Why Is This High-Income State’s Elderly Population Struggling Financially?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

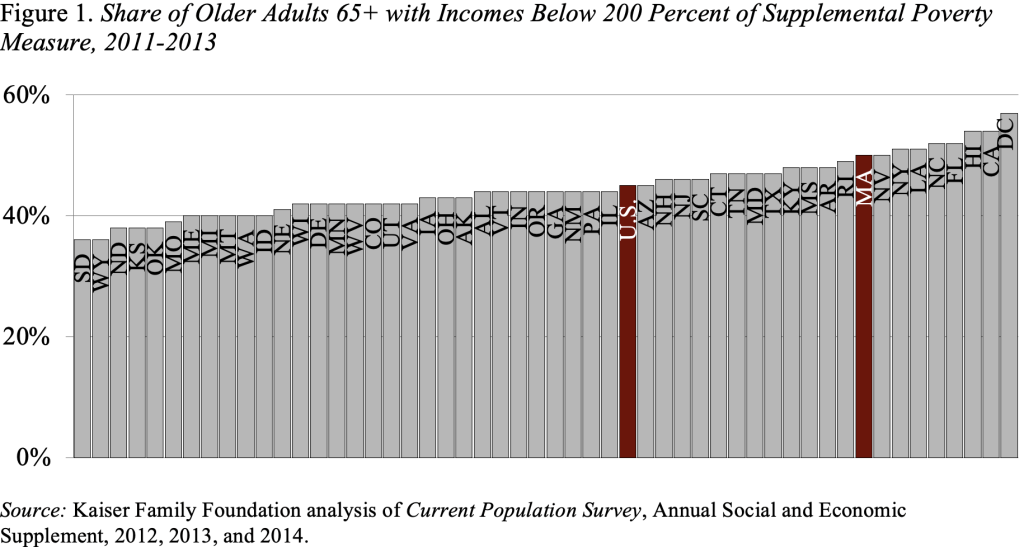

Half of older households fall below 200 percent of poverty.

Recently, I was appointed to the Governor’s Council to Address Aging in Massachusetts. The Council has a broad mandate, but I’m an economist so I care about whether older people in Massachusetts have enough money. Apparently they do not: Massachusetts ranks among the worst in the country in terms of income adequacy.

At the first meeting of the Council, members quoted the Elder Economic Security Standard Index, which is prepared by the Gerontology Institute at the University of Massachusetts Boston. The “Elder Index” measures the income level at which older people are able to cover their basic and necessary living expenses and age in their home, without relying on benefit programs, loans or gifts. The report showed that 61 percent of older single adults in Massachusetts had incomes below the Elder Index target, making the state #49 among the 50 states (and the District of Columbia), behind only Mississippi. For older adult couples, Massachusetts ranks #41 in elder economic security. This information is shocking for a high-income state like Massachusetts.

One question is whether the state’s dismal performance is a unique result of how the Elder Index is constructed. To answer that question, I looked at the U.S. Census Bureau’s Supplemental Poverty Measure, which reflects the amount of money needed for basic necessities like food, shelter, clothing, and utilities and is adjusted for geographic differences in the cost of housing. The Supplemental Poverty Measure shows that Massachusetts also ranks #41 in the percentage of older adults with incomes below 200 percent of this poverty threshold (see Figure).

Why does Massachusetts rank so poorly in its older citizens’ ability to meet their needs? The primary answer is the cost of housing. And a major component of the cost of housing for older households is the property tax. Allowing older households to defer their property taxes (with interest) until they move or die could greatly improve their economic situation.