Mayor de Blasio Proposes Auto-IRAs to Help New Yorkers Save for Retirement

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Auto-IRAs provide a retirement savings plan to workers who lack an employer plan.

Last week in his State of the City address, Mayor de Blasio once again proposed an auto-IRA program for working New Yorkers whose employer does not offer a retirement plan. Many of the plan specifics look very much like those in Oregon, California, Illinois, Connecticut, and Maryland. The following details are from a brief summary document provided by the Mayor’s office:

- Employers with at least 5 employees that do not offer a retirement plan will be required to auto-enroll their employees in the City plan with a default contribution, of the employees’ own earnings, of 5 percent.

- The contribution works as a payroll-deduction into a portable Roth IRA so it can be transferred from job-to-job.

- Employees can opt out at any time and can reduce or increase their contribution up to the annual IRA maximum.

- Employees can choose from a limited menu of low-cost investment options.

- The City’s Retirement Security Fund will be overseen by a board of appointees, managed by a private third-party administrator, and invested in low-cost indexed mutual funds.

- The City will subsidize the start-up costs, but the program will be funded by the low fees charged to participants’ accounts.

Employers would not contribute to the auto-IRA and have no legal responsibility for the program; their only cost is the time required to introduce workers to the program and facilitate the payroll deduction. Interviews with Oregon employers suggest that the initial introduction to employees takes about 1 to 2 hours, the initial start-up of contributions about 2 hours, and ongoing efforts about 30 minutes per pay period, for the employers’ entire workforce.

Like private sector workers nationwide, less than half of those in NYC currently work for an employer that offers a retirement plan. Retirement plans are essential because the evidence clearly shows that the only way people save is through some automatic mechanism that deducts contributions from their wages. This pattern means that people will not save on their own and will wind up at retirement totally dependent on Social Security. Because NYC is a high-cost area, wages tend to be higher than in the rest of the country. As a result, New Yorkers in the bottom half of the wage distribution will not benefit as much as others from the progressivity of the Social Security benefit formula. Without some saving, hardworking New Yorkers will not be able to maintain their standard of living once they retire.

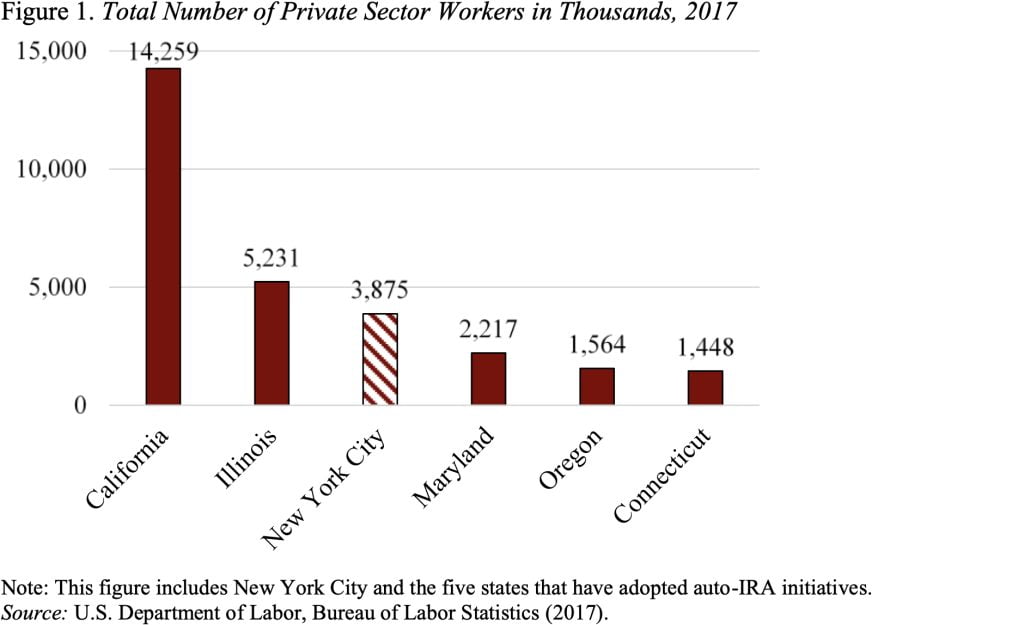

Generally, I don’t think it makes sense for these auto-IRA initiatives to be introduced at the city, as opposed to the state, level. But NYC has more private sector workers than the states of Maryland, Oregon, and Connecticut (see Figure 1). So, it should be able to construct a financially viable plan. Moreover, it can build on the experience of the states that have led the way.

The NYC program would need to be approved by City Council, and it is not clear if the Council will support the proposal. But the intent of city administrators is to introduce a bill this year and start up the program in 2021.

As much as I applaud the efforts by states and large localities, such as NYC, to fill in the gaps in the nation’s retirement system, this is still a really silly way to run a railroad. All Americans need an additional layer of retirement income on top of Social Security. Employers are increasingly reluctant to take on the responsibility of offering a plan, and only a third of all workers appear to have consistent employment in a job with benefits. The solution should come from the federal government. Indeed, President Obama proposed a national auto-IRA program, but Congress failed to take action. Therefore, the only option is this piecemeal approach.