposals. But no progress has been made in passing federal legislation. Into this breach have stepped the states.

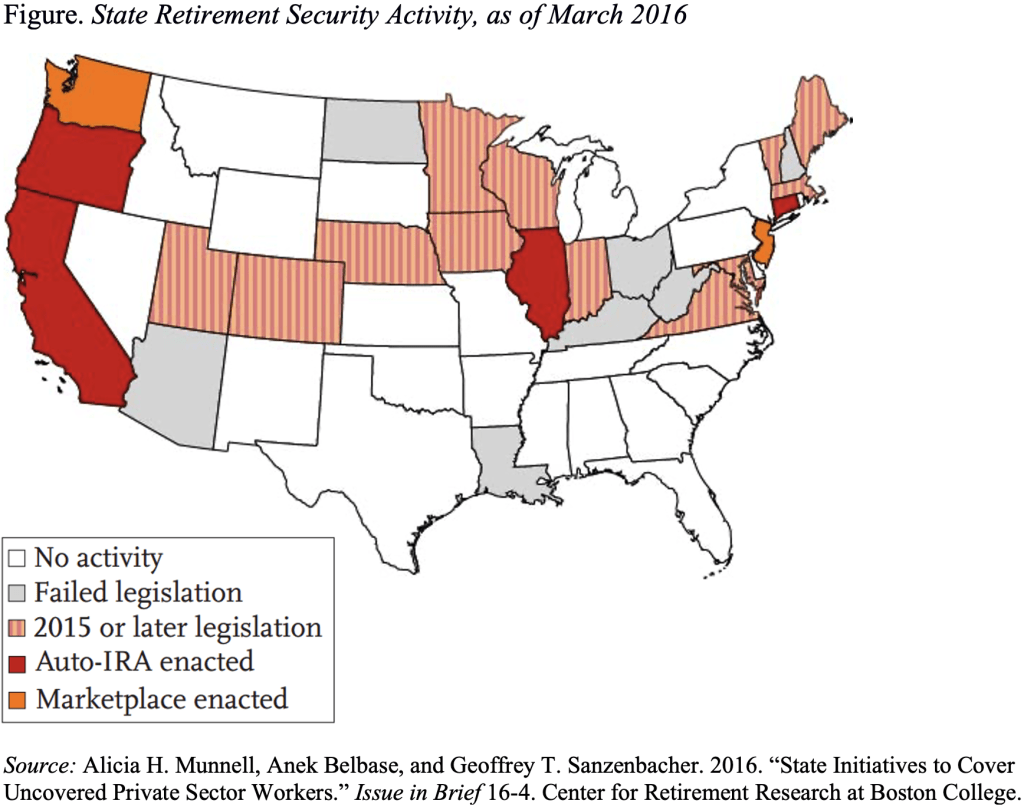

California led the way with the enactment in 2012 of the California Secure Choice Retirement Savings Program. Three other states – Connecticut, Illinois, and Oregon – have also passed legislation following the Auto-IRA model. Connecticut has completed its feasibility study and is asking the legislature for approval to get the program up and running. Illinois does not have to go back to the legislature, but has not yet completed a feasibility study. Oregon started a little later but is aiming at completing its study by the fall of 2016 and having its program up and running by 2017.

Two states – Washington and New Jersey – have followed a different path. These states have adopted a marketplace approach, which does not involve an employer mandate to automatically enroll uncovered workers, but rather provides employers with education on plan availability and makes pre-screened plans available through a central website to promote participation in low-cost, low-burden retirement plans.

Other states, such as Massachusetts, are toying with the idea of having both an Auto-IRA system and a state-run system of multiple employer plans (MEPs). MEPs would allow unrelated employers to offer 401(k) plans but offload a portion of the administrative burdens and fiduciary responsibilities to a third party.

The map shows that state activity to cover uncovered workers is widespread.

Our bias is that simply providing information through a marketplace instead of requiring employers without a plan to automatically enroll their employees in a state-initiated plan will have only a modest effect. A mandate coupled with auto-enrollment is the key to success. Hopefully, many of the states with active legislation will follow the Auto-IRA model.

Even if more states are successful in setting up a tier of retirement income for their citizens, this approach to implementing a retirement program is clearly a second-best alternative. A national Auto-IRA plan would be a much more efficient way to close the coverage gap, offering substantial economies of scale and avoiding the laborious, time-consuming, and expensive process of setting up 50 different state plans. This country needs federal legislation!